3 Networking Stocks to Watch Despite Industry Headwinds

Weak global economic conditions, soft demand from telco and cable customers and volatile supply chain dynamics continue to be concerns. Also, inventory reduction efforts by clients are affecting the performance of some participants of the Zacks Computer - Networking industry. Increasing focus on cloud computing, network security, big data and cloud storage is expected to boost the industry participants’ performance in the long run. The accelerated deployment of 5G is driving the proliferation of the Internet of Things (IoT), Advanced Driver Assistance Systems (ADAS), Augmented Reality/Virtual Reality (AR/VR) devices and 5G smartphones, calling for solid networking infrastructure. This spurred the demand for networking products, favoring prospects of prominent industry players like Cisco Systems, Inc CSCO, Extreme Networks Inc EXTR and Lantronix, Inc LTRX.

Industry Description

The Zacks Computer - Networking industry comprises companies that offer networking and Internet-connected products, including wireless (WiFi and Long-Term Evolution or LTE), Ethernet and powerline, focusing on dependability and ease of use. The products are available in numerous configurations to cater to the changing requirements of consumers in each geographic territory where it operates. Some industry players also provide mission-critical IoT solutions and network security services to help clients build next-generation connected products and implement and manage critical communications infrastructures in demanding environments with enhanced safety levels. Focus on developing IoT sensors, drones and wearables amid increasing demand for cloud computing-based contact tracing applications is driving the industry.

4 Trends Influencing the Industry's Future

Innovation in Networking Technologies is Opening New Business Avenues: The growing clout of Smart Home and Internet-connected products such as Smart TVs, game consoles, High Definition (HD) streaming players, security cameras, thermostats and smoke detectors continue to drive innovations in networking. The rapid proliferation of IoT, the increasing popularity of smart connected devices and the growing adoption of cloud computing in network security fuel the demand for an efficient network support infrastructure. The advancements in AI and ML and the high adoption of cloud applications hold immense potential for companies in the industry. Enterprises are striving to manage fixed and wireless devices in a secured infrastructure. To address the demand, industry firms are driving innovation in networking technologies, including network virtualization and Software-Defined Networking (SDN), which favor growth prospects.

Rapid Deployment of 5G to Boost Growth Prospects: Adopting a hybrid/flexible work model triggered the demand for network-intensive applications like video conferencing and cloud services. This accelerated 5G deployment globally. The success of 5G technology hinges on substantial investments to upgrade infrastructure in the core fiber backhaul network to support growth in data services. Efforts to develop smart connected homes, hospitals, factories, buildings, cities and self-driving vehicles bode well for industry players. These firms invest heavily in LTE, broadband and fiber to provide additional capacity and improve Internet and wireless networks. These initiatives hold promise.

The Uptick in Wi-Fi 6E Networking to Drive Momentum: Brisk technological advancement, dynamic products, high-speed connectivity, low latency and evolving industry standards define the Computer Networking industry. The growing clout of the latest Wi-Fi 6E-compliant residential gateways, Wi-Fi routers, set-top boxes and wireless range extenders is a testament to the same. The increasing demand to connect more devices to the network has been driving demand for Wi-Fi 6E devices. Wi-Fi 6E addresses Wi-Fi spectrum shortage issues by providing continuous channel bandwidth to support a higher number of connected devices without compromising speed. Moreover, the rollout of Wi-Fi 7 bodes well for the companies in this space.

Macroeconomic Turmoil Concerning: Global macroeconomic weakness and volatile supply chain dynamics are persistent concerns. Inflation could affect spending across small- and medium-sized businesses globally. The uncertainty in business visibility could dent the industry’s performance in the near term.

Zacks Industry Rank Indicates Bleak Near-Term Prospects

The Zacks Computer - Networking Industry is housed within the broader Zacks Computer and Technology sector. It carries a Zacks Industry Rank of 222, positioning it in the bottom 11% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is the average of the Zacks Rank of all the member stocks, indicates bleak near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

Before we present a few stocks you may want to consider for your portfolio, considering bright prospects, let us look at the industry’s recent stock-market performance and valuation picture.

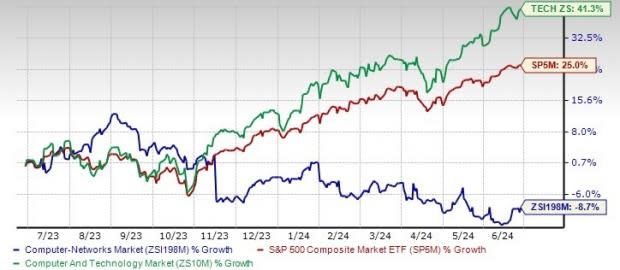

Industry Underperforms S&P 500 and the Sector

The Zacks Computer – Networking industry underperformed the S&P 500 composite and the broader Zacks Computer and Technology sector in the past year.

The industry is down 8.7% over this period against the broader sector’s rally of 41.3%. The S&P 500 has appreciated 25% over the same time frame.

One-Year Price Performance

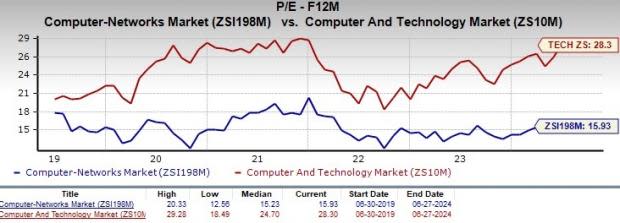

Industry's Current Valuation

Based on the forward 12-month price-to-earnings ratio (P/E), which is a common multiple for valuing Computer – Networking stocks, we see that the industry is currently trading at 15.93X compared with the S&P 500’s 21.57X. It is also below the sector’s forward-12-month P/E of 28.30X.

In the past five years, the industry traded as high as 20.33X and as low as 12.56X, with media being at 15.23X, as the charts below show.

Forward 12-Month P/E Ratio

3 Computer - Networking Stocks to Add to Watchlist

Cisco: Headquartered in San Jose, CA, Cisco is an IP-based networking company offering products and services to service providers, companies, commercial users and individuals.

Cisco’s business model has evolved, with subscription revenues accounting for more than half of its total revenues. In the last reported quarter, subscription revenues came in at $6.9 billion and contributed 54% to total revenues.

The addition of Splunk further enhances the recurring revenue base of the company. The buyout significantly expands Cisco’s portfolio of software-based solutions, contributing more than $4 billion in annualized recurring revenues and making it one of the largest software companies in the world. The launch of AI-powered Hypershield, which combines security and networking, strengthened Cisco’s security portfolio.

In the last reported quarter, revenues declined 12.8% year over year to $12.7 billion but beat the consensus mark by 1.71%. Networking revenues plunged 27% year over year to $6.52 billion, while Service revenues moved up 5.7% year over year to $3.68 billion.

For the current quarter, revenues are expected to be between $13.4 billion and $13.6 billion. Non-GAAP gross margin is anticipated between 66.5% and 67.5% for the quarter. Non-GAAP earnings are anticipated between 84 cents and 86 cents per share.

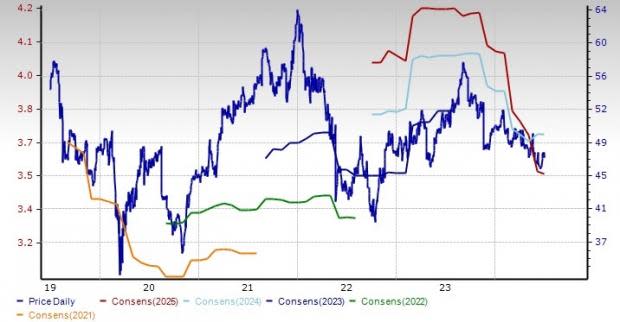

At present, CSCO carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

The Zacks Consensus Estimate for fiscal 2024 earnings is pegged at $3.71 per share, improved from an estimate of $3.68 per share in the past 60 days.

Price and Consensus: CSCO

Extreme Networks: Based in Morrisville, NC, Extreme Networks provides next-generation switching solutions that cater to the increasing requirements of enterprise local area networks or LAN, internet service, and content providers.

Increasing new logo bookings across the globe, with particular strength in the domestic market, is driving top-line expansion. The company expects the value proposition offered by its one network, one cloud strategy to drive SaaS annual recurring revenues further.

EXTR is reducing inventory to normalize inventory channels. However, EXTR expects customer and channel inventory digestion across the industry to remain an overhang on bookings and revenue growth in the current quarter.

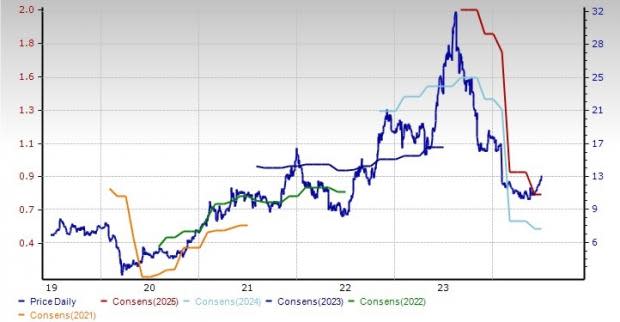

At present, EXTR carries a Zacks Rank #3. The Zacks Consensus Estimate for fiscal 2025 earnings is pegged at 77 cents per share, unchanged in the past 30 days.

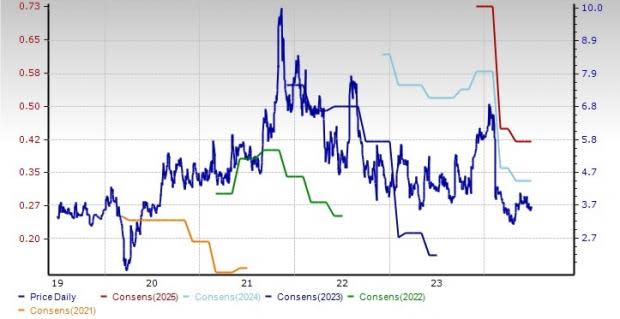

Price and Consensus: EXTR

Lantronix: Based in Irvine, CA, Lantronix specializes in providing Industrial and Enterprise Internet of Things (IoT) solutions for high-growth applications in certain verticals, including Intelligent Transportation, Smart Grid, Smart Cities and AI Data Centers.

Lantronix remains focused on three main vertical segments, including smart cities, automotive, infotainment and enterprise, to drive top-line growth. Management estimates these three vertical markets to have a combined served available market of $8.5 billion.

The company’s revenues totaled $41.2 million in the last reported quarter, up 25% year over year. Non-GAAP earnings of 11 cents per share came compared with 6 cents reported in the prior year quarter.

For the fourth quarter of fiscal year 2024, the company anticipates revenues to be $46.5-$51.5 million and non-GAAP earnings to be 12-18 cents per share.

Lantronix carries a Zacks Rank #3. The Zacks Consensus Estimate for the fiscal 2024 is pegged at 33 cents per share, unchanged in the past 30 days.

Price and Consensus: LTRX

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cisco Systems, Inc. (CSCO): Free Stock Analysis Report

Lantronix, Inc. (LTRX): Free Stock Analysis Report

Extreme Networks, Inc. (EXTR): Free Stock Analysis Report

Yahoo Finance

Yahoo Finance