3 High-Yield Dividend Stocks In The UK With Yields Up To 6.9%

As the United Kingdom braces for a general election, the financial markets remain a focal point of interest, with recent discussions around regulatory actions and market performance capturing headlines. Amidst these dynamic conditions, investors might consider the stability offered by high-yield dividend stocks, particularly those that can provide consistent returns in varying economic climates.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

James Latham (AIM:LTHM) | 6.38% | ★★★★★★ |

Impax Asset Management Group (AIM:IPX) | 7.10% | ★★★★★☆ |

Keller Group (LSE:KLR) | 3.56% | ★★★★★☆ |

DCC (LSE:DCC) | 3.53% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 5.82% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.90% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.87% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.43% | ★★★★★☆ |

NWF Group (AIM:NWF) | 4.39% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.67% | ★★★★★☆ |

Click here to see the full list of 56 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

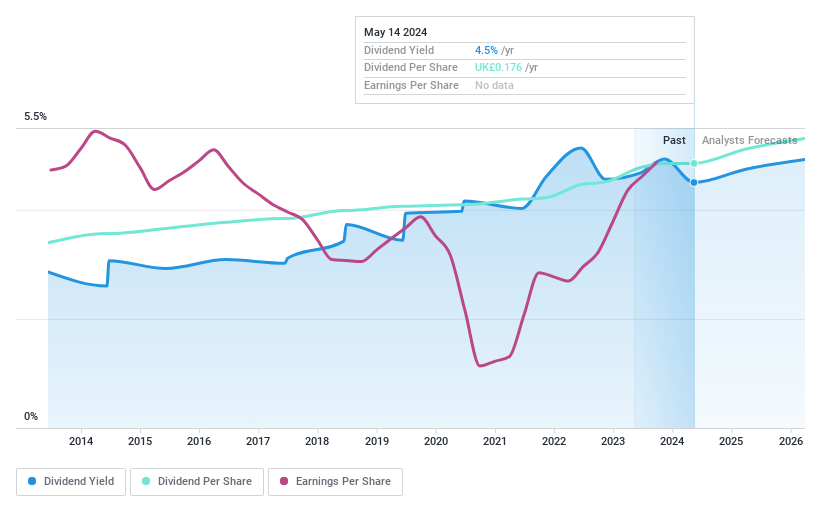

Castings

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Castings P.L.C. is a company based in the United Kingdom that specializes in iron casting and machining, serving markets including Europe, North and South America, with a market capitalization of approximately £160.79 million.

Operations: Castings P.L.C. generates revenue primarily through its Foundry Operations and Machining Operations, which respectively contributed £250.98 million and £37.65 million.

Dividend Yield: 6.9%

Castings P.L.C. offers a high dividend yield of 6.92%, above the UK market average, and has increased its dividends consistently over the past decade, reflecting stability and reliability in payouts. However, this dividend is not well supported by cash flows with a cash payout ratio of 100.4%. Recent financials show an earnings growth of 21.3% over the past year with sales rising from £200.99 million to £224.41 million, yet earnings are projected to decline annually by 5.8% over the next three years. Despite these challenges, Castings trades at a significant discount to estimated fair value and recently declared both regular and special dividends, underscoring a commitment to shareholder returns amidst strategic investments.

Click here to discover the nuances of Castings with our detailed analytical dividend report.

Our valuation report here indicates Castings may be undervalued.

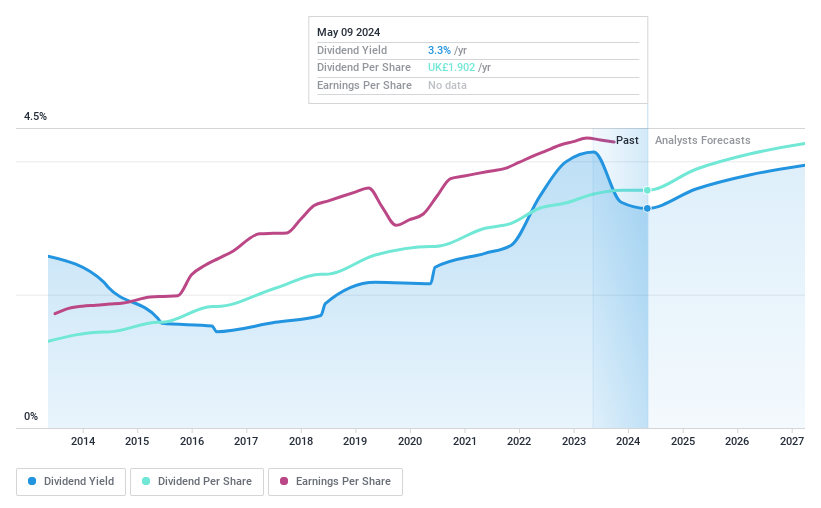

DCC

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DCC plc is a global company specializing in the sales, marketing, and distribution of carbon energy solutions, with a market capitalization of approximately £5.51 billion.

Operations: DCC plc generates revenue through three primary segments: DCC Energy (£14.22 billion), DCC Healthcare (£0.86 billion), and DCC Technology (£4.77 billion).

Dividend Yield: 3.5%

DCC maintains a consistent dividend yield at 3.53%, though it's lower than the top UK dividend payers. Dividend growth has been steady over the last decade, supported by a sustainable payout ratio of 59.5% from earnings and 39.5% from cash flows, ensuring reliability in future payments. Despite recent dips in sales and net income as reported in May 2024, DCC proposes a 5% increase in its annual dividend to £1.9657 per share, reflecting confidence in its financial management and outlook for strong operating profit growth for FY2025.

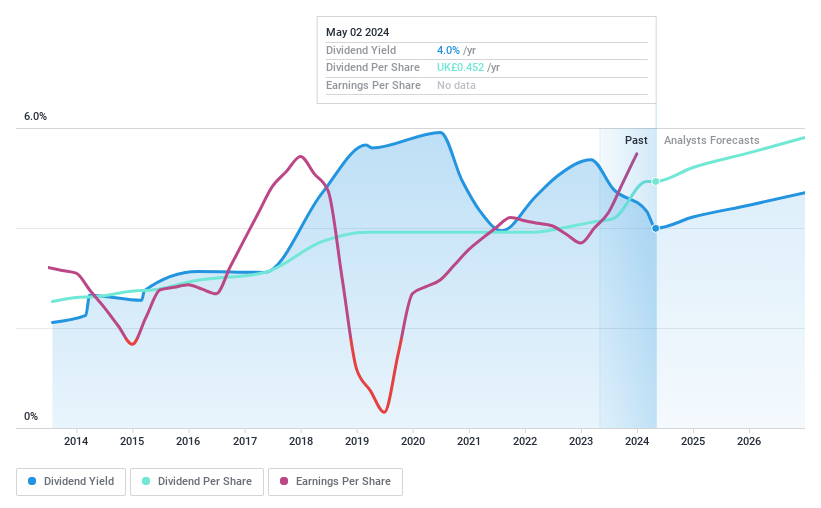

Keller Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Keller Group plc is a company that specializes in geotechnical services across North America, Europe, Asia-Pacific, the Middle East, and Africa, with a market capitalization of approximately £0.91 billion.

Operations: Keller Group plc generates £2.97 billion from its specialist geotechnical services.

Dividend Yield: 3.6%

Keller Group plc demonstrates a secure dividend profile with a 10-year history of stable and growing payouts, supported by a low cash payout ratio of 32.2% and an earnings payout ratio of 36.8%. Despite its dividend yield of 3.56% being below the top UK payers, it trades at a significant discount to fair value (28.2%) and has shown robust earnings growth, increasing by 94.3% over the past year. However, its share price has been highly volatile recently. At its recent AGM on May 15, 2024, Keller approved a final dividend of £0.313 per share.

Take a closer look at Keller Group's potential here in our dividend report.

Upon reviewing our latest valuation report, Keller Group's share price might be too pessimistic.

Summing It All Up

Click here to access our complete index of 56 Top Dividend Stocks.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:CGSLSE:DCC and LSE:KLR.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance