3 High Insider Ownership German Stocks With Up To 74% Earnings Growth

As European markets show signs of resilience, with Germany's DAX index notably advancing by 0.90%, investors are keenly observing trends and opportunities within the region. In this context, growth companies in Germany with high insider ownership present a compelling narrative, especially those demonstrating robust earnings growth amidst current market conditions.

Top 10 Growth Companies With High Insider Ownership In Germany

Name | Insider Ownership | Earnings Growth |

pferdewetten.de (XTRA:EMH) | 26.8% | 75.4% |

Deutsche Beteiligungs (XTRA:DBAN) | 35.4% | 31.6% |

YOC (XTRA:YOC) | 24.8% | 22.2% |

Exasol (XTRA:EXL) | 25.3% | 105.4% |

NAGA Group (XTRA:N4G) | 14.1% | 58.1% |

Alelion Energy Systems (DB:2FZ) | 37.4% | 106.6% |

Stratec (XTRA:SBS) | 30.9% | 22% |

elumeo (XTRA:ELB) | 25.8% | 99.1% |

Redcare Pharmacy (XTRA:RDC) | 17.7% | 46.9% |

Friedrich Vorwerk Group (XTRA:VH2) | 18% | 30.4% |

Let's explore several standout options from the results in the screener.

Brockhaus Technologies

Simply Wall St Growth Rating: ★★★★☆☆

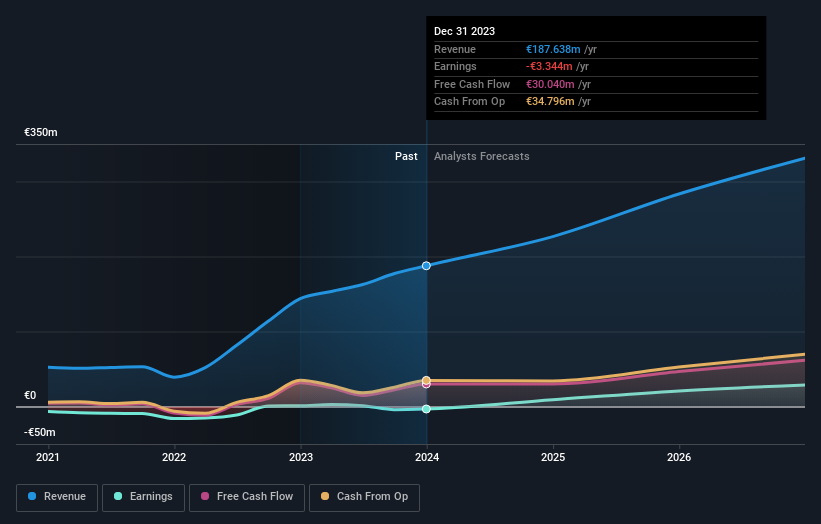

Overview: Brockhaus Technologies AG operates as a private equity firm with a market capitalization of approximately €316.56 million.

Operations: The company generates revenue primarily through its Security Technologies and Financial Technologies segments, totaling €39.43 million and €153.43 million respectively.

Insider Ownership: 26.6%

Earnings Growth Forecast: 74.2% p.a.

Brockhaus Technologies, a growth-oriented company in Germany with high insider ownership, reported a significant increase in sales to €39.85 million and revenue to €39.97 million for Q1 2024, despite widening its net loss to €1.38 million. The firm's revenue is expected to grow by 17.8% annually, outpacing the German market's 5.2%. Although its return on equity is projected at a modest 10.3%, Brockhaus is anticipated to reach profitability within three years, with earnings potentially growing by 74.21% per year.

Hypoport

Simply Wall St Growth Rating: ★★★★☆☆

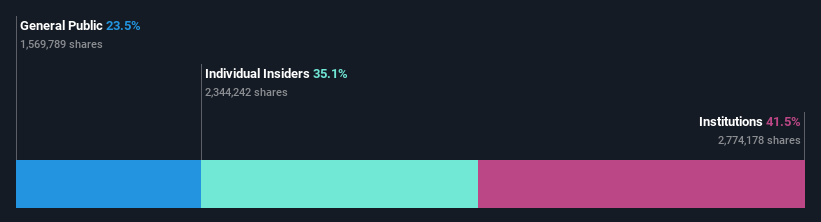

Overview: Hypoport SE, a technology-based financial service provider in Germany, has a market capitalization of approximately €2.04 billion.

Operations: The company generates revenue primarily through its Credit Platform and Insurance Platform segments, with €155.60 million and €66.29 million respectively.

Insider Ownership: 35.1%

Earnings Growth Forecast: 31.9% p.a.

Hypoport, a German company with significant insider ownership, showcased strong financial performance in Q1 2024, with sales increasing to €107.47 million and net income rising sharply to €3.04 million. Despite its highly volatile share price, Hypoport's earnings are expected to grow by 31.9% annually, outperforming the German market's forecast of 18.6%. However, its revenue growth projection of 13.4% lags behind the desired 20% threshold and one-off items have impacted earnings quality.

Dive into the specifics of Hypoport here with our thorough growth forecast report.

Our valuation report unveils the possibility Hypoport's shares may be trading at a premium.

Friedrich Vorwerk Group

Simply Wall St Growth Rating: ★★★★☆☆

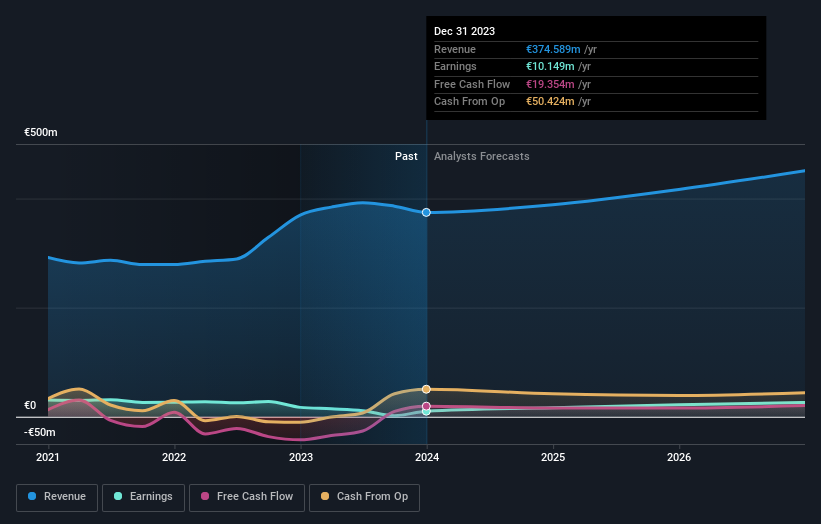

Overview: Friedrich Vorwerk Group SE specializes in solutions for the transformation and transportation of energy across Germany and Europe, with a market capitalization of approximately €0.36 billion.

Operations: The company generates revenue through segments focused on electricity (€72.07 million), natural gas (€157.60 million), clean hydrogen (€28.59 million), and adjacent opportunities (€118.73 million).

Insider Ownership: 18%

Earnings Growth Forecast: 30.4% p.a.

Friedrich Vorwerk Group SE, a German growth company with high insider ownership, reported a solid increase in Q1 2024 earnings, with sales rising to €76.71 million and net income improving to €1.56 million. The firm's revenue and earnings are expected to grow by 7.9% and 30.45% annually, surpassing the German market averages of 5.2% and 18.6%, respectively. However, its forecasted Return on Equity is relatively low at 11%, indicating potential challenges in achieving higher profitability levels.

Turning Ideas Into Actions

Dive into all 18 of the Fast Growing German Companies With High Insider Ownership we have identified here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include XTRA:BKHT XTRA:HYQ and XTRA:VH2.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance