3 High Insider Ownership Growth Companies On Chinese Exchange With Up To 33% Revenue Growth

As global markets navigate through varying economic signals, China's recent initiatives aimed at stabilizing its housing sector reflect broader efforts to support economic stability. In this context, examining growth companies with high insider ownership on Chinese exchanges offers insights into entities potentially poised for robust performance amidst these strategic economic measures.

Top 10 Growth Companies With High Insider Ownership In China

Name | Insider Ownership | Earnings Growth |

KEBODA TECHNOLOGY (SHSE:603786) | 12.8% | 25.1% |

Suzhou Sunmun Technology (SZSE:300522) | 37.6% | 63.4% |

Zhejiang Songyuan Automotive Safety SystemsLtd (SZSE:300893) | 20% | 24.2% |

Arctech Solar Holding (SHSE:688408) | 38.7% | 24.5% |

Sineng ElectricLtd (SZSE:300827) | 36.5% | 39.8% |

Anhui Huaheng Biotechnology (SHSE:688639) | 31.5% | 28.4% |

UTour Group (SZSE:002707) | 24% | 33.1% |

Xi'an Sinofuse Electric (SZSE:301031) | 36.8% | 43.1% |

Jilin University Zhengyuan Information Technologies (SZSE:003029) | 12.1% | 58.6% |

Offcn Education Technology (SZSE:002607) | 26.1% | 65.3% |

Let's take a closer look at a couple of our picks from the screened companies.

Jinan Shengquan Group Share Holding

Simply Wall St Growth Rating: ★★★★☆☆

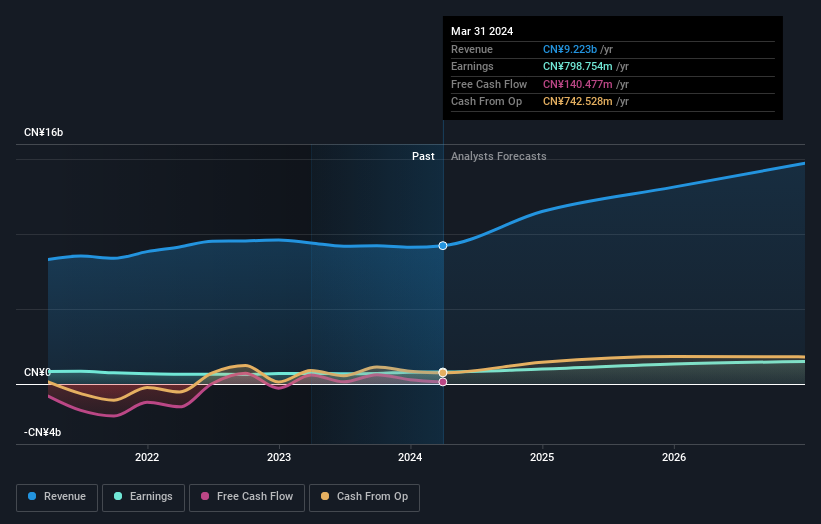

Overview: Jinan Shengquan Group Share Holding Co., Ltd. is a company that operates in the chemical industry with a market capitalization of approximately CN¥16.50 billion.

Operations: The revenue segments information for the company is not provided in the text.

Insider Ownership: 29.8%

Revenue Growth Forecast: 16.3% p.a.

Jinan Shengquan Group Share Holding, a Chinese company with substantial insider ownership, reported a steady increase in Q1 2024 earnings with sales rising to CNY 2.14 billion and net income up to CNY 137.38 million. Despite recent share dilution and dividends not well-covered by cash flow, the firm is trading below analyst price targets, suggesting potential upside. Analysts expect revenue and earnings to outpace the market with forecasts of 16.3% and 23.3% annual growth respectively, indicating robust future prospects despite some financial strains.

Shanghai Sinyang Semiconductor Materials

Simply Wall St Growth Rating: ★★★★★☆

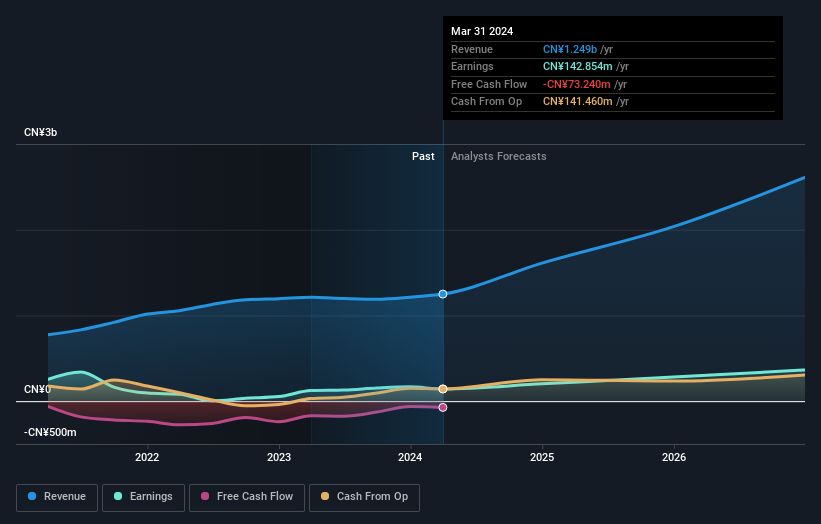

Overview: Shanghai Sinyang Semiconductor Materials Co., Ltd. is a company that specializes in the development and manufacturing of semiconductor materials, with a market capitalization of approximately CN¥9.93 billion.

Operations: The firm primarily generates revenue through the development and manufacturing of semiconductor materials.

Insider Ownership: 15.1%

Revenue Growth Forecast: 26% p.a.

Shanghai Sinyang Semiconductor Materials, a key player in China's semiconductor sector, has shown robust financial performance with substantial insider ownership. Recently, the company reported a 15.9% growth in earnings over the past year and anticipates significant earnings growth of 32.44% annually. Despite challenges such as low forecasted Return on Equity at 6.7% and large one-off items affecting financial results, revenue is expected to grow by 26% per year, outpacing the Chinese market forecast of 14%. Recent dividends demonstrate commitment to shareholder returns amidst these dynamics.

Changsha DIALINE New Material Sci.&Tech

Simply Wall St Growth Rating: ★★★★★☆

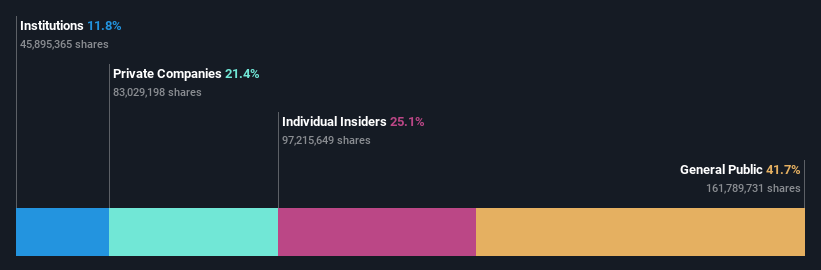

Overview: Changsha DIALINE New Material Sci.&Tech. Co., Ltd. focuses on the R&D, production, and sales of electroplated diamond wires in China, with a market capitalization of approximately CN¥3.27 billion.

Operations: The company primarily generates its revenue through the research, development, production, and sales of electroplated diamond wires.

Insider Ownership: 25.1%

Revenue Growth Forecast: 34% p.a.

Changsha DIALINE New Material Sci.&Tech., despite a recent dip in quarterly revenue and net income, maintains strong growth prospects with forecasted annual earnings growth of 48.39% and revenue growth at 34% per year, significantly outpacing the Chinese market averages. The company's aggressive share buyback strategy, repurchasing shares worth CNY 35 million recently, underscores its commitment to shareholder value. However, its unstable dividend track record may concern some investors looking for consistent returns.

Next Steps

Click through to start exploring the rest of the 404 Fast Growing Chinese Companies With High Insider Ownership now.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SHSE:605589 SZSE:300700 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance