3 Dividend Growers Suited for Income Investors

It’s easy to understand why dividends are so cherished among investors, as they provide a passive income stream, help limit the impact of drawdowns in other positions, and allow for maximum returns through dividend reinvestment.

In addition, a company's ability to consistently pay and increase dividend payouts reflects a stable and healthy financial position. And, of course, dividend boosts help send a positive message surrounding the long-term picture of the company, instilling confidence it can withstand near-term uncertainties or challenges.

Three companies – Enterprise Product Partners EPD, Abbott Laboratories ABT, and Broadcom AVGO – have all grown their payouts nicely.

For those seeking dividend-growers, let’s take a closer look at each.

Enterprise Product Partners

Enterprise Products Partners is a partnership that provides services to producers and consumers of commodities, including natural gas, natural gas liquids, oil, and refined petrochemical products.

Interestingly enough, in December, A.J. Teague, co-CEO, purchased roughly 2400 EPD shares at a total transaction value just above $65k. Insider buys can further inject confidence into shareholders.

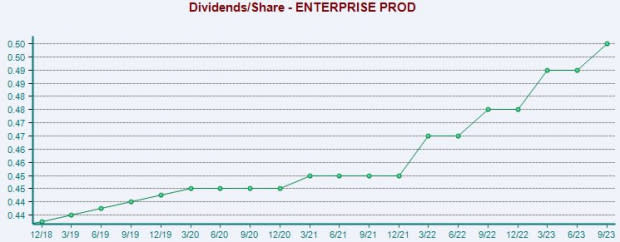

EPD recently announced a 3% boost to its quarterly payout, bringing it to $2.06 annually. The company has consistently increasingly rewarded its shareholders throughout the years, as seen in the chart below.

Image Source: Zacks Investment Research

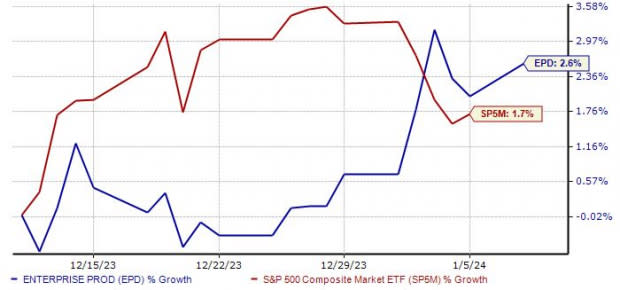

And perhaps to the surprise of some, EPD shares have displayed a small level of relative strength over the last month, adding +2.6% compared to the S&P 500’s 1.7% gain. While the performance disparity isn’t large, it’s certainly worth keeping tabs on.

Image Source: Zacks Investment Research

Broadcom

Broadcom is a premier designer, developer, and global supplier of a broad range of semiconductor devices. The revisions trend has been particularly potent for its current fiscal year, with the $47.88 Zacks Consensus EPS Estimate 11% higher over the last year.

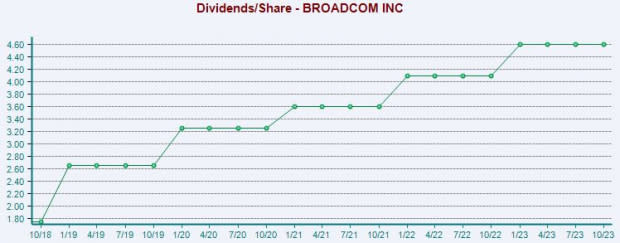

Image Source: Zacks Investment Research

Broadcom has shown a notable commitment to increasingly rewarding shareholders, boasting a sizable 13.7% five-year annualized dividend growth rate. AVGO shares currently yield a solid 2% annually, nicely above the Zacks Computer and Technology sector average of 0.7%.

Image Source: Zacks Investment Research

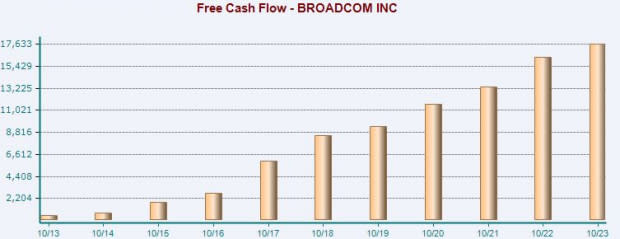

Impressive cash-generating abilities have protected the company’s payout, further illustrated below. AVGO posted free cash flow of $16.3 billion throughout its FY22, with the trailing twelve-month figure eclipsing $17.6 billion.

Image Source: Zacks Investment Research

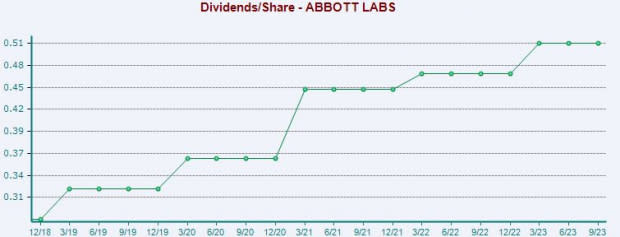

Abbott Laboratories

Abbott Labs discovers, develops, manufactures, and sells a diversified line of healthcare products. The company is a part of the elite Dividend Aristocrats group, a club reserved for those who have upped their payouts for 25+ consecutive years.

Image Source: Zacks Investment Research

Keep an eye out for the company’s upcoming release expected in late January, as the Zacks Consensus EPS Estimate of $1.19 suggests growth of 15% from the year-ago period. It’s worth noting that ABT has been a highly consistent earnings performer, exceeding our consensus EPS and revenue expectations in each of its last ten releases.

Bottom Line

Companies that consistently boost their dividend payouts reflect a successful and shareholder-friendly nature, opting to share a portion of profits with investors.

And for those seeking dividend growers, all three companies above – Enterprise Product Partners EPD, Abbott Laboratories ABT, and Broadcom AVGO – precisely fit the criteria.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT) : Free Stock Analysis Report

Enterprise Products Partners L.P. (EPD) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance