3 High Insider Ownership Growth Companies With Earnings Surging By 102%

As global markets exhibit resilience with major indices like the Dow Jones and S&P 500 reaching new heights, investors are increasingly attentive to opportunities that promise robust growth. In this context, companies with high insider ownership can be particularly compelling, as they often signal strong confidence from those closest to the business in its growth prospects and financial health.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 35.4% |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 29.9% |

Arctech Solar Holding (SHSE:688408) | 38.7% | 25.4% |

Gaming Innovation Group (OB:GIG) | 22.8% | 36.2% |

Vow (OB:VOW) | 31.8% | 99.4% |

Elliptic Laboratories (OB:ELABS) | 31.4% | 124.6% |

Nordic Halibut (OB:NOHAL) | 29.9% | 90.7% |

EHang Holdings (NasdaqGM:EH) | 33% | 98.1% |

Adocia (ENXTPA:ADOC) | 12.8% | 104.5% |

Here we highlight a subset of our preferred stocks from the screener.

Techwing

Simply Wall St Growth Rating: ★★★★★★

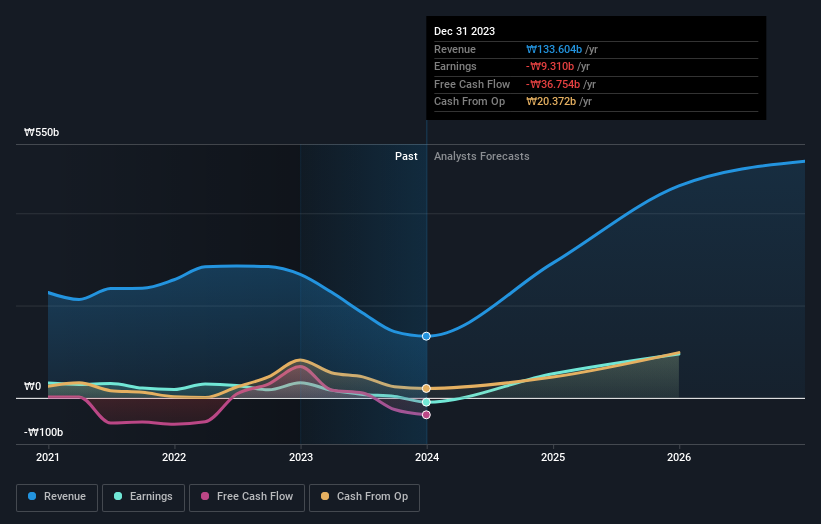

Overview: Techwing, Inc. operates in the semiconductor industry, focusing on the development, manufacturing, sale, and servicing of inspection equipment both domestically in South Korea and internationally, with a market capitalization of approximately ₩1.47 trillion.

Operations: Techwing generates its revenue primarily through two divisions: the Display Equipment Division, which brought in ₩18.87 billion, and the Semiconductor Equipment Division, with revenues of ₩115.07 billion.

Insider Ownership: 19.9%

Earnings Growth Forecast: 102.5% p.a.

Techwing, despite a challenging year with a net loss of KRW 9.31 billion, shows promise with expected revenue growth at 39.5% per year, outpacing the KR market's 9.8%. Earnings are forecasted to surge by 102.53% annually over the next three years, positioning it for profitability and above-average market growth. However, its financial stance is shaky as earnings do not comfortably cover interest payments, and its share price has been highly volatile recently.

Dive into the specifics of Techwing here with our thorough growth forecast report.

Our valuation report here indicates Techwing may be overvalued.

Guangzhou Kingmed Diagnostics Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guangzhou Kingmed Diagnostics Group Co., Ltd. operates in the healthcare sector, providing medical diagnostic services with a market capitalization of approximately CN¥17.96 billion.

Operations: The company generates its revenue primarily from third-party medical diagnostic services, totaling approximately CN¥8.26 billion.

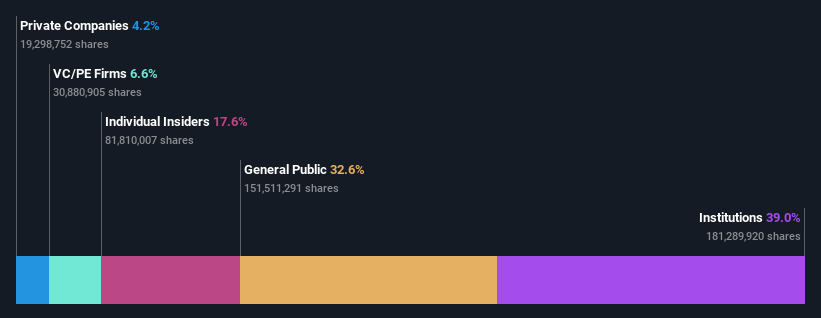

Insider Ownership: 17.6%

Earnings Growth Forecast: 35.3% p.a.

Guangzhou Kingmed Diagnostics Group has experienced a significant downturn, with recent quarterly revenue dropping to CNY 1.84 billion from CNY 2.12 billion year-over-year and shifting from a net profit to a loss of CNY 18.64 million. Despite these challenges, the company's earnings are expected to grow by 35.29% annually over the next three years, outpacing the Chinese market's average. Additionally, its recent share buyback program underscores a commitment to shareholder value, enhancing insider ownership stakes and potentially stabilizing equity incentives.

iSoftStone Information Technology (Group)

Simply Wall St Growth Rating: ★★★★★☆

Overview: iSoftStone Information Technology (Group) Co., Ltd. is a technology service provider specializing in end-to-end solutions, with a market capitalization of approximately CN¥38.20 billion.

Operations: iSoftStone's revenue is primarily derived from Communication Equipment (CN¥7.05 billion), followed by Financial Technology (CN¥4.04 billion), Internet Service (CN¥3.29 billion), and High Technology and Manufacturing (CN¥2.37 billion).

Insider Ownership: 23.8%

Earnings Growth Forecast: 24.6% p.a.

iSoftStone Information Technology (Group) Co., Ltd. has seen a decline in sales and net income, with recent figures showing CNY 17.58 billion in sales and CNY 533.9 million in net income, down from the previous year. Despite this downturn, the company's earnings are projected to grow by 24.6% annually over the next three years, outstripping the Chinese market forecast of 23.3%. This growth is supported by strategic international partnerships, like its recent collaboration with Huawei aimed at expanding digital services in the Middle East and Central Asia. However, challenges persist with a volatile share price and lower profit margins compared to last year.

Key Takeaways

Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1495 companies by clicking here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include KOSDAQ:A089030 SHSE:603882 and SZSE:301236.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance