3 SGX Dividend Stocks Delivering From 3.7% To 9.6% Yield

As global markets continue to navigate through a period of economic recovery and sustainability-focused innovations, the Singapore Exchange (SGX) remains a focal point for investors seeking stable returns. Amidst this backdrop, dividend stocks on the SGX offer an appealing option for those looking to balance yield with potential growth in sectors aligned with broader market trends. In this context, understanding what constitutes a resilient dividend stock is crucial, especially in an environment that values both financial and environmental sustainability.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

Civmec (SGX:P9D) | 6.14% | ★★★★★☆ |

Singapore Exchange (SGX:S68) | 3.56% | ★★★★★☆ |

Multi-Chem (SGX:AWZ) | 9.64% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.97% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.71% | ★★★★★☆ |

BRC Asia (SGX:BEC) | 7.73% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 6.74% | ★★★★★☆ |

Singapore Airlines (SGX:C6L) | 7.09% | ★★★★★☆ |

YHI International (SGX:BPF) | 6.56% | ★★★★★☆ |

Sing Investments & Finance (SGX:S35) | 6.00% | ★★★★☆☆ |

Click here to see the full list of 19 stocks from our Top SGX Dividend Stocks screener.

We'll examine a selection from our screener results.

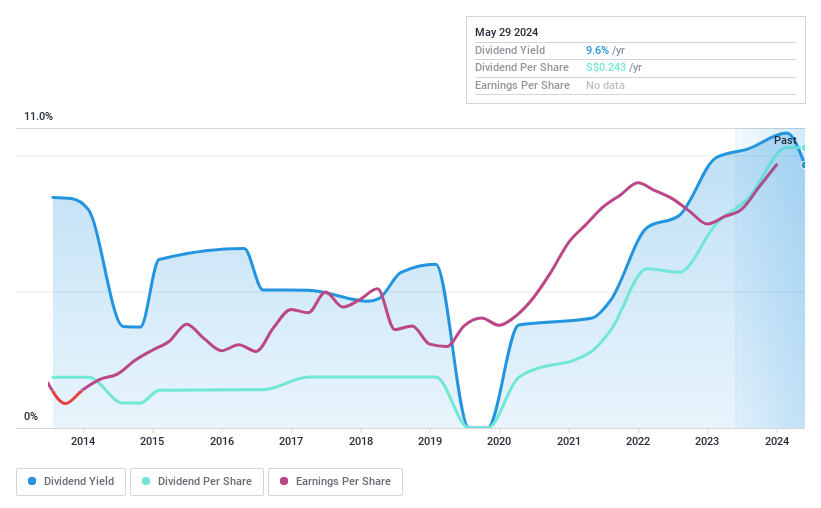

Multi-Chem

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Multi-Chem Limited, primarily an investment holding company, operates in the distribution of information technology products across regions including Singapore, Greater China, Australia, and India, with a market capitalization of approximately SGD 227.04 million.

Operations: Multi-Chem Limited generates revenue from its IT business in Singapore (SGD 372.78 million), Australia (SGD 54.60 million), India (SGD 40.56 million), Greater China (SGD 34.96 million), and other regions totaling SGD 153.93 million, alongside a smaller PCB business segment in Singapore contributing SGD 1.79 million.

Dividend Yield: 9.6%

Multi-Chem Limited, a Singapore-based company, has experienced fluctuating dividend reliability over the past decade, with significant annual drops exceeding 20%. Despite this volatility, recent changes in the board structure could influence future governance and oversight. The company's dividends are currently supported by earnings and cash flows with payout ratios of 80.7% and 88.1%, respectively. Additionally, Multi-Chem's dividend yield stands at a competitive 9.64%, positioning it well within the top quartile of SG market dividend payers.

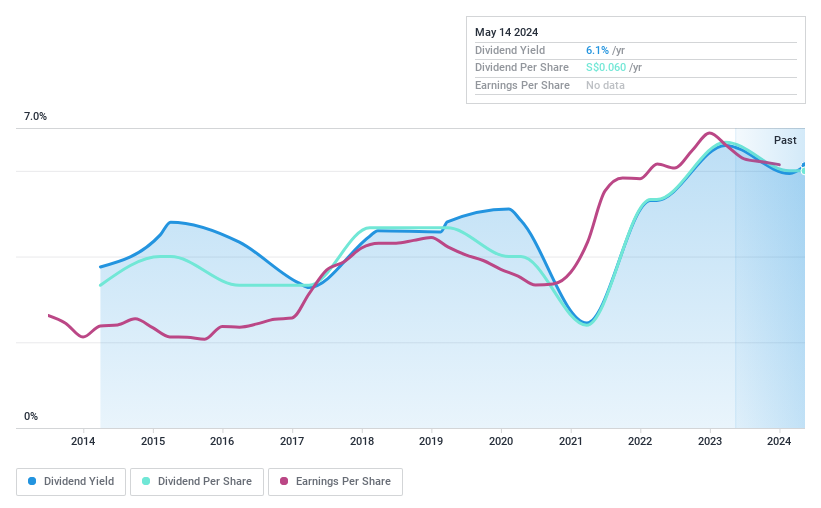

Sing Investments & Finance

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sing Investments & Finance Limited operates in Singapore, offering financing services to both individuals and corporations, with a market capitalization of approximately SGD 236.44 million.

Operations: Sing Investments & Finance Limited generates revenue primarily through its credit and lending segment, totaling SGD 68.26 million.

Dividend Yield: 6%

Sing Investments & Finance has shown a mixed performance in its dividend reliability, with a history of volatile payments over the past decade. Despite this instability, the company's dividends are well-supported financially, evidenced by a low cash payout ratio of 9.6% and an earnings payout ratio of 42.7%, suggesting prudent financial management. Recently, at their annual general meeting on March 27, 2024, they proposed a dividend of S$0.06 per share for the year ended December 31, 2023.

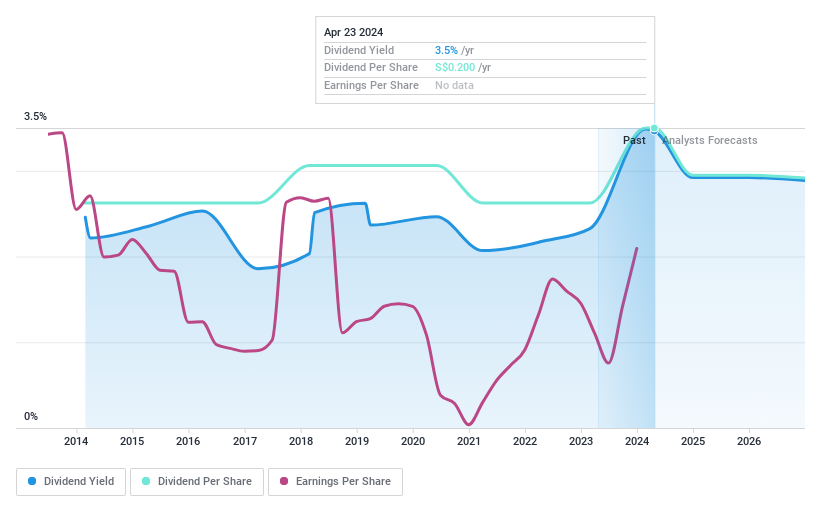

UOL Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: UOL Group Limited operates in property development and hospitality, with a presence in multiple countries including Singapore, Australia, the UK, and the US, boasting a market cap of SGD 4.55 billion.

Operations: UOL Group Limited generates revenue through various segments, including property development in Singapore (SGD 1.16 billion), China (SGD 10.10 million), and the United Kingdom (SGD 42.56 million); property investments totaling SGD 518.93 million; technology operations which brought in SGD 110.08 million; and hotel operations in Singapore (SGD 464.93 million), Australia (SGD 125.64 million), and other locations totaling SGD 172.40 million.

Dividend Yield: 3.7%

UOL Group Limited offers a modest dividend yield of 3.71%, which is lower than the top quartile of Singapore dividend stocks at 6.19%. However, its dividends are well-supported by earnings with a payout ratio of 17.9% and cash flows with a cash payout ratio of 59.3%. Recent corporate events include the appointment of a new CFO effective June 10, 2024, and shareholder approval for both regular and special dividends totaling S$0.20 per share during the April AGM.

Next Steps

Discover the full array of 19 Top SGX Dividend Stocks right here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:AWZ SGX:S35 and SGX:U14.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance