3 High Insider Ownership US Stocks With Up To 59% Revenue Growth

Over the past year, the United States stock market has experienced a significant upswing, rising by 25%, while remaining steady in the last week. In such a thriving market, companies with high insider ownership can be particularly compelling as they often indicate strong confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 21.3% |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.2% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 21.7% |

Cipher Mining (NasdaqGS:CIFR) | 18.5% | 58.8% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Bridge Investment Group Holdings (NYSE:BRDG) | 11.6% | 98.2% |

EHang Holdings (NasdaqGM:EH) | 33% | 101.9% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

ZKH Group (NYSE:ZKH) | 17.7% | 104.4% |

BBB Foods (NYSE:TBBB) | 23.6% | 92.4% |

Let's review some notable picks from our screened stocks.

EHang Holdings

Simply Wall St Growth Rating: ★★★★★★

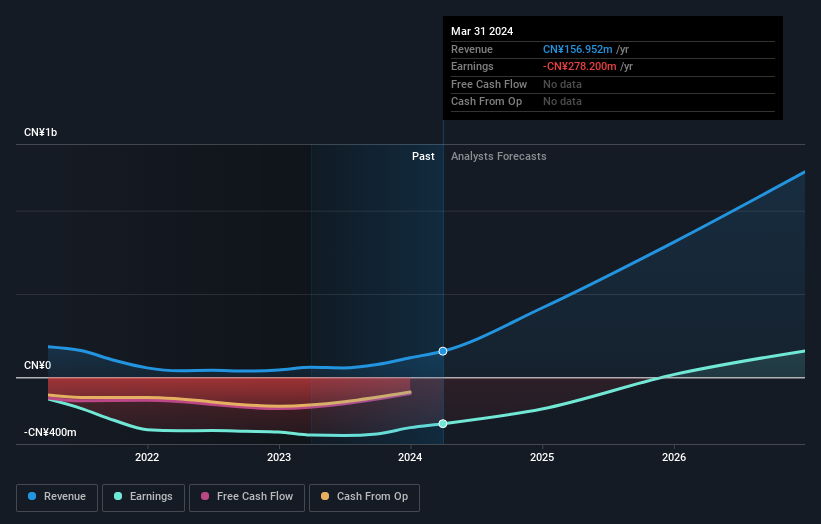

Overview: EHang Holdings Limited is a global company based in the People's Republic of China that specializes in autonomous aerial vehicle technology, with a market capitalization of approximately $1.00 billion.

Operations: The company generates its revenue from autonomous aerial vehicle technology operations across various global regions including the People’s Republic of China, East Asia, West Asia, and Europe.

Insider Ownership: 33%

Revenue Growth Forecast: 59.7% p.a.

EHang Holdings, a pioneer in autonomous aerial vehicles, showcased substantial year-over-year revenue growth in Q1 2024 and anticipates a significant increase for Q2. Despite ongoing net losses, improvements are evident with reduced losses compared to the previous year. The company's strategic moves include successful demo flights in the UAE and partnerships for advanced eVTOL battery technologies, positioning it well within the high-growth urban air mobility market. However, share price volatility and recent shareholder dilution present challenges.

Coastal Financial

Simply Wall St Growth Rating: ★★★★★☆

Overview: Coastal Financial Corporation, serving as the bank holding company for Coastal Community Bank, offers a range of banking products and services to small and medium-sized businesses, professionals, and individuals in Washington's Puget Sound region, with a market capitalization of approximately $588.18 million.

Operations: The bank's revenue is generated through its segments: CCBX at $174.24 million, Community Bank at $148.46 million, and Treasury & Administration contributing $9.32 million.

Insider Ownership: 18.6%

Revenue Growth Forecast: 53% p.a.

Coastal Financial Corporation experienced an increase in net charge-offs to US$57.22 million this quarter from US$32.30 million last year, impacting earnings which declined to US$6.8 million from US$12.39 million. Despite these challenges, the company's revenue is growing at 53% annually, outpacing the U.S market forecast of 8.4%. Insider activities show more buying than selling over the past three months, aligning with a positive outlook as analysts project a 26.6% potential rise in stock price based on current valuations being significantly below fair value estimates.

Youdao

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Youdao, Inc. is an internet technology company operating in China, offering online services across content, community, communication, and commerce sectors with a market capitalization of approximately $433.85 million.

Operations: The company generates its revenue through various online services in content, community, communication, and commerce sectors.

Insider Ownership: 20.3%

Revenue Growth Forecast: 12.7% p.a.

Youdao, Inc. recently posted a significant turnaround in its financial results for Q1 2024, with net income reaching CNY 12.43 million compared to a substantial loss the previous year. This improvement aligns with an anticipated profitability within three years and earnings growth forecasted at a robust rate annually. Despite trading at 87.7% below its estimated fair value, indicating potential undervaluation, concerns about financial sustainability persist due to less than one year of cash runway available.

Taking Advantage

Navigate through the entire inventory of 177 Fast Growing US Companies With High Insider Ownership here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqGM:EH NasdaqGS:CCB and NYSE:DAO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance