3 Growth Companies On The Japanese Exchange With At Least 24% Insider Ownership

Amidst a backdrop of marginal weekly losses on Japan's Nikkei 225 and TOPIX indices, investors remain attuned to the Bank of Japan's hints at potential interest rate hikes. This cautious market sentiment underscores the importance of focusing on growth companies with substantial insider ownership, as these firms often demonstrate alignment between management interests and shareholder value, potentially offering resilience in uncertain economic climates.

Top 10 Growth Companies With High Insider Ownership In Japan

Name | Insider Ownership | Earnings Growth |

SHIFT (TSE:3697) | 35.5% | 27.2% |

Medley (TSE:4480) | 34.1% | 28.4% |

Hottolink (TSE:3680) | 27% | 57.3% |

Kasumigaseki CapitalLtd (TSE:3498) | 35.5% | 44.6% |

Micronics Japan (TSE:6871) | 15.3% | 37.4% |

ExaWizards (TSE:4259) | 24.8% | 84.3% |

Money Forward (TSE:3994) | 21.4% | 63.5% |

Soracom (TSE:147A) | 17.2% | 59.1% |

freee K.K (TSE:4478) | 24% | 78.4% |

CYBERDYNE (TSE:7779) | 38.9% | 72.3% |

We'll examine a selection from our screener results.

DIP

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DIP Corporation operates as a labor force solution company in Japan, offering personnel recruiting services with a market capitalization of approximately ¥153.33 billion.

Operations: The company generates revenue through two primary segments: the DX Business, which brought in ¥5.98 billion, and the Human Resources Services Business, contributing ¥47.80 billion.

Insider Ownership: 37.9%

DIP Corporation, a growth-oriented firm with substantial insider ownership in Japan, is trading at 56.5% below its estimated fair value, presenting a potentially attractive entry point relative to industry peers. Despite an unstable dividend track record, recent corporate actions indicate a strategic pivot towards innovative sectors such as AI services. Forecasted revenue and earnings growth of 11.3% and 15% per year respectively outpace the broader Japanese market, underpinned by recent executive reshuffles aimed at bolstering its AI and digital transformation capabilities.

DaikokutenbussanLtd

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Daikokutenbussan Co., Ltd. operates discount stores and has a market capitalization of approximately ¥112.25 billion.

Operations: The company primarily generates its income through the operation of discount retail stores.

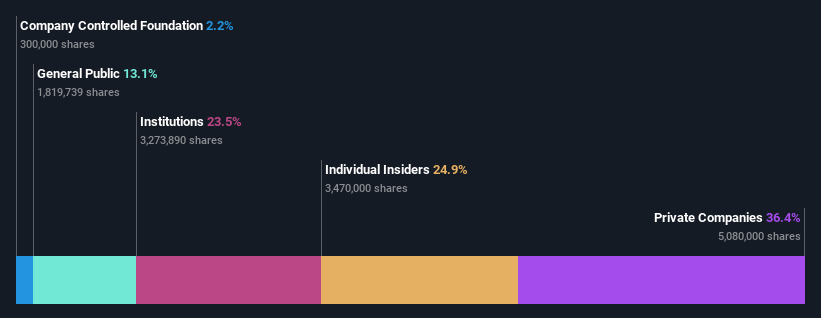

Insider Ownership: 24.9%

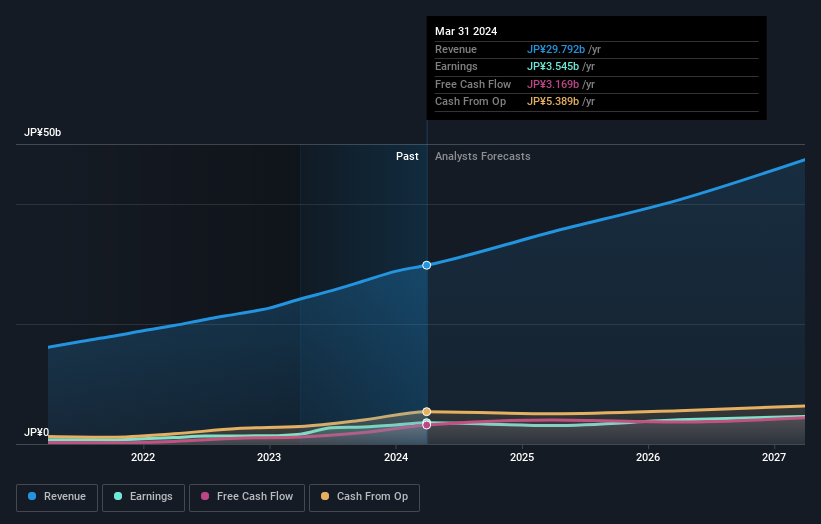

Daikokutenbussan Co., Ltd., a Japanese company with high insider ownership, is poised for significant growth. The company recently projected robust financials for fiscal year ending May 2024, expecting JPY 270.48 billion in net sales and JPY 6.19 billion profit attributable to owners. Earnings have surged by 72.4% over the past year and are anticipated to grow by 28.94% annually, outperforming the market's forecast of 9.2%. Despite this rapid growth, revenue expansion at a rate of 10.6% per year lags behind more aggressive industry benchmarks.

LITALICO

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LITALICO Inc. operates schools for learning and preschools in Japan, with a market capitalization of approximately ¥69.08 billion.

Operations: The firm's operations focus on educational services for children in Japan.

Insider Ownership: 37.7%

LITALICO Inc., a growth-oriented company with substantial insider ownership in Japan, is trading at 27% below its estimated fair value. The company's earnings have increased by 115.6% over the past year and are expected to grow annually by 12.56%. Although this growth rate exceeds the Japanese market average of 9.2%, its revenue growth forecast of 13.8% per year is moderate compared to more aggressive industry benchmarks. LITALICO's return on equity is also projected to be high at 24.2% in three years' time.

Delve into the full analysis future growth report here for a deeper understanding of LITALICO.

Our expertly prepared valuation report LITALICO implies its share price may be lower than expected.

Where To Now?

Click this link to deep-dive into the 103 companies within our Fast Growing Japanese Companies With High Insider Ownership screener.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include TSE:2379 TSE:2791 and TSE:7366.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance