3 Cheap Top-Ranked Stocks Investors Can't Ignore

Despite the market’s incredible run so far year-to-date, not all stocks have become expensive, with plenty of deals out there.

Value-focused investors target mispriced stocks with the idea that others will eventually ‘catch on’ and recognize their actual value, which can lead to serious gains. After all, we all enjoy a nice deal.

And for those seeking stocks without stretched valuations, Abercrombie & Fitch ANF, PACCAR Inc. PCAR, and Caterpillar CAT – could all be considerations.

In addition to sound valuation levels, all three sport a favorable Zacks Rank and carry solid growth profiles, with the former indicating optimism among analysts. Let’s take a closer look at each.

Caterpillar

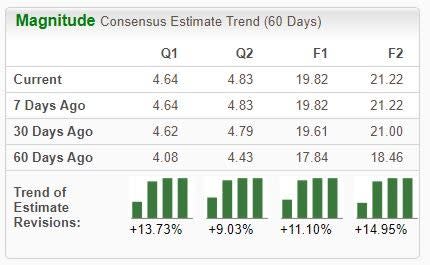

Caterpillar is the world's leading manufacturer of construction and mining equipment, off-highway diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives. The stock sports the highly-coveted Zacks Rank #1 (Strong Buy), with earnings expectations increasing across all timeframes.

Image Source: Zacks Investment Research

The company’s shares aren’t expensive given its growth trajectory, with earnings forecasted to soar 43% on 12% higher revenues in its current year. Shares currently trade at a 14.2X forward earnings multiple (F1), beneath the 15.8X five-year median and the respective Zacks – Machinery industry average.

Image Source: Zacks Investment Research

Caterpillar has been a consistent earnings performer as of late, exceeding Zacks Consensus Estimates in back-to-back releases. Just in its latest print, the machinery titan penciled in a 23% EPS beat and reported revenue 5% ahead of expectations.

As shown below, the company’s revenue has recovered nicely from pandemic lows.

Image Source: Zacks Investment Research

Abercrombie & Fitch

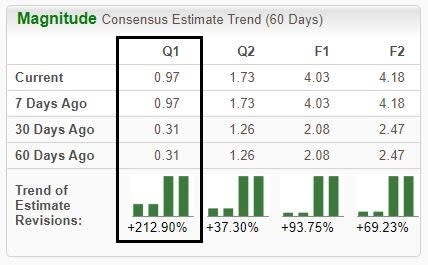

Abercrombie & Fitch, a current Zacks Rank #1 (Strong Buy), operates as a specialty retailer of many types of premium, high-quality casual apparel for men, women, and kids through a vast store network.

Analysts have taken their earnings expectations notably higher, with the revisions trend particularly robust for its upcoming quarterly release expected in late November.

Image Source: Zacks Investment Research

The company posted a blowout quarter in its latest print, exceeding the Zacks Consensus EPS Estimate by more than 740% and posting an 11% sales surprise. The market was impressed with the results, sending ANF shares soaring post-earnings.

Image Source: Zacks Investment Research

Shares aren’t expensive given the company’s growth trajectory, with earnings forecasted to climb 1,500% on 10% higher revenues in its current year. ANF shares presently trade at a 13.6X forward earnings multiple (F1), nicely beneath the 17.6X five-year median.

PACCAR Inc.

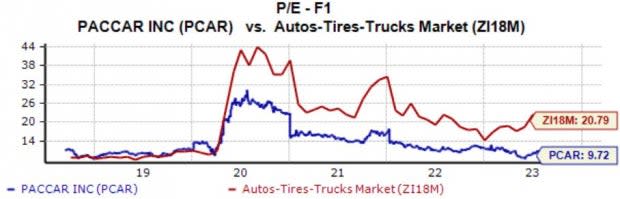

PACCAR is a global leader in the design, manufacture, and customer support of high-quality premium trucks. Like those above, analysts have become bullish on the company’s earnings outlook, landing the stock into the highly-coveted Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Income-focused investors could gravitate toward PCAR, with shares currently yielding a respectable 1.3% annually. Dividend growth is there, too, with the payout growing by nearly 5% annually over the last five years.

PCAR shares currently trade at a 9.7X forward earnings multiple, well below the 12.2X five-year median and the respective Zacks – Autos/Tires/Trucks industry average. Shares traded as high as 18.2X in 2022.

Image Source: Zacks Investment Research

Bottom Line

Value-conscious investors are always looking for deals, sitting in the shadows and waiting for the rest of the crowd to catch on. The strategy can be quite lucrative, especially when it’s paired with the Zacks Rank.

And for those seeking stocks with sound valuations, all three above – Abercrombie & Fitch ANF, PACCAR Inc. PCAR, and Caterpillar CAT – precisely fit the criteria. On top of sound valuations, all three sport a favorable Zacks Rank, indicating optimism among analysts.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Caterpillar Inc. (CAT) : Free Stock Analysis Report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

PACCAR Inc. (PCAR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance