3 High Yield Dividend Stocks In The UK With Returns Up To 6.9%

As the United Kingdom approaches a pivotal general election, financial markets are showing modest gains, with the FTSE 100 recently marking an increase. In such a dynamic economic environment, high-yield dividend stocks can offer investors potential stability and consistent returns.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

James Latham (AIM:LTHM) | 6.30% | ★★★★★★ |

Impax Asset Management Group (AIM:IPX) | 7.10% | ★★★★★☆ |

Keller Group (LSE:KLR) | 3.54% | ★★★★★☆ |

Dunelm Group (LSE:DNLM) | 7.19% | ★★★★★☆ |

DCC (LSE:DCC) | 3.50% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 5.75% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.77% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.20% | ★★★★★☆ |

NWF Group (AIM:NWF) | 4.52% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.59% | ★★★★★☆ |

Click here to see the full list of 56 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

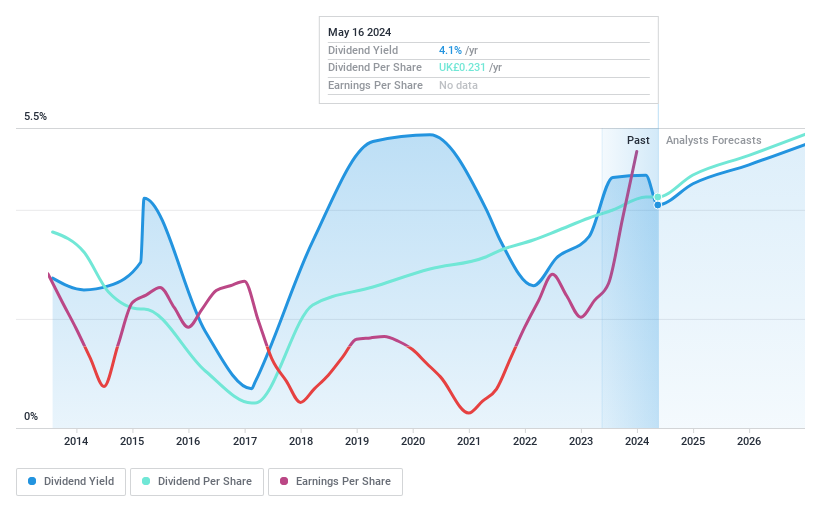

Drax Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Drax Group plc operates in the renewable power generation sector in the United Kingdom, with a market capitalization of approximately £2.02 billion.

Operations: Drax Group plc generates revenue primarily through three segments: Customers (£4.96 billion), Generation (£6.79 billion), and Pellet Production (£0.82 billion).

Dividend Yield: 4.4%

Drax Group plc, despite a robust increase in earnings by 560.6% over the past year, presents challenges for dividend-focused investors with its unstable dividend history and a forecasted average earnings decline of 15.3% per year over the next three years. The company's dividends are well-covered by both earnings and cash flows, with payout ratios of 16.2% and 22.7%, respectively. Recent strategic moves include securing a new £150 million term-loan facility to refinance upcoming debt maturities and appointing Rob Shuter as non-executive director, enhancing its financial oversight capabilities.

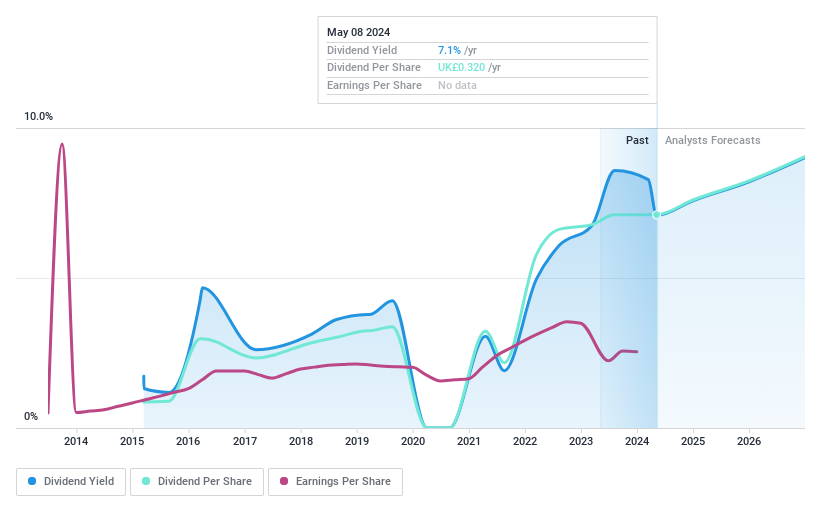

OSB Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: OSB Group Plc is a UK-based company specializing in mortgage lending and retail savings, with a market capitalization of approximately £1.82 billion.

Operations: OSB Group Plc generates its revenue primarily through its subsidiaries, Onesavings Bank Plc and Charter Court Financial Services Group Plc, which contributed £429.10 million and £230.20 million respectively.

Dividend Yield: 6.9%

OSB Group's dividend history shows instability, with volatile payments over the last 9 years and a high bad loans ratio at 3%. However, the dividends are currently well-covered by earnings with a payout ratio of 48.4%, and forecasts suggest this will improve to 34.5% in three years. Recent board appointments, including Henry Daubeney and Victoria Hyde, bring extensive financial expertise which might influence future financial stability and reporting practices.

Plus500

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Plus500 Ltd. is a fintech company that operates technology-based trading platforms across Europe, the United Kingdom, Australia, and other international markets, with a market capitalization of approximately £1.75 billion.

Operations: Plus500 Ltd. generates its revenue primarily from CFD trading, amounting to $719.10 million.

Dividend Yield: 5.8%

Plus500 has demonstrated unstable dividends with significant annual fluctuations over the past decade. Despite this, its current dividend yield of 5.83% ranks in the top 25% in the UK market. The dividends are well-supported by earnings and cash flows, with a payout ratio of 25.4% and a cash payout ratio of 37.7%, respectively. However, earnings are expected to decline by an average of 1% annually over the next three years, which could impact future dividend sustainability.

Get an in-depth perspective on Plus500's performance by reading our dividend report here.

Our valuation report here indicates Plus500 may be undervalued.

Make It Happen

Unlock more gems! Our Top Dividend Stocks screener has unearthed 53 more companies for you to explore.Click here to unveil our expertly curated list of 56 Top Dividend Stocks.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:DRX LSE:OSB and LSE:PLUS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance