3 High Yield Dividend Stocks Offering Up To 4.5%

In a week marked by moderate gains in major U.S. stock indexes and a general anticipation of upcoming earnings reports, investors are closely watching market movements. Amidst this landscape, high-yield dividend stocks emerge as noteworthy considerations for those seeking potential income-generating investments in the current economic environment.

Top 10 Dividend Stocks

Name | Dividend Yield | Dividend Rating |

Yamato Kogyo (TSE:5444) | 3.74% | ★★★★★★ |

Ping An Bank (SZSE:000001) | 6.97% | ★★★★★★ |

Business Brain Showa-Ota (TSE:9658) | 3.56% | ★★★★★★ |

Globeride (TSE:7990) | 3.78% | ★★★★★★ |

HITO-Communications HoldingsInc (TSE:4433) | 3.38% | ★★★★★★ |

FALCO HOLDINGS (TSE:4671) | 6.61% | ★★★★★★ |

Kwong Lung Enterprise (TPEX:8916) | 5.79% | ★★★★★★ |

GakkyushaLtd (TSE:9769) | 4.05% | ★★★★★★ |

DoshishaLtd (TSE:7483) | 3.47% | ★★★★★★ |

Innotech (TSE:9880) | 3.93% | ★★★★★★ |

Click here to see the full list of 1965 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

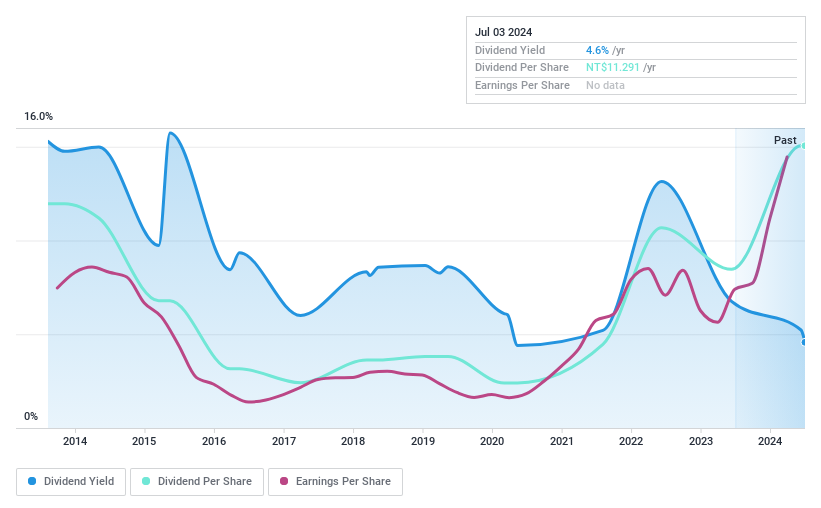

Yungshin Construction & DevelopmentLtd

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yungshin Construction & Development Ltd, operating under the ticker TPEX:5508, is a company engaged in construction and development with a market capitalization of NT$53.70 billion.

Operations: Yungshin Construction & Development Ltd generates its revenue primarily from residential and commercial building projects, totaling NT$10.54 billion.

Dividend Yield: 4.6%

Yungshin Construction & Development Ltd. maintains a payout ratio of 69.4%, indicating that its dividends are well-supported by earnings, alongside a cash payout ratio of 42.8%, which confirms strong coverage by cash flows as well. However, the company's dividend track record is marked by instability and volatility over the past decade, reflecting potential concerns for long-term reliability in its dividend payments. Recently, on June 12, 2024, Yungshin announced an increase in dividends to TWD 11.2912 per share with a total distribution of TWD 2.46 billion effective July 31, showcasing a commitment to returning value to shareholders despite historical inconsistencies.

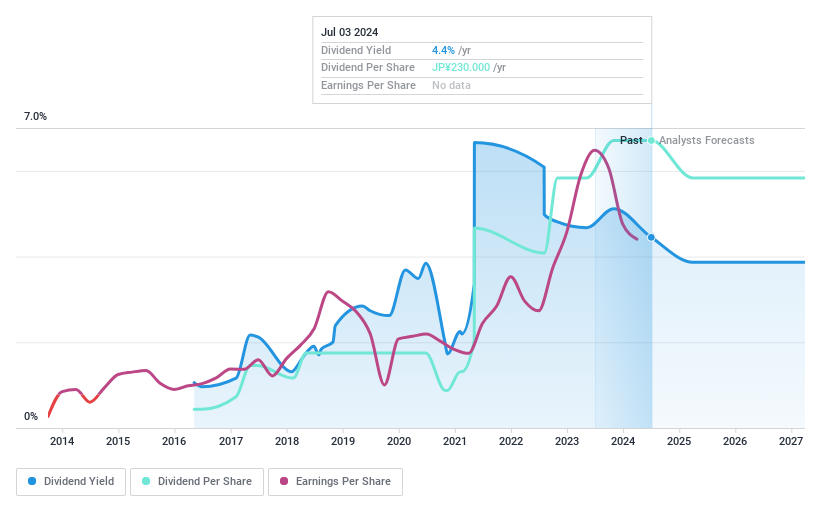

Nippon Yakin Kogyo

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Yakin Kogyo Co., Ltd. is a global manufacturer and seller of stainless steel products, with a market capitalization of ¥65.48 billion.

Operations: Nippon Yakin Kogyo Co., Ltd. generates its revenues primarily through the production and international sale of stainless steel products.

Dividend Yield: 4.4%

Nippon Yakin Kogyo's dividend profile shows a mix of strengths and concerns. Despite a volatile dividend history over the past 8 years, its current dividends are well-supported with a payout ratio of 29.4% and cash payout ratio at 17.3%. Trading at 45% below estimated fair value suggests attractiveness in pricing. Recent activities include completing a share buyback program for ¥1,849.87 million, aiming to enhance shareholder returns and improve capital efficiency, which could positively impact future dividend reliability.

Unlock comprehensive insights into our analysis of Nippon Yakin Kogyo stock in this dividend report.

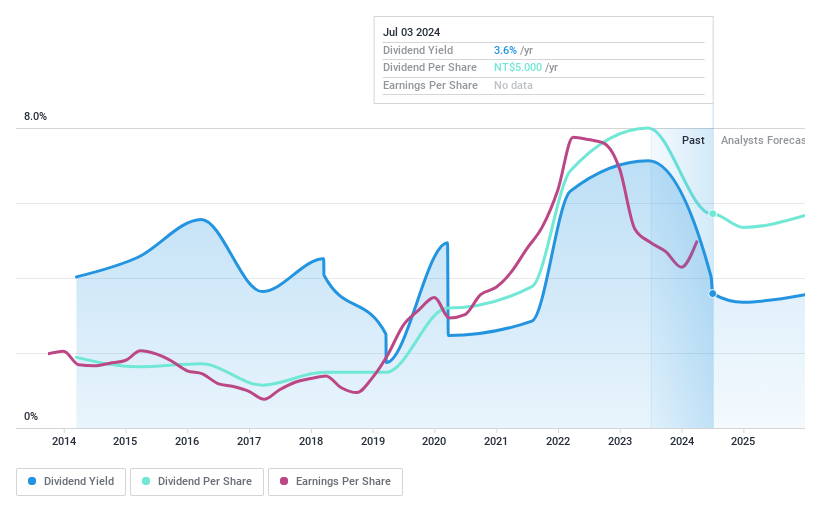

Taiwan Surface Mounting Technology

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taiwan Surface Mounting Technology Corp., with a market capitalization of NT$39.62 billion, specializes in the design, processing, manufacturing, and trading of TFT-LCD panels, general electronic information products, and PCB surface mount packaging globally.

Operations: Taiwan Surface Mounting Technology Corp. generates NT$48.01 billion in revenue from its electronic components and parts segment.

Dividend Yield: 3.6%

Taiwan Surface Mounting Technology Corp. recently declared a dividend of TWD 5.0 per share, totaling TWD 1.46 billion, set for payment on August 9, 2024. Despite this distribution, the company's dividend yield of 3.58% trails behind the top quartile in its market and has shown volatility over the past decade with significant annual fluctuations exceeding 20%. Financially, while its earnings cover dividends with a payout ratio of 50.4%, revenue growth is modest year-over-year at TWD18.78 billion compared to TWD17.44 billion last year, and earnings forecasts predict a decline over the next three years.

Where To Now?

Embark on your investment journey to our 1965 Top Dividend Stocks selection here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TPEX:5508 TSE:5480 and TWSE:6278.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance