3 High Insider Ownership Growth Companies On Chinese Exchange With Earnings Growth Of 28%

As global markets navigate through various economic signals, China's stock market has shown mixed responses, particularly with its manufacturing sector experiencing a slowdown. This context sets the stage for examining growth companies in China that boast high insider ownership—a factor often linked to strong corporate governance and alignment of interests between shareholders and management.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

ShenZhen Woer Heat-Shrinkable MaterialLtd (SZSE:002130) | 19% | 27.9% |

Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 24% | 22.3% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.4% | 28.4% |

Arctech Solar Holding (SHSE:688408) | 25.9% | 25.8% |

Cubic Sensor and InstrumentLtd (SHSE:688665) | 10.1% | 34.3% |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Suzhou Sunmun Technology (SZSE:300522) | 36.5% | 63.4% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Fujian Wanchen Biotechnology Group (SZSE:300972) | 14.9% | 75.9% |

UTour Group (SZSE:002707) | 23% | 33.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

Suzhou HYC TechnologyLtd

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou HYC Technology Co., Ltd. specializes in providing industrial testing equipment and turnkey solutions for various sectors including flat panel display, intelligent wearable, semiconductor, and automotive electronics in China, with a market capitalization of CN¥10.30 billion.

Operations: The company generates revenue primarily through the production and supply of industrial testing equipment and comprehensive solutions across several sectors, notably in flat panel display, intelligent wearable, semiconductor, and automotive electronics.

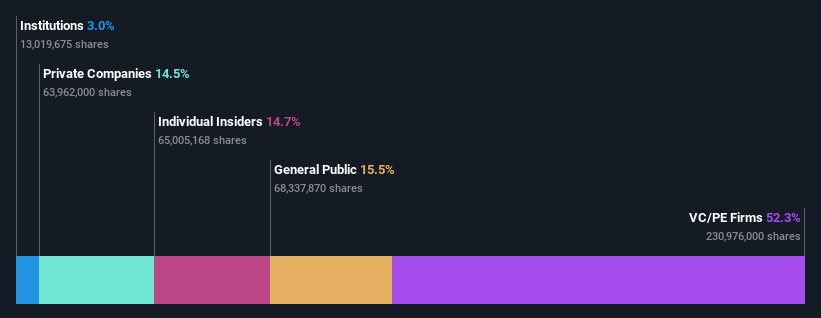

Insider Ownership: 14.7%

Earnings Growth Forecast: 57.5% p.a.

Suzhou HYC TechnologyLtd., a growth-oriented company with high insider ownership, is experiencing significant earnings and revenue growth, outpacing the Chinese market averages with earnings forecasted to grow at 57.5% per year and revenue at 32.4% per year. However, its dividend sustainability is questionable as it's not well covered by free cash flows. Recent activities include a share buyback where the company repurchased shares for CNY 19.35 million, indicating confidence from management despite a recent substantial net loss reported in Q1 2024.

Suzhou TZTEK Technology

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou TZTEK Technology Co., Ltd specializes in the design, development, assembly, and debugging of industrial vision equipment in China, with a market capitalization of approximately CN¥6.27 billion.

Operations: The company generates revenue through the design, development, assembly, and debugging of industrial vision equipment in China.

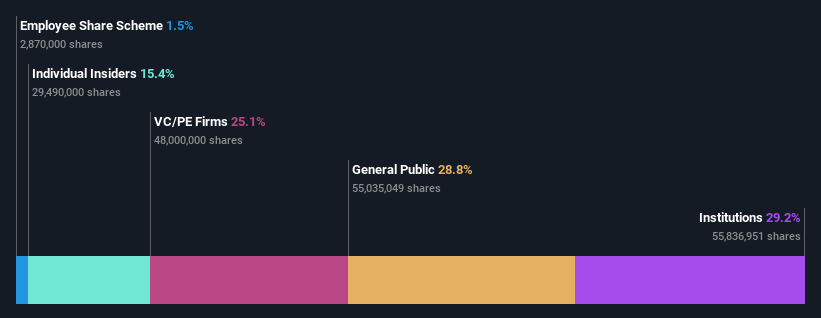

Insider Ownership: 15.3%

Earnings Growth Forecast: 28.5% p.a.

Suzhou TZTEK Technology, despite a recent net loss of CNY 38 million in Q1 2024, is positioned for robust growth with earnings and revenue forecasted to expand by 28.5% and 28.3% per year respectively—surpassing the Chinese market projections. Trading at a P/E ratio of 29.8x, below the industry average, it offers good relative value. However, its dividend sustainability is under scrutiny as it's poorly covered by free cash flows, reflecting potential financial strain despite optimistic growth forecasts.

Eaglerise Electric & Electronic (China)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Eaglerise Electric & Electronic (China) Co., Ltd. is a company that specializes in the manufacture and distribution of various electronic components, with a market capitalization of approximately CN¥7.29 billion.

Operations: The revenue segments for the company are not specified in the provided text.

Insider Ownership: 32.2%

Earnings Growth Forecast: 28.6% p.a.

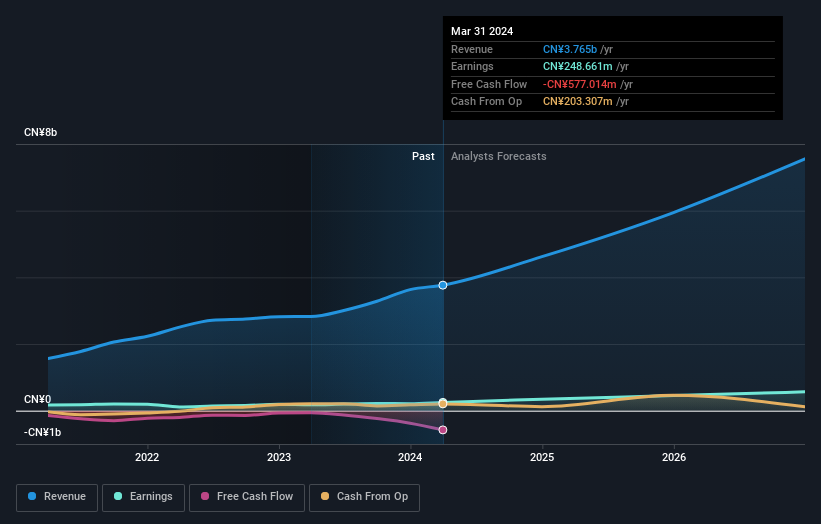

Eaglerise Electric & Electronic (China) Co. Ltd, demonstrating a robust profit growth of 41.7% over the past year, is set to continue this trend with earnings expected to increase by 28.56% annually. Despite a volatile share price and shareholder dilution in the past year, its revenue growth forecast at 25.2% annually outpaces the Chinese market's average. The company's recent no-share buyback and consistent dividend payouts reflect a proactive management strategy amidst these financial dynamics.

Summing It All Up

Unlock our comprehensive list of 368 Fast Growing Chinese Companies With High Insider Ownership by clicking here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:688001SHSE:688003 and SZSE:002922

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance