3 Buffett Stocks Approach 52-Week Lows As End of Year Nears

Following the release of its third-quarter 13 filing earlier this month, several stocks in Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway (NYSE:BRK.A)(NYSE:BRK.B) equity portfolio have dived near their 52-week lows.

The billionaire investor seeks a margin of safety between a company's share price and its intrinsic value. Additionally, he advocates for buying wonderful companies at fair prices instead of fair companies at wonderful prices. Buffett also tends to favor high-quality companies that he understands and have strong moats.

The guru, whom many regard as one of the greatest investors of all time, disclosed in the quarterly filing he, along with his two investing lieutenants, entered new positions in Liberty Live Group (NASDAQ:LLYVA), Sirius XM Holdings Inc. (NASDAQ:SIRI) and Atlanta Braves Holdings Inc. (NASDAQ:BATRK) as well as divested his holdings of General Motors Co. (NYSE:GM), Celanese Corp. (NYSE:CE), Johnson & Johnson (NYSE:JNJ), Mondelez International Inc. (NASDAQ:MDLZ), Procter & Gamble Inc. (NYSE:PG) and United Parcel Service Inc. (NYSE:UPS). The Activision Blizzard Inc. (ATVI) investment was also dissolved following the closure of its acquisition deal with Microsoft Corp. (NASDAQ:MSFT).

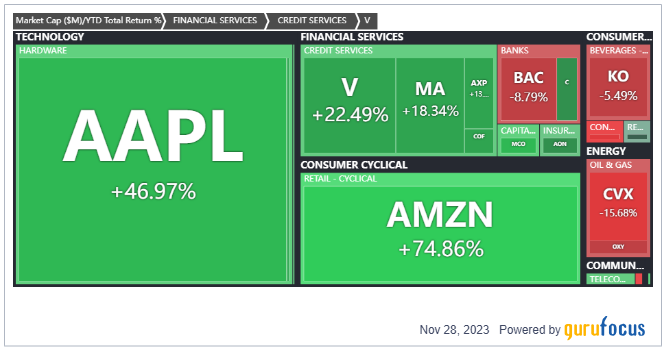

The third-quarter 13F filing showed the equity portfolio consisted of 45 stocks as of the three months ended Sept. 30, which was valued at $313.26 billion. Buffett's holdings have posted strong performances so far in 2023, with only six of the top 20 positions declining.

As of Nov. 28, Buffett's stocks that have collapsed to near their lowest prices in a year are Chevron Corp. (NYSE:CVX), Diageo PLC (NYSE:DEO) and The Kroger Co. (KR).

Investors should be aware 13F filings do not give a complete picture of a firm's holdings as the reports only include its positions in U.S. stocks and American depository receipts, but they can still provide valuable information. Further, the reports only reflect trades and holdings as of the most-recent portfolio filing date, which may or may not be held by the reporting firm today or even when this article was published.

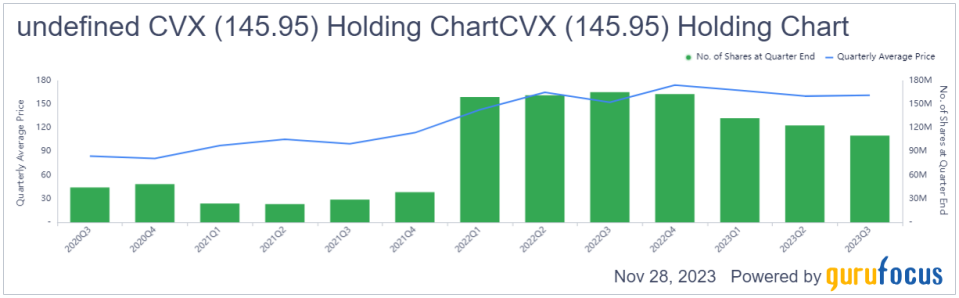

Chevron

Chevron's (NYSE:CVX) shares have tumbled nearly 20% over the past year. The stock is currently 3.72% above its yearly low of $140.72.

The Oracle of Omaha owns 110.25 million shares of the company, which represent 5.93% of his equity portfolio. It is also his fifth-largest holding.

The San Ramon, California-based oil and gas producer has a $276.88 billion market cap; its shares were trading around $145.42 on Tuesday with a price-earnings ratio of 10.80, a price-book ratio of 1.66 and a price-sales ratio of 1.35.

The GF Value Line suggests the stock is modestly undervalued based on its historical ratios, past financial performance and analysts' future earnings projections.

At 87 out of 100, the GF Score indicates the company has good outperformance potential on the back of high ratings for growth, profitability, financial strength, momentum and value.

Of the gurus invested in Chevron, Buffett has the largest stake with 5.86% of its outstanding shares. Ken Fisher (Trades, Portfolio), Diamond Hill Capital (Trades, Portfolio), Steven Cohen (Trades, Portfolio), Charles Brandes (Trades, Portfolio) and several other gurus also have positions in the stock.

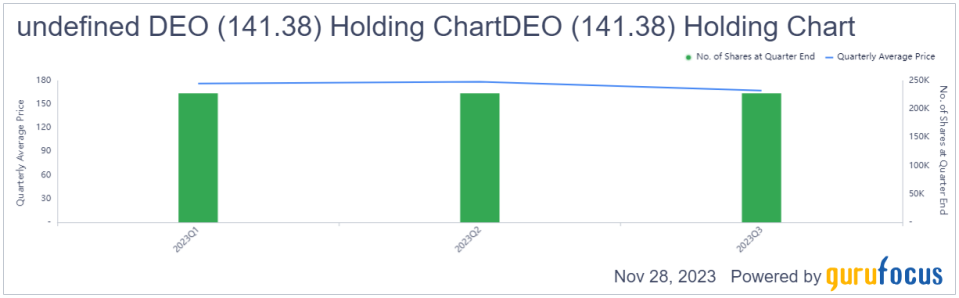

Diageo

Shares of Diageo (NYSE:DEO) have retreated more than 20% over the past year. The stock is currently trading 4.24% above its annual low of $135.63.

Buffett holds 227,750 shares currently, which occupy 0.01% of the equity portfolio.

The beer and spirits manufacturer headquartered in London, which owns brands like Guinness, Johnnie Walker, Smirnoff, Captain Morgan and Baileys, has a market cap of $78.25 billion; its shares were trading around $140.80 on Tuesday with a price-earnings ratio of 17.33, a price-book ratio of 7.99 and a price-sales ratio of 3.68.

According to the GF Value Line, the stock is significantly undervalued currently.

The GF Score of 89 implies the company has good outperformance potential, driven by high ratings for three of the criteria as well as more moderate financial strength and momentum ranks.

With a 0.24% stake, Tom Gayner (Trades, Portfolio) is the company's largest guru shareholder. Other notable guru investors include Mario Gabelli (Trades, Portfolio), Fisher, Tweedy Browne (Trades, Portfolio), Sarah Ketterer (Trades, Portfolio) and Jim Simons (Trades, Portfolio)' Renaissance Technologies.

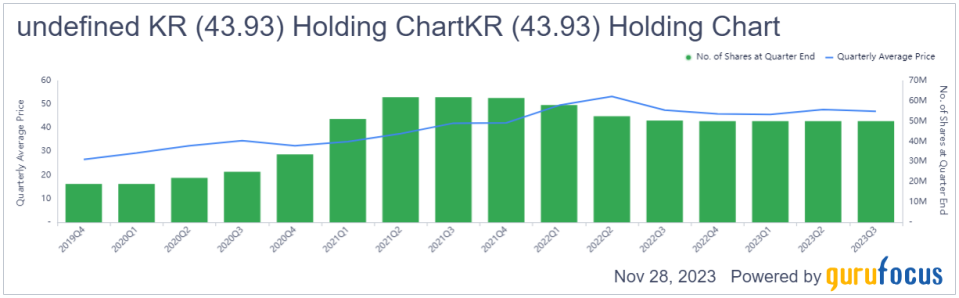

Kroger

Kroger's (KR) stock has fallen approximately 11% over the past year. The shares are currently 4.35% above their annual low of $42.09.

The guru owns 50 million shares of the company, accounting for 0.71% of his equity portfolio.

The Cincinnati-based company, which operates a chain of supermarkets, has a $31.43 billion market cap; its shares were trading around $43.92 on Tuesday with a price-earnings ratio of 19.61, a price-book ratio of 2.98 and a price-sales ratio of 0.21.

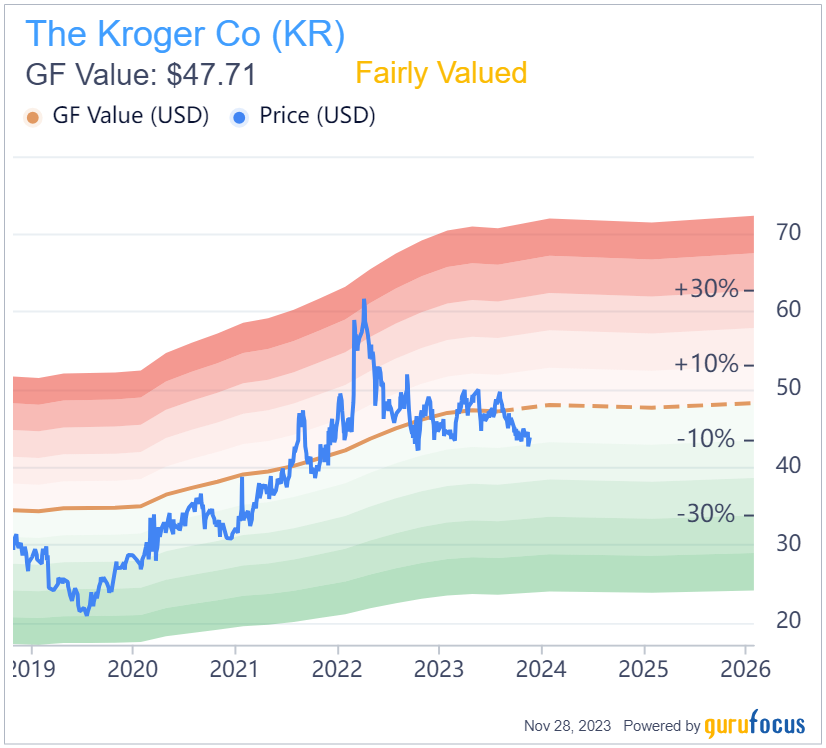

Based on the GF Value Line, the stock appears to be fairly valued currently.

The GF Score of 92 means the company has high outperformance potential, raking in high ratings for two of the criteria and more moderate financial strength, value and momentum ranks.

Buffett is Kroger's largest guru shareholder with a 6.95% stake. Jim Simons (Trades, Portfolio)' Renaissance Technologies, Bill Nygren (Trades, Portfolio) and Ray Dalio (Trades, Portfolio)'s Bridgewater Associates also have notable holdings.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance