3 High Insider Ownership ASX Stocks With Minimum 21% Earnings Growth

Amid fluctuating conditions in the Australian market, with the ASX200 experiencing a downturn influenced by recent inflation data, investors continue to navigate through sector-specific performances and key corporate developments. In such a landscape, stocks demonstrating robust insider ownership coupled with strong earnings growth potential stand out as particularly noteworthy candidates for those looking to invest in companies with aligned management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Australia

Name | Insider Ownership | Earnings Growth |

Hartshead Resources (ASX:HHR) | 13.9% | 86.3% |

Cettire (ASX:CTT) | 28.7% | 29.9% |

Gratifii (ASX:GTI) | 15.6% | 112.4% |

Acrux (ASX:ACR) | 14.6% | 115.3% |

Doctor Care Anywhere Group (ASX:DOC) | 28.4% | 96.4% |

Alpha HPA (ASX:A4N) | 26.3% | 95.9% |

Plenti Group (ASX:PLT) | 12.6% | 106.4% |

Botanix Pharmaceuticals (ASX:BOT) | 11.4% | 120.9% |

Hillgrove Resources (ASX:HGO) | 10.4% | 45.4% |

Liontown Resources (ASX:LTR) | 16.4% | 63.9% |

We'll examine a selection from our screener results.

Altium

Simply Wall St Growth Rating: ★★★★★☆

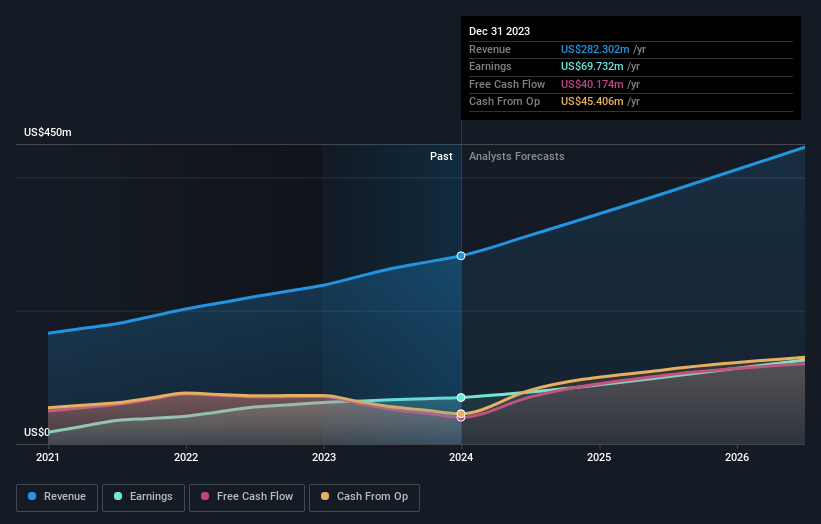

Overview: Altium Limited, with a market capitalization of A$8.81 billion, is engaged in the development and sale of computer software for designing electronic products across the United States and globally.

Operations: The company generates revenue through its Cloud Platform and Design Software segments, with earnings of $60.36 million and $221.94 million respectively.

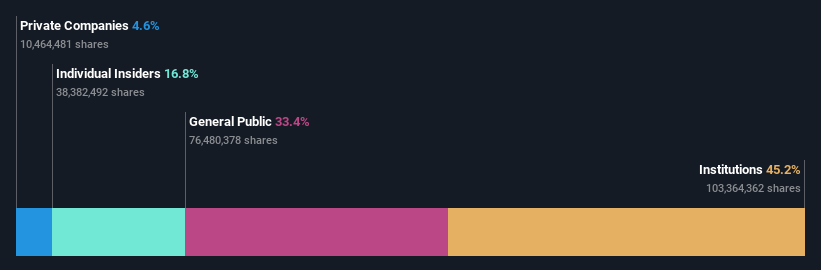

Insider Ownership: 11.7%

Earnings Growth Forecast: 21.2% p.a.

Altium, a key player in the technology sector, is demonstrating robust growth with earnings projected to increase by 21.17% annually, outpacing the Australian market's average of 13.8%. This growth is supported by strategic partnerships and enhancements in global distribution channels, such as the recent appointment of a dedicated distributor partner manager for Phase Holographic Imaging's HoloMonitor technology. Despite forecasts suggesting revenue growth below 20% per year, Altium maintains high-quality earnings and a strong return on equity expected at 36.5% in three years.

Click here and access our complete growth analysis report to understand the dynamics of Altium.

Upon reviewing our latest valuation report, Altium's share price might be too optimistic.

Bell Financial Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bell Financial Group Limited, operating in Australia, offers a range of services including broking, online broking, corporate finance, and financial advisory to private, institutional, and corporate clients with a market capitalization of approximately A$413.76 million.

Operations: The company generates revenue through several key segments: retail broking (A$103.58 million), institutional broking (A$50.36 million), financial products and services (A$48.10 million), and technology and platform services (A$26.20 million).

Insider Ownership: 10.7%

Earnings Growth Forecast: 26.9% p.a.

Bell Financial Group, despite trading 26.4% below its estimated fair value, shows promising growth prospects with earnings expected to rise by 26.95% annually. This performance surpasses the Australian market's forecasted growth of 13.8%. However, its dividend sustainability is questionable as it is not well covered by earnings or cash flows. Additionally, while BFG's revenue growth at 5.6% per year slightly outpaces the market average of 5.1%, it remains below the high-growth benchmark of 20% per year.

IperionX

Simply Wall St Growth Rating: ★★★★★☆

Overview: IperionX Limited is a company focused on the exploration and development of mineral properties in the United States, with a market capitalization of approximately A$602.31 million.

Operations: The firm is primarily involved in the exploration and development of mineral properties in the United States, with no specific revenue segments detailed.

Insider Ownership: 15.2%

Earnings Growth Forecast: 47.4% p.a.

IperionX, an emerging leader in advanced titanium technologies, has recently partnered with Vegas Fastener Manufacturing to supply the U.S. Army with specialized components, reflecting its strategic entry into critical defense and aerospace sectors. Despite a substantial follow-on equity offering of A$50 million at a discounted price, the company's innovative approach and recent inclusion in key indices underline its growth trajectory. However, it faces challenges such as a net loss of US$10.5 million in the last half-year and shareholder dilution over the past year.

Take a closer look at IperionX's potential here in our earnings growth report.

Our valuation report here indicates IperionX may be overvalued.

Where To Now?

Reveal the 90 hidden gems among our Fast Growing ASX Companies With High Insider Ownership screener with a single click here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ASX:ALU ASX:BFG and ASX:IPX.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance