3 Recent IPOs to Buy Now: Reddit, ARM, IBIT Bitcoin ETF

Initial Public Offerings, or IPOs, are the lifeblood of Wall Street. Monitoring the IPO market is critical for savvy investors because it allows them to gauge the market’s health, follow new trends and accumulate and profit from companies that are early in their bullish trend.

As these new issues offer a way for investors to get on the bus early, prominent and innovative companies are closely watched by analysts and investors on Wall Street.

The IPO Resurgence

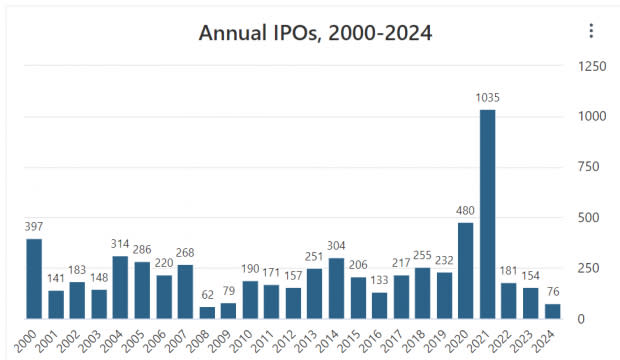

Unfortunately for public market investors, the IPO market has waned the past few years. In 2004, for example, 314 companies went public. But less than 200 companies went public in 2022 and 2023 combined.

In a 2016 interview, Mark Cuban explained the problem: “Companies are waiting seven, nine, ten years or longer to go public and by then their hyper-growth is typically gone.” In other words, instead of going public while the company is still growing rapidly, firms wait until growth is slow and, worse, use the IPO as a liquidity event to sell into.

Image Source: StockAnalysis.com

Nevertheless, IPOs are returning to form, and three opportunities are emerging in 2024.

3 Recent IPOs to Buy Now

Reddit: Capitalizing on AI

Reddit (RDDT) is a social media platform that allows users to share and discuss a plethora of content within unique communities dubbed “subreddits.” Though Reddit has fewer users than Meta Platforms (META), it has a loyal and consistent following.

Image Source: Priori Data

Reddit’s unique structure positions the company perfectly to capitalize on the scorching hot growth in the artificial intelligence (AI) industry. Because of the length of threads and the fresh content produced in subreddits, the social media platform can be used by AI firms to train large language models like Microsoft (MSFT) and OpenAI’s ChatGPT. Reddit is perfectly positioned for sustained growth with the AI revolution gaining momentum. Furthermore, the mania in Gamestop (GME) shares is likely to drive further traffic to the website.

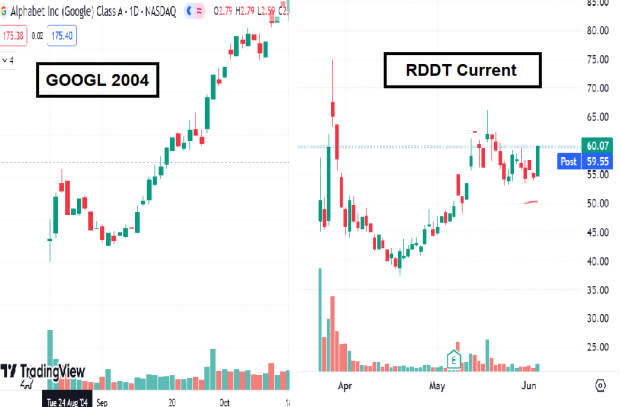

RDDT IPO U-turn Base

One of the most powerful IPO base structures is the IPO “U-turn” base. Google parent Alphabet (GOOGL) exploded out of an IPO U-turn base structure in 2004 and rewarded investors handsomely. Below is a comparison between RDDT and GOOGL.

Image Source: Zacks Investment Research

Arm Holdings: Energy Efficiency Drives Growth

ARM Holdings (ARM) designs and licenses semiconductor intellectual property, mainly for mobile devices. A common trait of winning stocks is a wide moat. Scalable, energy-efficient chips separate ARM from its competitors and helped drive year-over-year growth last quarter to a blistering 183%.

ARM Lockup Period No Longer a Concern

A lockup period refers to a certain amount of time insiders must hold an IPO to protect outside investors. When a lockup period expires, stocks often face selling pressure as insiders cash out. However, with ARM’s lockup period expiration in the rearview mirror, it is no longer a concern.

IBIT Bitcoin ETF

The approval of several Spot Bitcoin ETFs last year made it possible for more investors to buy Bitcoin. Wednesday, Fidelity’s Wise Origin Bitcoin Fund (FBTC) saw record inflows, indicating that the insatiable demand for Bitcoin ETFs was not a fluke. Meanwhile, Blackrock’s (BLK) iShares Bitcoin Trust (IBIT) is nearing a technical breakout zone as record short Bitcoin futures numbers, bullish seasonality and post-halving tailwinds act as potential fuel for Bitcoin’s next run.

Image Source: TradingView

Bottom Line

The IPO market is displaying signs of a resurgence. Arm Holdings, Reddit and IBIT are stocks to watch.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

ARM Holdings PLC Sponsored ADR (ARM) : Free Stock Analysis Report

GameStop Corp. (GME) : Free Stock Analysis Report

Alphabet Inc. (GOOGL) : Free Stock Analysis Report

Meta Platforms, Inc. (META) : Free Stock Analysis Report

iShares Bitcoin Trust (IBIT): ETF Research Reports

Fidelity Wise Origin Bitcoin Fund (FBTC): ETF Research Reports

Reddit Inc. (RDDT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance