3 High-Yield Dividend Stocks In The UK Offering Up To 7.2%

Amidst the backdrop of fluctuating global markets and looming political events, the UK's financial landscape remains a focal point for investors, particularly as the FTSE 100 shows signs of volatility ahead of critical elections. In such times, high-yield dividend stocks can be appealing for their potential to offer stability and consistent returns.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

James Latham (AIM:LTHM) | 6.35% | ★★★★★★ |

Impax Asset Management Group (AIM:IPX) | 7.19% | ★★★★★☆ |

Epwin Group (AIM:EPWN) | 5.71% | ★★★★★☆ |

Dunelm Group (LSE:DNLM) | 7.37% | ★★★★★☆ |

DCC (LSE:DCC) | 3.53% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 5.89% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.90% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.86% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.37% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.77% | ★★★★★☆ |

Click here to see the full list of 56 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

James Latham

Simply Wall St Dividend Rating: ★★★★★★

Overview: James Latham plc is a UK-based company specializing in the import and distribution of timber, panels, and decorative surfaces across the UK, Ireland, other parts of Europe, and internationally, with a market capitalization of approximately £247.30 million.

Operations: James Latham plc generates £366.51 million from its timber importing and distribution activities.

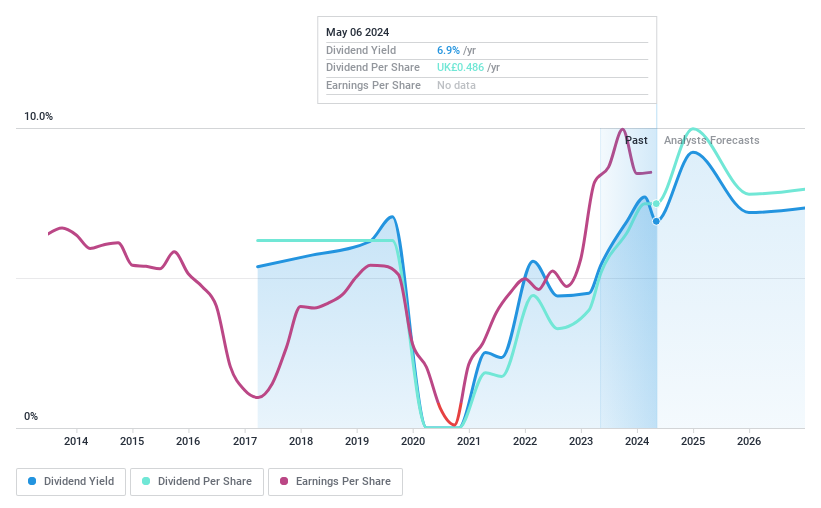

Dividend Yield: 6.4%

James Latham has maintained a stable dividend payout with a 10-year track record of reliability, boasting an attractive yield of 6.35%, which ranks in the top 25% of UK dividend payers. The dividends are well-covered by both earnings and cash flows, with a payout ratio at 30% and a cash payout ratio at 87.4%. Despite recent financial setbacks where net income dropped to £22.66 million from £35.92 million year-over-year, the company continues to reward shareholders, evidenced by a recent increase in its annual dividend to 33.75 pence per share and special dividends reflecting robust profit levels and strong cash positions.

Navigate through the intricacies of James Latham with our comprehensive dividend report here.

Our valuation report unveils the possibility James Latham's shares may be trading at a premium.

HSBC Holdings

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: HSBC Holdings plc operates globally, offering banking and financial services with a market capitalization of approximately £126.48 billion.

Operations: HSBC Holdings plc generates revenue through several key divisions: Commercial Banking ($19.43 billion), Global Banking and Markets ($15.80 billion), and Wealth and Personal Banking ($24.34 billion).

Dividend Yield: 7.0%

HSBC Holdings has shown a mixed performance in its dividend offerings, with a history of less than 10 years and some volatility in payments. Its current dividend yield of 6.98% places it among the top UK payers, supported by a reasonable payout ratio of 52.7%. However, earnings are expected to decline by an average of 2.8% annually over the next three years, which could challenge future dividend sustainability despite current coverage. Additionally, HSBC faces challenges with a high bad loans ratio at 2%, indicating potential risk in asset quality.

Take a closer look at HSBC Holdings' potential here in our dividend report.

Our valuation report unveils the possibility HSBC Holdings' shares may be trading at a discount.

Ninety One Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Ninety One Group is an independent global asset manager with operations worldwide, boasting a market capitalization of approximately £1.52 billion.

Operations: Ninety One Group generates its revenue primarily through its investment management business, which brought in £588.50 million.

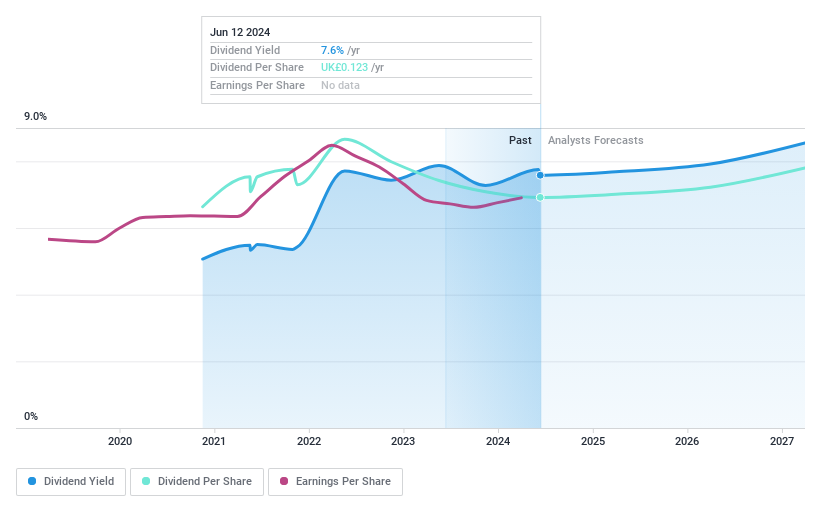

Dividend Yield: 7.2%

Ninety One Group's recent financial performance shows a slight dip in revenue and earnings, with sales dropping from £745.5 million to £697.8 million year-over-year and net income marginally increasing to £163.9 million. Despite this, the company maintains a reasonable dividend payout ratio of 66.8%, ensuring dividends are well-covered by earnings and cash flows (65.5%). However, its dividend track record is relatively short at under 10 years, with a recent decrease in the final dividend to 6.4 pence per share for FY2024, reflecting potential concerns about long-term sustainability amidst organizational changes like key personnel shifts within its Emerging Market Corporate Debt fund management team.

Get an in-depth perspective on Ninety One Group's performance by reading our dividend report here.

Upon reviewing our latest valuation report, Ninety One Group's share price might be too pessimistic.

Where To Now?

Get an in-depth perspective on all 56 Top Dividend Stocks by using our screener here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:LTHM LSE:HSBA and LSE:N91.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance