3 Japanese Exchange Stocks Estimated To Be Up To 31.4% Undervalued

Amid a backdrop of uncertainty surrounding the Bank of Japan's monetary policy, Japan's stock markets experienced negative returns last week. This environment may prompt investors to look for potentially undervalued opportunities within the Japanese exchange as they navigate these shifting market dynamics. In assessing what makes a good stock investment, especially in current conditions, it is crucial to consider factors such as the company’s fundamental strength, market position, and its potential resilience or adaptability to economic shifts highlighted by recent market activities.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

Name | Current Price | Fair Value (Est) | Discount (Est) |

Link and Motivation (TSE:2170) | ¥466.00 | ¥895.90 | 48% |

Plus Alpha ConsultingLtd (TSE:4071) | ¥1946.00 | ¥3564.14 | 45.4% |

Hibino (TSE:2469) | ¥2637.00 | ¥4933.90 | 46.6% |

FP Partner (TSE:7388) | ¥2758.00 | ¥5067.34 | 45.6% |

OSAKA Titanium technologiesLtd (TSE:5726) | ¥2795.00 | ¥5520.71 | 49.4% |

S-Pool (TSE:2471) | ¥321.00 | ¥594.93 | 46% |

Macromill (TSE:3978) | ¥856.00 | ¥1670.80 | 48.8% |

NIHON CHOUZAILtd (TSE:3341) | ¥1496.00 | ¥2816.24 | 46.9% |

IbidenLtd (TSE:4062) | ¥6526.00 | ¥12147.34 | 46.3% |

freee K.K (TSE:4478) | ¥2434.00 | ¥4463.08 | 45.5% |

Here we highlight a subset of our preferred stocks from the screener

Trend Micro

Overview: Trend Micro Incorporated, specializing in the development and sale of security-related software and services for computers, operates both in Japan and internationally, with a market cap of approximately ¥841.79 billion.

Operations: The company generates revenue primarily from the sale of security software and related services, with operations spanning both domestic and international markets.

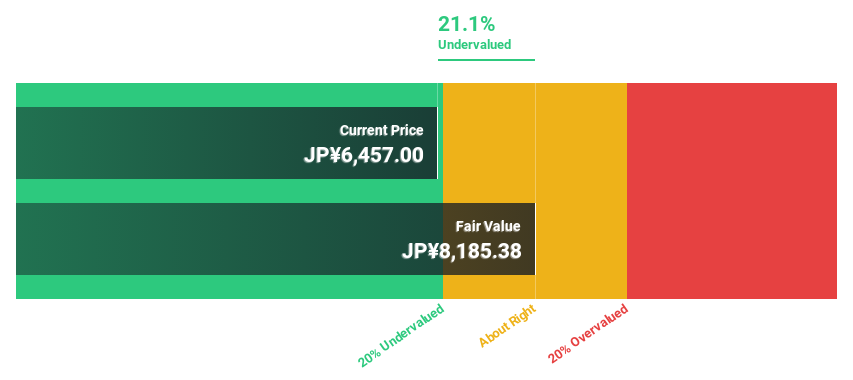

Estimated Discount To Fair Value: 21.1%

Trend Micro, a leader in cybersecurity solutions, is currently trading below its estimated fair value by more than 20%, marked at ¥6457 against a fair value of ¥8185.38. Despite lower profit margins this year (5.9%) compared to last (11.9%), the company's earnings are expected to grow significantly at 22.5% annually over the next three years, outpacing the Japanese market forecast of 8.9%. Recent strategic buybacks and innovative product launches in AI security further underscore its proactive approach in an evolving industry landscape.

The growth report we've compiled suggests that Trend Micro's future prospects could be on the up.

Take a closer look at Trend Micro's balance sheet health here in our report.

BuySell TechnologiesLtd

Overview: BuySell Technologies Co., Ltd. operates in the kimono and branded goods reuse sector in Japan, with a market capitalization of approximately ¥59.69 billion.

Operations: The company generates its revenue primarily from the reuse of kimonos and branded merchandise.

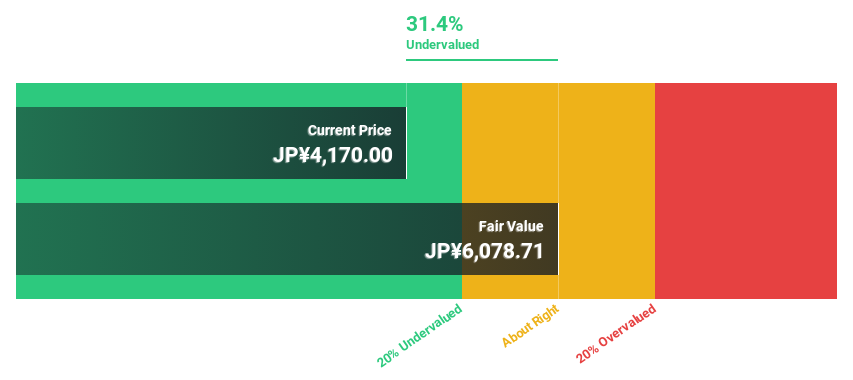

Estimated Discount To Fair Value: 31.4%

BuySell Technologies Ltd., despite a decrease in net profit margin from 5.8% to 3.3% over the past year, is projected for substantial earnings growth at 28.67% annually, outstripping Japan's market forecast of 8.9%. Recently, the company raised its financial outlook significantly for FY2024, predicting revenues to hit JPY 59.07 billion and profits at JPY 2.01 billion, reflecting robust operational improvements and market performance expectations. However, its share price remains highly volatile and debt coverage by operating cash flow is weak.

Nippon Gas

Overview: Nippon Gas Co., Ltd. operates primarily in the supply and sale of LP gas and natural gas within Japan, with a market capitalization of approximately ¥272.60 billion.

Operations: The company generates revenue from three key segments: the LP Gas Business (¥84.80 billion), City Gas Business (¥67.10 billion), and Electricity Business (¥42.46 billion).

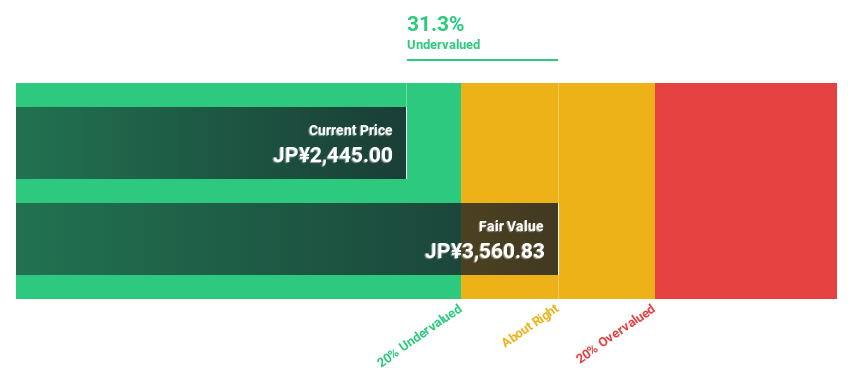

Estimated Discount To Fair Value: 31.3%

Nippon Gas, trading 31.3% below its estimated fair value, shows promise based on cash flow analysis despite an unstable dividend track record. Recent share buyback announcements underline management's confidence in the company's valuation and financial health. With earnings forecast to grow by 9.8% annually—outpacing the Japanese market average of 8.9%—and a projected high return on equity of 24%, the stock appears undervalued. However, its revenue growth projection of 5.5% per year, though above market average, is modest compared to high-growth sectors.

Taking Advantage

Click through to start exploring the rest of the 94 Undervalued Japanese Stocks Based On Cash Flows now.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSE:4704 TSE:7685 and TSE:8174.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance