3 Leading UK Dividend Stocks With Yields Up To 4.8%

Amidst a backdrop of fluctuating global markets and keen investor focus on upcoming economic indicators, the UK market shows signs of resilience, with the FTSE 100 poised to break a three-day losing streak. In such an environment, dividend stocks remain appealing for their potential to offer investors steady income streams and relative stability.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 8.12% | ★★★★★★ |

Impax Asset Management Group (AIM:IPX) | 6.99% | ★★★★★☆ |

Dunelm Group (LSE:DNLM) | 7.44% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 5.98% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.86% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.84% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.41% | ★★★★★☆ |

NWF Group (AIM:NWF) | 4.00% | ★★★★★☆ |

James Latham (AIM:LTHM) | 3.01% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.79% | ★★★★★☆ |

Click here to see the full list of 58 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

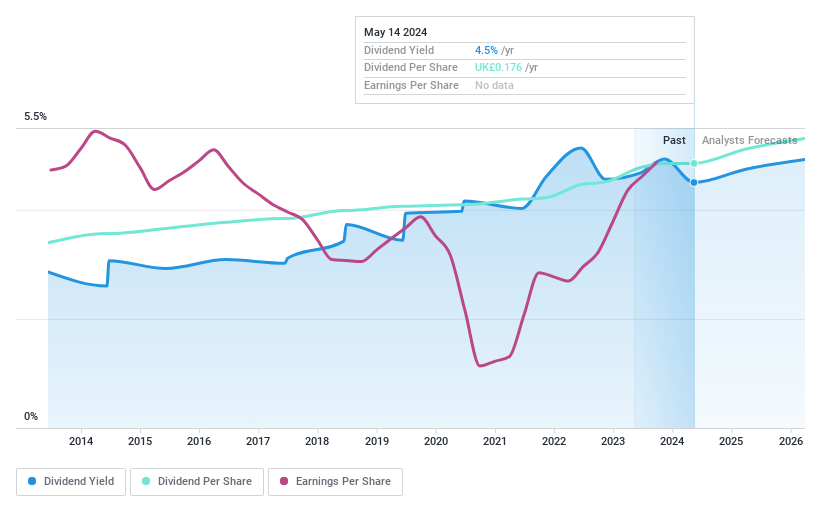

Castings

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Castings P.L.C. is a company involved in iron casting and machining, with a market capitalization of approximately £169.92 million.

Operations: Castings P.L.C. generates its revenue primarily from its specialized activities in iron casting and machining.

Dividend Yield: 4.5%

Castings P.L.C. has declared a special dividend of £0.07 and a final dividend of £0.1419, cumulating to an annual payout of £0.1832 per share, marking a 5.6% increase from last year, reflecting its progressive dividend policy. Despite this growth, Castings' dividend yield stands at 4.51%, which is below the top UK market quartile average of 5.71%. Financially, the company supports these dividends with a robust earnings report showing a net income rise to £16.72 million from last year's £13.79 million and maintains healthy coverage ratios with earnings covering dividends at 29.5% and cash flows at 69.9%. However, future earnings are expected to decline by an average of 5.8% annually over the next three years.

Delve into the full analysis dividend report here for a deeper understanding of Castings.

Our valuation report unveils the possibility Castings' shares may be trading at a discount.

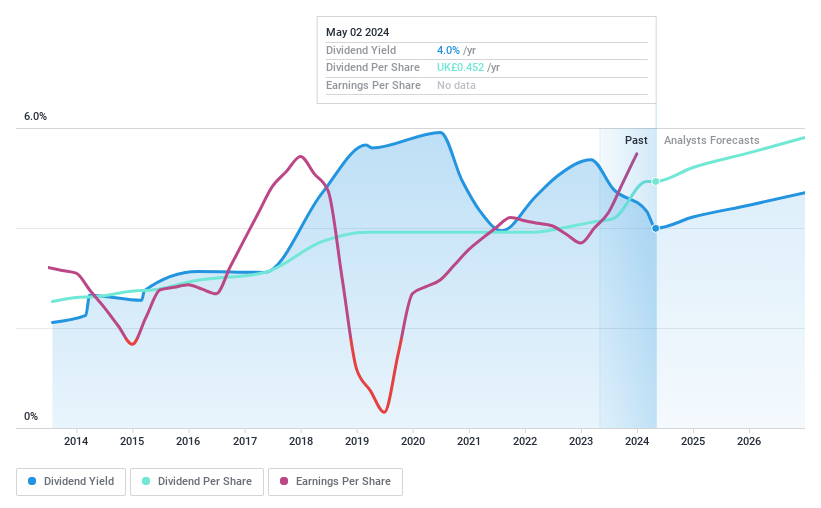

Keller Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Keller Group plc is a specialist geotechnical service provider operating across North America, Europe, Asia-Pacific, the Middle East, and Africa, with a market capitalization of approximately £0.90 billion.

Operations: Keller Group plc generates £2.97 billion from its geotechnical services across various global regions.

Dividend Yield: 3.7%

Keller Group plc recently approved a final dividend of 31.3 pence per share at its AGM on May 15, 2024. The company's dividends are well-supported, with a payout ratio of 36.8% and a cash payout ratio of 32.2%, indicating strong coverage by both earnings and cash flows. Despite trading at 28.4% below estimated fair value and showing robust earnings growth of 94.3% last year, Keller's dividend yield of 3.66% remains below the top quartile average in the UK market (5.71%). Dividends have shown stability and growth over the past decade, reinforcing their reliability.

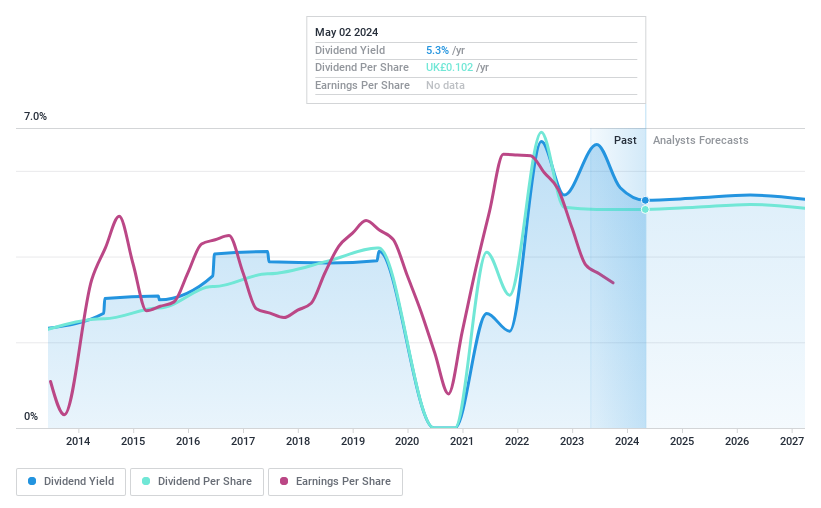

Norcros

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Norcros plc is a company that develops, manufactures, and markets bathroom and kitchen products in the United Kingdom and South Africa, with a market capitalization of approximately £189.98 million.

Operations: Norcros plc generates its revenue from the development, manufacturing, and marketing of bathroom and kitchen products primarily in the United Kingdom and South Africa.

Dividend Yield: 4.8%

Norcros plc, with a recent earnings growth of 59.5%, reported a decline in sales to £392.1 million for FY24 from £441 million the previous year. Despite this, net income rose to £26.8 million from £16.8 million, supporting a stable total annual dividend of 10.2 pence per share, covered by earnings at a payout ratio of 27.9% and cash flows at 31.2%. However, dividends have been historically volatile over the last decade and are below the top UK dividend payers' yield average at 4.81%.

Taking Advantage

Embark on your investment journey to our 58 Top Dividend Stocks selection here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:CGSLSE:KLR and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance