3 High Insider Ownership US Stocks Achieving At Least 29% Earnings Growth

The U.S. stock market continues to demonstrate resilience, with major indices like the Dow Jones, S&P 500, and Nasdaq Composite achieving sustained gains amid optimistic economic forecasts and strong tech sector performance. In such a buoyant environment, growth companies with high insider ownership can be particularly compelling as these insiders may have significant confidence in their companies' future prospects.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.3% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 22.1% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

Duolingo (NasdaqGS:DUOL) | 15% | 48.1% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

BBB Foods (NYSE:TBBB) | 22.9% | 94.7% |

Here we highlight a subset of our preferred stocks from the screener.

Ameresco

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ameresco, Inc. is a clean technology integrator offering energy efficiency and renewable energy solutions across the United States, Canada, Europe, and internationally, with a market capitalization of approximately $1.38 billion.

Operations: The company's revenue is generated from various segments including $404.22 million from U.S. Federal, $177.87 million from Europe, and $121.60 million from Alternative Fuels.

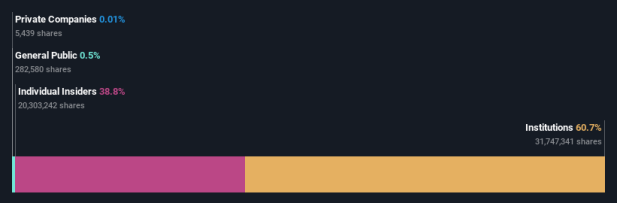

Insider Ownership: 38%

Earnings Growth Forecast: 29.7% p.a.

Ameresco, a company focused on sustainable energy solutions, recently announced significant contracts and projects that underscore its growth trajectory and commitment to innovation. Notably, it secured a major contract with Snohomish County Public Utility District for a large battery energy storage system, marking the largest standalone battery project in the Pacific Northwest. This project highlights Ameresco's strategic focus on long-term sustainability projects that offer both environmental benefits and financial stability. Despite this positive outlook, Ameresco faces challenges such as interest payments not being well covered by earnings and a forecasted low Return on Equity in three years time. However, analysts remain optimistic about its potential for substantial price appreciation.

RingCentral

Simply Wall St Growth Rating: ★★★★☆☆

Overview: RingCentral, Inc. offers global cloud communications, video meetings, collaboration, and contact center software-as-a-service solutions with a market capitalization of approximately $2.60 billion.

Operations: The company generates its revenue primarily from internet software and services, totaling approximately $2.25 billion.

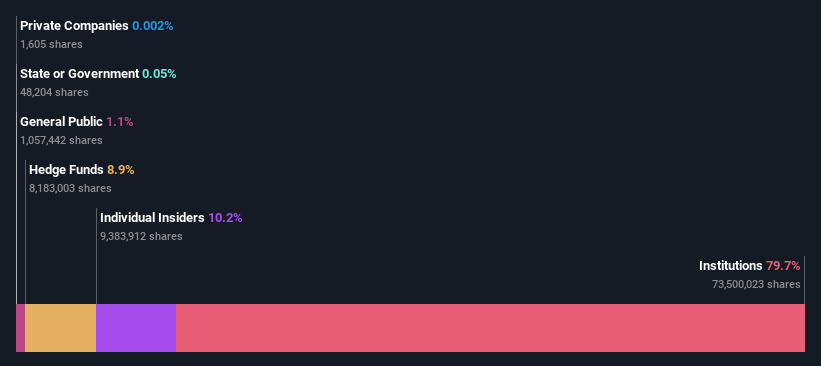

Insider Ownership: 10.4%

Earnings Growth Forecast: 69.8% p.a.

RingCentral, a key player in cloud communication solutions, is set to capitalize on hybrid work trends through strategic partnerships and product innovations. Recent collaborations with Vodafone Business Ireland and Avaya enhance its offerings across Europe, integrating AI-driven capabilities for seamless enterprise communication. Financially, RingCentral raised its 2024 revenue guidance to US$2.38-2.40 billion after reporting a reduced net loss in Q1 2024. Despite slower than market forecasted revenue growth at 7.2% annually, the company's substantial insider ownership aligns interests with shareholders, supporting its transition to profitability within three years.

Click here to discover the nuances of RingCentral with our detailed analytical future growth report.

Ryan Specialty Holdings

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ryan Specialty Holdings, Inc. provides specialty products and solutions for insurance brokers, agents, and carriers across the United States, Canada, the United Kingdom, Europe, and Singapore with a market capitalization of approximately $14.99 billion.

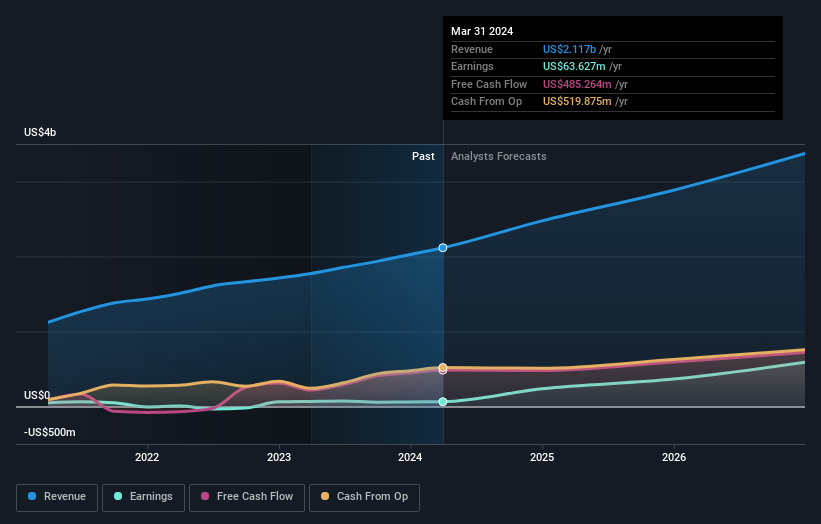

Operations: The company generates its revenue primarily from insurance brokerage services, totaling $2.12 billion.

Insider Ownership: 19.4%

Earnings Growth Forecast: 56.6% p.a.

Ryan Specialty Holdings, recently added to multiple S&P indices, is navigating significant executive transitions set for October 2024. With a robust forecasted annual earnings growth of 56.6% and revenue growth at 16.5%, the company outpaces the US market averages significantly in both metrics. However, its high debt levels and large one-off items impacting financial results present challenges. These developments follow strong Q1 performance with revenues up to US$552.05 million and net income at US$40.68 million.

Turning Ideas Into Actions

Access the full spectrum of 179 Fast Growing US Companies With High Insider Ownership by clicking on this link.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NYSE:AMRC NYSE:RNG and NYSE:RYAN.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance