3 High Yield Dividend Stocks On KRX With Up To 5.6% Yield

The South Korean market has shown robust growth, rising by 6.8% over the past year with earnings expected to grow by 29% annually. In this buoyant environment, high-yield dividend stocks can be particularly appealing for investors looking for both stability and income.

Top 10 Dividend Stocks In South Korea

Name | Dividend Yield | Dividend Rating |

Kia (KOSE:A000270) | 4.26% | ★★★★★★ |

NH Investment & Securities (KOSE:A005940) | 6.41% | ★★★★★☆ |

LOTTE Fine Chemical (KOSE:A004000) | 4.61% | ★★★★★☆ |

Shinhan Financial Group (KOSE:A055550) | 4.45% | ★★★★★☆ |

Industrial Bank of Korea (KOSE:A024110) | 7.18% | ★★★★★☆ |

KT (KOSE:A030200) | 5.49% | ★★★★★☆ |

KB Financial Group (KOSE:A105560) | 3.90% | ★★★★★☆ |

HANYANG ENGLtd (KOSDAQ:A045100) | 3.00% | ★★★★★☆ |

Kyung Nong (KOSE:A002100) | 4.78% | ★★★★★☆ |

Tong Yang Life Insurance (KOSE:A082640) | 5.56% | ★★★★☆☆ |

Click here to see the full list of 70 stocks from our Top KRX Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

Kia

Simply Wall St Dividend Rating: ★★★★★★

Overview: Kia Corporation, primarily engaged in the manufacturing and selling of vehicles across regions including South Korea, North America, and Europe, has a market capitalization of approximately ₩51.81 trillion.

Operations: Kia Corporation generates its revenue through vehicle sales across South Korea, North America, and Europe.

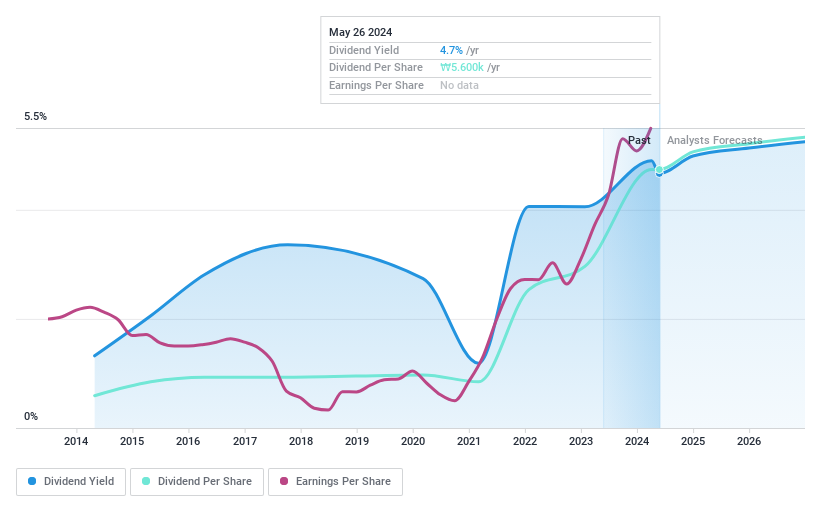

Dividend Yield: 4.3%

Kia Corporation, with a stable dividend yield of 4.26%, ranks in the top 25% of dividend payers in South Korea. The dividends, supported by a low payout ratio of 23.4% and a cash payout ratio of 25.4%, show sustainability backed by both earnings and cash flows. Dividends have grown consistently over the past decade, reflecting reliability in payments. Recent strategic alliances, including expanding into Li-Metal battery development with SES AI, underscore ongoing innovation and potential for future growth avenues despite recent legal settlements concerning vehicle theft vulnerabilities which resulted in a substantial financial commitment from Kia to enhance security features across several models.

Delve into the full analysis dividend report here for a deeper understanding of Kia.

The valuation report we've compiled suggests that Kia's current price could be quite moderate.

TKG Huchems

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TKG Huchems Co., Ltd. is a South Korean company that manufactures and sells fine chemical products globally, with a market capitalization of approximately ₩756.29 billion.

Operations: TKG Huchems Co., Ltd. generates its revenue through the manufacture and sale of fine chemical products across domestic and international markets.

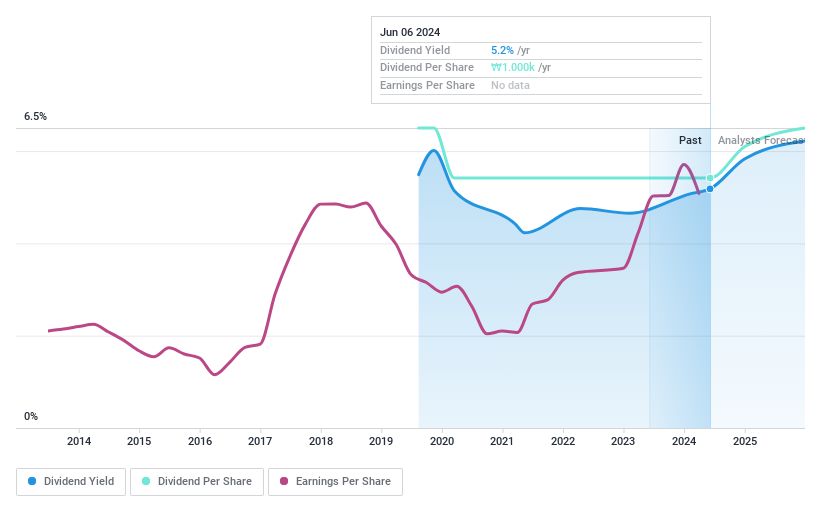

Dividend Yield: 5.1%

TKG Huchems, despite a solid dividend yield of 5.07%, faces challenges with its dividend reliability. With a history of less than 10 years in dividend payments and recent volatility, including an over 20% annual drop, stability is a concern. The dividends are covered by earnings and cash flows with payout ratios of 32% and 37.2%, respectively, suggesting some level of sustainability. However, the company's recent financial performance shows a decline in net income from KRW 45.12 billion to KRW 30.38 billion as of Q1 2024, highlighting potential risks in maintaining its dividend payments amidst fluctuating profits.

Unlock comprehensive insights into our analysis of TKG Huchems stock in this dividend report.

Upon reviewing our latest valuation report, TKG Huchems' share price might be too pessimistic.

Hyosung ITX

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hyosung ITX Co. Ltd is a South Korean company that offers business solutions, with a market capitalization of approximately ₩158.50 billion.

Operations: Hyosung ITX Co. Ltd specializes in providing business solutions within South Korea.

Dividend Yield: 5.6%

Hyosung ITX offers a competitive dividend yield of 5.63%, ranking in the top 25% within the South Korean market. The company's dividends are well-supported by both earnings and cash flows, with a payout ratio of 62.5% and a cash payout ratio of 21.8%. Despite its solid performance, Hyosung ITX has been distributing dividends for less than a decade, which may raise concerns about the long-term stability and reliability of its dividend payments. Additionally, recent corporate actions include extending their buyback plan until June 17, 2025, potentially impacting future dividend policies.

Summing It All Up

Unlock more gems! Our Top KRX Dividend Stocks screener has unearthed 67 more companies for you to explore.Click here to unveil our expertly curated list of 70 Top KRX Dividend Stocks.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include KOSE:A000270 KOSE:A069260 and KOSE:A094280.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance