3 Key Japanese Dividend Stocks With Yields Up To 3.5%

Amid a backdrop of a strengthening Japanese stock market, with the Nikkei 225 Index recently climbing by 2.6% and the TOPIX Index up by 3.1%, investors are increasingly attentive to opportunities within Japan's dividend-paying stocks. In this context, identifying stocks that not only provide attractive yields but also demonstrate stability and potential for growth in such dynamic market conditions becomes particularly compelling.

Top 10 Dividend Stocks In Japan

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.74% | ★★★★★★ |

Globeride (TSE:7990) | 3.78% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.56% | ★★★★★★ |

Nihon Tokushu Toryo (TSE:4619) | 3.86% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 6.61% | ★★★★★★ |

KurimotoLtd (TSE:5602) | 5.11% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.05% | ★★★★★★ |

DoshishaLtd (TSE:7483) | 3.47% | ★★★★★★ |

Innotech (TSE:9880) | 3.93% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.38% | ★★★★★☆ |

Click here to see the full list of 376 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Open Up Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Open Up Group Inc., with a market cap of ¥179.00 billion, operates in engineer dispatching, subcontracting, outsourcing, and recruiting for sectors including construction management, manufacturing, machinery, electronics, and IT software both in Japan and globally.

Operations: Open Up Group Inc. generates its revenues primarily through engineering dispatch, subcontracting, outsourcing, and recruitment services across multiple sectors such as construction management, manufacturing, machinery, electronics, and IT software on a global scale.

Dividend Yield: 3.1%

Open Up Group recently raised its quarterly dividend to JPY 20 per share from JPY 17 and expects a yearly dividend of JPY 45.00, up from JPY 35. Although its current yield of 3.09% is below the top-tier Japanese dividends, the sustainability is supported by a low payout ratio of earnings (28.9%) and cash flows (30%). However, the company's dividend history has been marked by volatility and unreliability over the past decade, despite recent increases in payments.

Click to explore a detailed breakdown of our findings in Open Up Group's dividend report.

Upon reviewing our latest valuation report, Open Up Group's share price might be too optimistic.

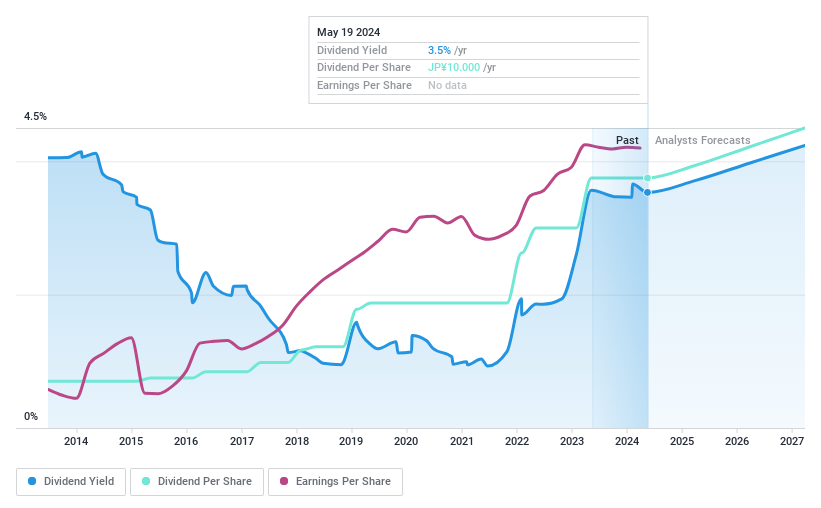

Systena

Simply Wall St Dividend Rating: ★★★★★★

Overview: Systena Corporation operates in Japan, focusing on solution and framework design, IT services, business solutions, and cloud businesses with a market capitalization of ¥127.56 billion.

Operations: Systena Corporation generates its revenues primarily from solution and framework design, IT services, business solutions, and cloud-based services in Japan.

Dividend Yield: 3.5%

Systena has recently enhanced shareholder returns through increased dividends and a substantial share buyback program. The company raised its quarterly dividend to ¥6.00 from ¥5.00 and plans an annual payout of ¥6.00, up from the previous year's ¥5.00, reflecting a stable dividend growth trend over the past decade. Additionally, Systena repurchased shares worth ¥3,176.34 million, completing its announced buyback plan ahead of schedule on June 30, 2024, signaling strong financial health and commitment to returning value to shareholders.

Click here and access our complete dividend analysis report to understand the dynamics of Systena.

Upon reviewing our latest valuation report, Systena's share price might be too pessimistic.

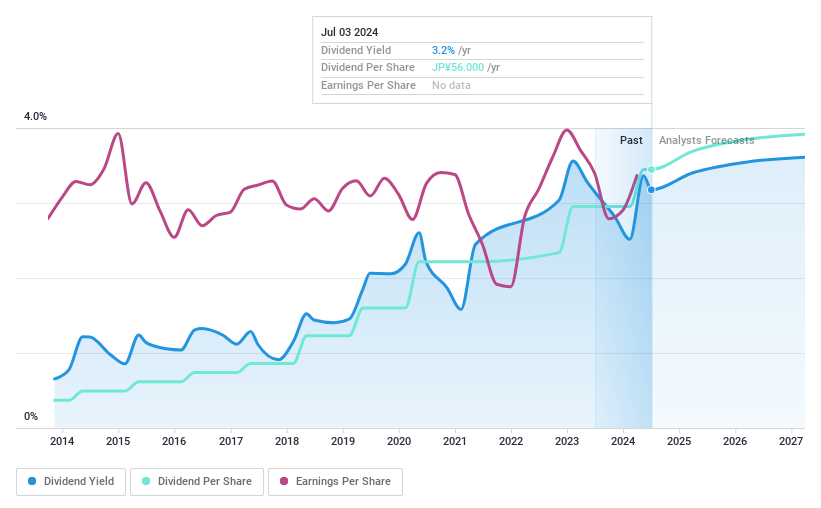

Takuma

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Takuma Co., Ltd. specializes in the design, construction, and management of boilers, plant machinery, and environmental equipment in Japan, with a market capitalization of approximately ¥137.40 billion.

Operations: Takuma Co., Ltd. generates revenue through the design, construction, and supervision of boilers, plant machinery, and environmental control systems in Japan.

Dividend Yield: 3.2%

Takuma's dividend yield at 3.18% trails the top quartile of Japanese dividend stocks, though it has shown consistent growth and reliability over the past decade. However, its dividends are not well supported by earnings or free cash flows, indicating potential sustainability issues. Recent share buybacks totaling ¥1,195.68 million suggest an effort to enhance shareholder value and improve capital efficiency but raise questions about long-term dividend affordability given the financial underpinnings.

Click here to discover the nuances of Takuma with our detailed analytical dividend report.

Our valuation report unveils the possibility Takuma's shares may be trading at a premium.

Next Steps

Investigate our full lineup of 376 Top Dividend Stocks right here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:2154 TSE:6013 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance