3 High-Performing Swiss Dividend Stocks Yielding Up To 4.9%

The Switzerland market has recently exhibited a pattern of cautious optimism, with the SMI index showing a slight increase despite broader fluctuations and investor wariness ahead of key economic data releases. In this context, selecting dividend stocks that not only offer attractive yields but also demonstrate resilience in varied market conditions becomes particularly pertinent.

Top 10 Dividend Stocks In Switzerland

Name | Dividend Yield | Dividend Rating |

Vontobel Holding (SWX:VONN) | 5.56% | ★★★★★★ |

Cembra Money Bank (SWX:CMBN) | 5.13% | ★★★★★★ |

Banque Cantonale Vaudoise (SWX:BCVN) | 4.49% | ★★★★★★ |

St. Galler Kantonalbank (SWX:SGKN) | 4.36% | ★★★★★★ |

Novartis (SWX:NOVN) | 3.36% | ★★★★★☆ |

Roche Holding (SWX:ROG) | 3.90% | ★★★★★☆ |

CPH Group (SWX:CPHN) | 5.88% | ★★★★★☆ |

Julius Bär Gruppe (SWX:BAER) | 4.97% | ★★★★★☆ |

Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.72% | ★★★★★☆ |

Helvetia Holding (SWX:HELN) | 5.15% | ★★★★★☆ |

Click here to see the full list of 26 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of from the screener.

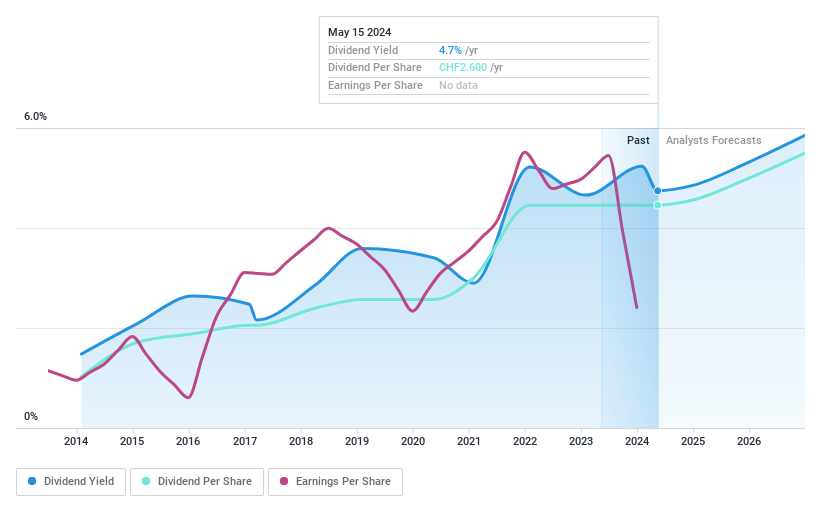

Julius Bär Gruppe

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Julius Bär Gruppe AG is a global wealth management firm operating in Switzerland, Europe, the Americas, and Asia with a market capitalization of CHF 10.71 billion.

Operations: Julius Bär Gruppe AG generates CHF 3.24 billion from its private banking segment.

Dividend Yield: 5%

Julius Bär Gruppe has demonstrated a reliable dividend history over the past decade, with growing payments that currently place its yield in the top 25% of Swiss dividend stocks. However, challenges persist as its dividends are not well covered by earnings, reflected in a high payout ratio of 117.8%. Additionally, profit margins have declined from 24.6% to 14% over the past year, indicating potential pressure on future payouts. Recent executive changes suggest strategic shifts focusing on Asian markets which could impact performance.

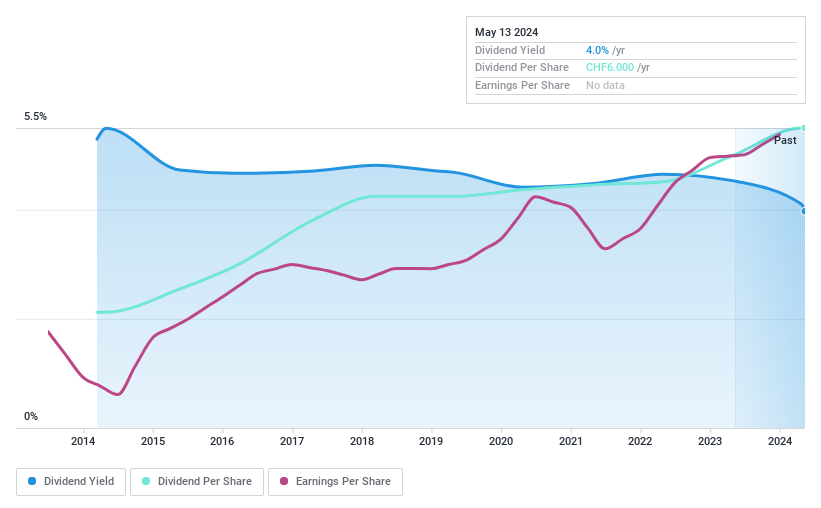

Compagnie Financière Tradition

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Compagnie Financière Tradition SA is a global interdealer broker dealing in both financial and non-financial products, with a market capitalization of CHF 1.13 billion.

Operations: Compagnie Financière Tradition SA generates revenue primarily from three geographical segments: Americas (CHF 350.89 million), Asia-Pacific (CHF 271.44 million), and Europe, Middle East, and Africa (CHF 431.78 million).

Dividend Yield: 4.1%

Compagnie Financière Tradition has shown a stable dividend history, with a consistent increase in payments over the last decade and a current yield of 4.12%. Despite recent share price volatility, its dividends are well-supported by both earnings and cash flows, with payout ratios of 47.2% and 40.8% respectively. Recent financial results from 2023 show an uptick in revenue to CHF 983.3 million and net income to CHF 94.42 million, reinforcing its capacity to maintain dividend payouts amidst market fluctuations.

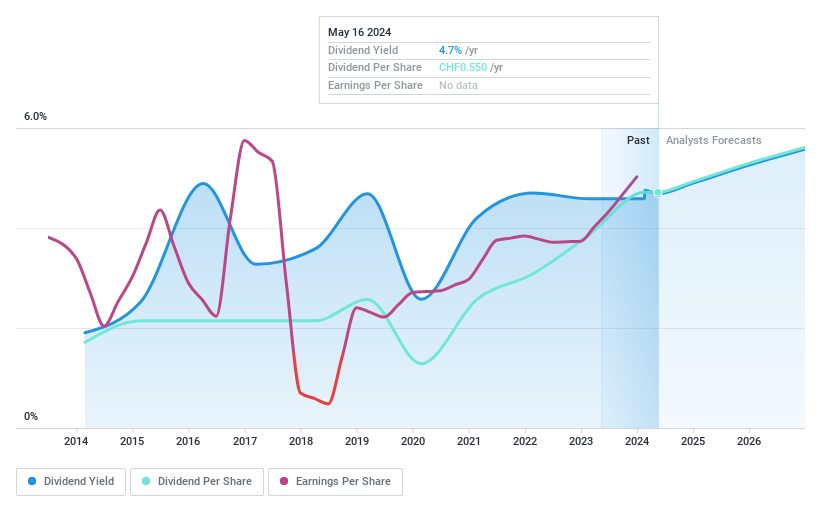

EFG International

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EFG International AG operates primarily in private banking, wealth management, and asset management, with a market capitalization of approximately CHF 4.07 billion.

Operations: EFG International AG generates its revenue from various geographical segments, with CHF 450.20 million from Switzerland & Italy, CHF 249.70 million from Continental Europe & Middle East, CHF 177.40 million from the United Kingdom, CHF 165.30 million from Asia Pacific, and CHF 133.20 million from the Americas; sector-specific revenues include CHF 122.40 million from Investment and Wealth Solutions and CHF 83 million from Global Markets & Treasury.

Dividend Yield: 4.1%

EFG International exhibits a mixed dividend profile, with past payments showing volatility and an unreliable growth pattern. Despite this, dividends are currently covered by earnings with a payout ratio of 58.5%, suggesting some level of sustainability. However, the company's dividend yield at 4.06% is slightly below the top quartile in the Swiss market. Additionally, EFG recently extended its buyback plan until July 2024, potentially impacting future dividend distributions.

Next Steps

Explore the 26 names from our Top Dividend Stocks screener here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SWX:BAER SWX:CFT and SWX:EFGN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance