23 Cities Where a $100K Salary Can Buy You a 3-Bedroom House — and 27 Cities Where It Doesn’t

Depending on where you live, earning a $100,000 salary might cover most of a three-bedroom home purchase or it may not be anywhere near enough money to put toward buying a house with this many bedrooms.

To determine the cities where a $100K salary is enough to afford a three-bedroom home, GOBankingRates found the average home value for a three-bedroom home in March 2024 and assumed an 8% down payment, typical for first-time homebuyers, to calculate the average mortgage amount. Each city’s average expenditure cost was calculated using cost-of-living indexes and the national average cost for expenditures for all residents. The annual total cost of living for each city was then determined using the average expenditure cost and average mortgage cost.

Of the top 50 most populated cities in the United States, a $100K salary would be enough money for first-time homebuyers purchasing three-bedroom homes in 23 cities and not enough money in 27 cities.

View More: 7 Locations Where Housing Prices Are Plummeting Post-Pandemic

Learn More: 4 Genius Things All Wealthy People Do With Their Money

23 Cities Where an $100K Salary Buys You a 3-Bedroom House

Ranked from least to most salary needed, first-time homebuyers can purchase homes on a $100k salary in the following 23 cities.

Read Next: Why a Billionaire Bought a Bunch of Homes in Duluth, Minnesota

See More: 5 Cheapest and Safest Places To Live in Wyoming

Detroit, Michigan

Population total: 636,787

March 2024 3-bedroom home value: $72,447

Annual average expenditure cost: $22,795.25

8% down (down payment): $5,796

8% down (loan amount): $66,652

8% down (average mortgage monthly cost): $447

8% down (average mortgage annual cost): $5,370

8% down (annual total cost of living): $28,165

Salary needed (needs = 50%): $56,330

Is a $100k salary enough? Yes

Find Out: I’m a Real Estate Agent: 3 States Where You Should Sell Your Property in the Next 5 Years

Memphis, Tennessee

Population total: 630,027

March 2024 3-bedroom home value: $142,809

Annual average expenditure cost: $23,198.02

8% down (down payment): $11,425

8% down (loan amount): $131,384

8% down (average mortgage monthly cost): $882

8% down (average mortgage annual cost): $10,585

8% down (annual total cost of living): $33,783

Salary needed (needs = 50%): $67,565

Is a $100k salary enough? Yes

Baltimore, Maryland

Population total: 584,548

March 2024 3-bedroom home value: $185,071

Annual average expenditure cost: $23,842.91

8% down (down payment): $14,806

8% down (loan amount): $170,265

8% down (average mortgage monthly cost): $1,143

8% down (average mortgage annual cost): $13,717

8% down (annual total cost of living): $37,560

Salary needed (needs = 50%): $75,120

Is a $100k salary enough? Yes

Discover More: 9 Major US Cities Where Buying a Home Is Surprisingly Cheap

El Paso, Texas

Population total: 677,181

March 2024 3-bedroom home value: $217,215

Annual average expenditure cost: $21,944.26

8% down (down payment): $17,377

8% down (loan amount): $199,838

8% down (average mortgage monthly cost): $1,342

8% down (average mortgage annual cost): $16,099

8% down (annual total cost of living): $38,044

Salary needed (needs = 50%): $76,088

Is a $100k salary enough? Yes

Tulsa, Oklahoma

Population total: 411,938

March 2024 3-bedroom home value: $203,466

Annual average expenditure cost: $23,694.11

8% down (down payment): $16,277

8% down (loan amount): $187,189

8% down (average mortgage monthly cost): $1,257

8% down (average mortgage annual cost): $15,080

8% down (annual total cost of living): $38,775

Salary needed (needs = 50%): $77,549

Is a $100k salary enough? Yes

Be Aware: I’m a Real Estate Agent: Buy Property in These 5 Fast-Growing Cities To Be Rich in 5 Years

Oklahoma City, Oklahoma

Population total: 681,088

March 2024 3-bedroom home value: $206,378

Annual average expenditure cost: $23,735.95

8% down (down payment): $16,510

8% down (loan amount): $189,868

8% down (average mortgage monthly cost): $1,275

8% down (average mortgage annual cost): $15,296

8% down (annual total cost of living): $39,032

Salary needed (needs = 50%): $78,065

Is a $100k salary enough? Yes

Philadelphia, Pennsylvania

Population total: 1,593,208

March 2024 3-bedroom home value: $188,842

Annual average expenditure cost: $25,384.72

8% down (down payment): $15,107

8% down (loan amount): $173,735

8% down (average mortgage monthly cost): $1,166

8% down (average mortgage annual cost): $13,997

8% down (annual total cost of living): $39,381

Salary needed (needs = 50%): $78,763

Is a $100k salary enough? Yes

For You: Here’s When To Buy a New House, According to Kevin O’Leary

Indianapolis, Indiana

Population total: 882,006

March 2024 3-bedroom home value: $222,608

Annual average expenditure cost: $23,343.04

8% down (down payment): $17,809

8% down (loan amount): $204,799

8% down (average mortgage monthly cost): $1,375

8% down (average mortgage annual cost): $16,499

8% down (annual total cost of living): $39,842

Salary needed (needs = 50%): $79,685

Is a $100k salary enough? Yes

Wichita, Kansas

Population total: 395,951

March 2024 3-bedroom home value: $194,618

Annual average expenditure cost: $25,228.61

8% down (down payment): $15,569

8% down (loan amount): $179,049

8% down (average mortgage monthly cost): $1,202

8% down (average mortgage annual cost): $14,425

8% down (annual total cost of living): $39,653

Salary needed (needs = 50%): $79,307

Is a $100k salary enough? Yes

Read Next: ‘Rich Dad’ Robert Kiyosaki: Use This Two-Step Formula for Real Estate Investing

Milwaukee, Wisconsin

Population total: 573,299

March 2024 3-bedroom home value: $206,627

Annual average expenditure cost: $24,579.64

8% down (down payment): $16,530

8% down (loan amount): $190,097

8% down (average mortgage monthly cost): $1,276

8% down (average mortgage annual cost): $15,315

8% down (annual total cost of living): $39,894

Salary needed (needs = 50%): $79,789

Is a $100k salary enough? Yes

Kansas City, Missouri

Population total: 505,958

March 2024 3-bedroom home value: $232,466

Annual average expenditure cost: $23,421.28

8% down (down payment): $18,597

8% down (loan amount): $213,869

8% down (average mortgage monthly cost): $1,436

8% down (average mortgage annual cost): $17,230

8% down (annual total cost of living): $40,651

Salary needed (needs = 50%): $81,302

Is a $100k salary enough? Yes

Find Out: Here’s the Salary a Single Person Needs To Live Comfortably in Hawaii

Louisville, Kentucky

Population total: 629,176

March 2024 3-bedroom home value: $248,265

Annual average expenditure cost: $22,484.73

8% down (down payment): $19,861

8% down (loan amount): $228,404

8% down (average mortgage monthly cost): $1,533

8% down (average mortgage annual cost): $18,401

8% down (annual total cost of living): $40,886

Salary needed (needs = 50%): $81,771

Is a $100k salary enough? Yes

San Antonio, Texas

Population total: 1,445,662

March 2024 3-bedroom home value: $241,060

Annual average expenditure cost: $23,295.28

8% down (down payment): $19,285

8% down (loan amount): $221,776

8% down (average mortgage monthly cost): $1,489

8% down (average mortgage annual cost): $17,867

8% down (annual total cost of living): $41,162

Salary needed (needs = 50%): $82,324

Is a $100k salary enough? Yes

View Next: I’m a Real Estate Agent: 5 Places I’d Buy a Vacation Home If I Had $500,000

Columbus, Ohio

Population total: 902,449

March 2024 3-bedroom home value: $251,828

Annual average expenditure cost: $23,912.62

8% down (down payment): $20,146

8% down (loan amount): $231,682

8% down (average mortgage monthly cost): $1,555

8% down (average mortgage annual cost): $18,665

8% down (annual total cost of living): $42,578

Salary needed (needs = 50%): $85,155

Is a $100k salary enough? Yes

Houston, Texas

Population total: 2,296,253

March 2024 3-bedroom home value: $253,294

Annual average expenditure cost: $23,889.79

8% down (down payment): $20,264

8% down (loan amount): $233,031

8% down (average mortgage monthly cost): $1,564

8% down (average mortgage annual cost): $18,774

8% down (annual total cost of living): $42,663

Salary needed (needs = 50%): $85,327

Is a $100k salary enough? Yes

Explore More: 8 States To Move to If You Don’t Want To Pay Taxes on Social Security

Fort Worth, Texas

Population total: 924,663

March 2024 3-bedroom home value: $276,304

Annual average expenditure cost: $24,570.53

8% down (down payment): $22,104

8% down (loan amount): $254,200

8% down (average mortgage monthly cost): $1,707

8% down (average mortgage annual cost): $20,479

8% down (annual total cost of living): $45,050

Salary needed (needs = 50%): $90,099

Is a $100k salary enough? Yes

Jacksonville, Florida

Population total: 950,203

March 2024 3-bedroom home value: $284,225

Annual average expenditure cost: $24,292.13

8% down (down payment): $22,738

8% down (loan amount): $261,487

8% down (average mortgage monthly cost): $1,756

8% down (average mortgage annual cost): $21,066

8% down (annual total cost of living): $45,358

Salary needed (needs = 50%): $90,717

Is a $100k salary enough? Yes

Trending Now: 5 Types of Homes That Will Plummet in Value in 2024

Albuquerque, New Mexico

Population total: 562,551

March 2024 3-bedroom home value: $322,961

Annual average expenditure cost: $22,718.29

8% down (down payment): $25,837

8% down (loan amount): $297,124

8% down (average mortgage monthly cost): $1,995

8% down (average mortgage annual cost): $23,937

8% down (annual total cost of living): $46,655

Salary needed (needs = 50%): $93,311

Is a $100k salary enough? Yes

Omaha, Nebraska

Population total: 489,201

March 2024 3-bedroom home value: $265,738

Annual average expenditure cost: $26,796.17

8% down (down payment): $21,259

8% down (loan amount): $244,479

8% down (average mortgage monthly cost): $1,641

8% down (average mortgage annual cost): $19,696

8% down (annual total cost of living): $46,492

Salary needed (needs = 50%): $92,984

Is a $100k salary enough? Yes

That’s Interesting: I’m a Real Estate Agent: Here Are the 4 Florida Cities Where You Should Avoid Buying a Home

Dallas, Texas

Population total: 1,300,642

March 2024 3-bedroom home value: $302,341

Annual average expenditure cost: $24,446.95

8% down (down payment): $24,187

8% down (loan amount): $278,154

8% down (average mortgage monthly cost): $1,867

8% down (average mortgage annual cost): $22,409

8% down (annual total cost of living): $46,856

Salary needed (needs = 50%): $93,712

Is a $100k salary enough? Yes

Arlington, Texas

Population total: 393,469

March 2024 3-bedroom home value: $301,340

Annual average expenditure cost: $24,521.92

8% down (down payment): $24,107

8% down (loan amount): $277,233

8% down (average mortgage monthly cost): $1,861

8% down (average mortgage annual cost): $22,335

8% down (annual total cost of living): $46,857

Salary needed (needs = 50%): $93,713

Is a $100k salary enough? Yes

Read More: In Less Than a Decade, You Won’t Be Able To Afford Homes in These ZIP Codes

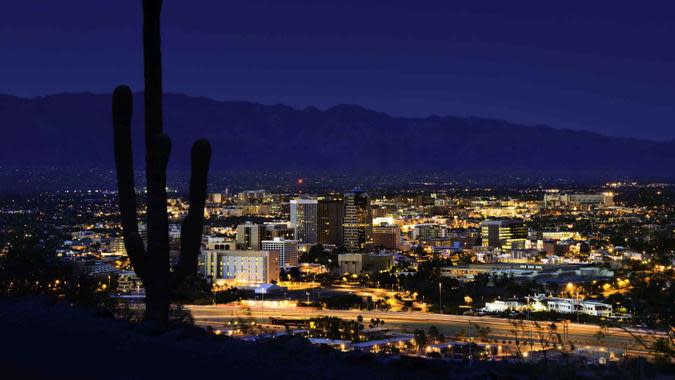

Tucson, Arizona

Population total: 541,033

March 2024 3-bedroom home value: $328,348

Annual average expenditure cost: $22,799.35

8% down (down payment): $26,268

8% down (loan amount): $302,080

8% down (average mortgage monthly cost): $2,028

8% down (average mortgage annual cost): $24,336

8% down (annual total cost of living): $47,136

Salary needed (needs = 50%): $94,272

Is a $100k salary enough? Yes

Chicago, Illinois

Population total: 2,721,914

March 2024 3-bedroom home value: $310,187

Annual average expenditure cost: $25,700.99

8% down (down payment): $24,815

8% down (loan amount): $285,372

8% down (average mortgage monthly cost): $1,916

8% down (average mortgage annual cost): $22,990

8% down (annual total cost of living): $48,691

Salary needed (needs = 50%): $97,383

Is a $100k salary enough? Yes

Try This: 8 Places Where Houses Are Suddenly Major Bargains

27 Cities Where a 3-Bedroom House Requires More Money Than a $100K Salary

Each of these 27 cities mentioned requires a salary of well over $100K to purchase a three-bedroom home.

Bakersfield, California

Population total: 404,321

March 2024 3-bedroom home value: $352,682

Annual average expenditure cost: $24,825.63

8% down (down payment): $28,215

8% down (loan amount): $324,467

8% down (average mortgage monthly cost): $2,178

8% down (average mortgage annual cost): $26,140

8% down (annual total cost of living): $50,966

Salary needed (needs = 50%): $101,931

Is a $100k salary enough? No

Learn More: Charlie Munger: Why 95% of Investors Have No Chance of Beating the S&P 500 Index

Charlotte, North Carolina

Population total: 875,045

March 2024 3-bedroom home value: $361,398

Annual average expenditure cost: $24,391.03

8% down (down payment): $28,912

8% down (loan amount): $332,486

8% down (average mortgage monthly cost): $2,232

8% down (average mortgage annual cost): $26,786

8% down (annual total cost of living): $51,177

Salary needed (needs = 50%): $102,354

Is a $100k salary enough? No

Minneapolis, Minnesota

Population total: 426,877

March 2024 3-bedroom home value: $346,274

Annual average expenditure cost: $25,878.22

8% down (down payment): $27,702

8% down (loan amount): $318,572

8% down (average mortgage monthly cost): $2,139

8% down (average mortgage annual cost): $25,665

8% down (annual total cost of living): $51,543

Salary needed (needs = 50%): $103,087

Is a $100k salary enough? No

Check Out: I’m a Self-Made Millionaire: 5 Stocks You Shouldn’t Sell

Fresno, California

Population total: 541,528

March 2024 3-bedroom home value: $369,760

Annual average expenditure cost: $24,926.44

8% down (down payment): $29,581

8% down (loan amount): $340,179

8% down (average mortgage monthly cost): $2,284

8% down (average mortgage annual cost): $27,406

8% down (annual total cost of living): 541,528

Salary needed (needs = 50%): $104,665

Is a $100k salary enough? No

Raleigh, North Carolina

Population total: 465,517

March 2024 3-bedroom home value: $392,401

Annual average expenditure cost: $24,487.14

8% down (down payment): $31,392

8% down (loan amount): $361,009

8% down (average mortgage monthly cost): $2,424

8% down (average mortgage annual cost): $29,084

8% down (annual total cost of living): $53,571

Salary needed (needs = 50%): $107,142

Is a $100k salary enough? No

Find Out: Here’s How Much a $1,000 Investment in Ford Stock 10 Years Ago Would Be Worth Today

Virginia Beach, Virginia

Population total: 457,900

March 2024 3-bedroom home value: $352,981

Annual average expenditure cost: $27,140.05

8% down (down payment): $28,238

8% down (loan amount): $324,743

8% down (average mortgage monthly cost): $2,180

8% down (average mortgage annual cost): $26,162

8% down (annual total cost of living): $53,302

Salary needed (needs = 50%): $106,605

Is a $100k salary enough? No

Atlanta, Georgia

Population total: 494,838

March 2024 3-bedroom home value: $394,339

Annual average expenditure cost: $24,460.76

8% down (down payment): $31,547

8% down (loan amount): $362,792

8% down (average mortgage monthly cost): $2,436

8% down (average mortgage annual cost): $29,228

8% down (annual total cost of living): $53,688

Salary needed (needs = 50%): $107,377

Is a $100k salary enough? No

Discover Next: I’m a Self-Made Millionaire: 5 Stocks You Shouldn’t Sell

Las Vegas, Nevada

Population total: 644,835

March 2024 3-bedroom home value: $402,830

Annual average expenditure cost: $24,686.44

8% down (down payment): $32,226

8% down (loan amount): $370,603

8% down (average mortgage monthly cost): $2,488

8% down (average mortgage annual cost): $29,857

8% down (annual total cost of living): $54,543

Salary needed (needs = 50%): $109,087

Is a $100k salary enough? No

Phoenix, Arizona

Population total: 1,609,456

March 2024 3-bedroom home value: $420,223

Annual average expenditure cost: $24,081.70

8% down (down payment): $33,618

8% down (loan amount): $386,606

8% down (average mortgage monthly cost): $2,596

8% down (average mortgage annual cost): $31,146

8% down (annual total cost of living): $55,228

Salary needed (needs = 50%): $110,456

Is a $100k salary enough? No

Be Aware: 10 Valuable Stocks That Could Be the Next Apple or Amazon

Mesa, Arizona

Population total: 503,390

March 2024 3-bedroom home value: $426,211

Annual average expenditure cost: $23,977.80

8% down (down payment): $34,097

8% down (loan amount): $392,114

8% down (average mortgage monthly cost): $2,632

8% down (average mortgage annual cost): $31,590

8% down (annual total cost of living): $55,568

Salary needed (needs = 50%): $111,135

Is a $100k salary enough? No

Nashville, Tennessee

Population total: 684,103

March 2024 3-bedroom home value: $425,219

Annual average expenditure cost: $24,152.59

8% down (down payment): $34,018

8% down (loan amount): $391,201

8% down (average mortgage monthly cost): $2,626

8% down (average mortgage annual cost): $31,516

8% down (annual total cost of living): $55,669

Salary needed (needs = 50%): $111,338

Is a $100k salary enough? No

Read More: Retirement Savings: I Lost $400K in a Roth IRA

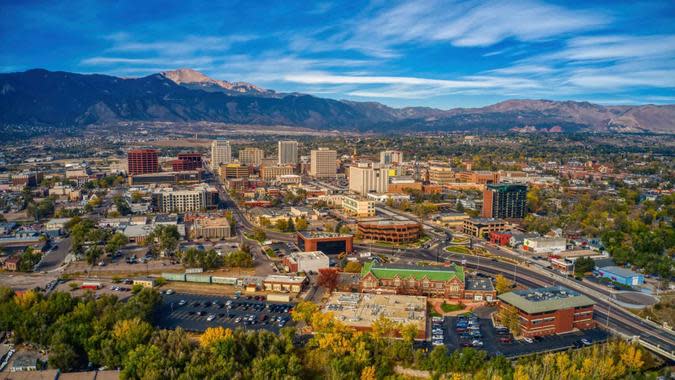

Colorado Springs, Colorado

Population total: 479,612

March 2024 3-bedroom home value: $417,965

Annual average expenditure cost: $24,981.06

8% down (down payment): $33,437

8% down (loan amount): $384,528

8% down (average mortgage monthly cost): $2,582

8% down (average mortgage annual cost): $30,979

8% down (annual total cost of living): $55,960

Salary needed (needs = 50%): $111,919

Is a $100k salary enough? No

Sacramento, California

Population total: 523,600

March 2024 3-bedroom home value: $461,693

Annual average expenditure cost: $26,770.21

8% down (down payment): $36,935

8% down (loan amount): $424,757

8% down (average mortgage monthly cost): $2,852

8% down (average mortgage annual cost): $34,220

8% down (annual total cost of living): $60,990

Salary needed (needs = 50%): $121,980

Is a $100k salary enough? No

See More: 6 Rare Coins That Will Spike in Value in 2024

Austin, Texas

Population total: 958,202

March 2024 3-bedroom home value: $506,425

Annual average expenditure cost: $24,633.37

8% down (down payment): $40,514

8% down (loan amount): $465,911

8% down (average mortgage monthly cost): $3,128

8% down (average mortgage annual cost): $37,535

8% down (annual total cost of living): $62,169

Salary needed (needs = 50%): $124,337

Is a $100k salary enough? No

Portland, Oregon

Population total: 646,101

March 2024 3-bedroom home value: $536,334

Annual average expenditure cost: $25,879.81

8% down (down payment): $42,907

8% down (loan amount): $493,428

8% down (average mortgage monthly cost): $3,313

8% down (average mortgage annual cost): $39,752

8% down (annual total cost of living): $65,632

Salary needed (needs = 50%): $131,264

Is a $100k salary enough? No

For You: How Can You Withdraw Money From a Bank Account? 3 Ways To Know

Miami, Florida

Population total: 443,665

March 2024 3-bedroom home value: $594,251

Annual average expenditure cost: $24,715.22

8% down (down payment): $47,540

8% down (loan amount): $546,711

8% down (average mortgage monthly cost): $3,670

8% down (average mortgage annual cost): $44,045

8% down (annual total cost of living): $68,760

Salary needed (needs = 50%): $137,520

Is a $100k salary enough? No

Denver, Colorado

Population total: 710,800

March 2024 3-bedroom home value: $616,470

Annual average expenditure cost: $26,967.12

8% down (down payment): $49,318

8% down (loan amount): $567,152

8% down (average mortgage monthly cost): $3,808

8% down (average mortgage annual cost): $45,691

8% down (annual total cost of living): $72,659

Salary needed (needs = 50%): $145,317

Is a $100k salary enough? No

That’s Interesting: I’m a Self-Made Millionaire: Here’s My Monthly Budget

District of Columbia (DC)

Population total: 670,587

March 2024 3-bedroom home value: $694,622

Annual average expenditure cost: $30,680.57

8% down (down payment): $55,570

8% down (loan amount): $639,053

8% down (average mortgage monthly cost): $4,290

8% down (average mortgage annual cost): $51,484

8% down (annual total cost of living): $82,165

Salary needed (needs = 50%): $164,329

Is a $100k salary enough? No

Boston, Massachusetts

Population total: 665,945

March 2024 3-bedroom home value: $771,921

Annual average expenditure cost: $29,415.76

8% down (down payment): $61,754

8% down (loan amount): $710,168

8% down (average mortgage monthly cost): $4,768

8% down (average mortgage annual cost): $57,213

8% down (annual total cost of living): $86,629

Salary needed (needs = 50%): $173,258

Is a $100k salary enough? No

Trending Now: Bill Gates’ $10.95 Million Daily Income: How the Microsoft Legend Spends It

New York, New York

Population total: 8,622,467

March 2024 3-bedroom home value: $772,901

Annual average expenditure cost: $32,186.32

8% down (down payment): $61,832

8% down (loan amount): $711,069

8% down (average mortgage monthly cost): $4,774

8% down (average mortgage annual cost): $57,286

8% down (annual total cost of living): $89,472

Salary needed (needs = 50%): $178,944

Is a $100k salary enough? No

Long Beach, California

Population total: 462,293

March 2024 3-bedroom home value: $948,674

Annual average expenditure cost: $26,208.58

8% down (down payment): $75,894

8% down (loan amount): $872,780

8% down (average mortgage monthly cost): $5,859

8% down (average mortgage annual cost): $70,314

8% down (annual total cost of living): $96,522

Salary needed (needs = 50%): $96,522

Is a $100k salary enough? No

Learn More: I’m a Bank Teller: 3 Times You Should Never Ask for $50 Bills From the Bank

Seattle, Washington

Population total: 734,603

March 2024 3-bedroom home value: $954,891

Annual average expenditure cost: $26,563.48

8% down (down payment): $76,391

8% down (loan amount): $878,500

8% down (average mortgage monthly cost): $5,898

8% down (average mortgage annual cost): $70,775

8% down (annual total cost of living): $97,338

Salary needed (needs = 50%): $194,676

Is a $100k salary enough? No

Los Angeles, California

Population total: 3,881,041

March 2024 3-bedroom home value: $968,769

Annual average expenditure cost: $26,393.29

8% down (down payment): $77,502

8% down (loan amount): $891,268

8% down (average mortgage monthly cost): $5,984

8% down (average mortgage annual cost): $71,803

8% down (annual total cost of living): $98,196

Salary needed (needs = 50%): $196,393

Is a $100k salary enough? No

Read Next: How Much Does the Average Middle-Class Person Have in Savings?

Oakland, California

Population total: 437,825

March 2024 3-bedroom home value: $951,756

Annual average expenditure cost: $30,282.67

8% down (down payment): $76,141

8% down (loan amount): $875,616

8% down (average mortgage monthly cost): $5,879

8% down (average mortgage annual cost): $70,542

8% down (annual total cost of living): $100,825

Salary needed (needs = 50%): $201,650

Is a $100k salary enough? No

San Diego, California

Population total: 1,383,987

March 2024 3-bedroom home value: $1,049,853

Annual average expenditure cost: $28,404.21

8% down (down payment): $83,988

8% down (loan amount): $965,865

8% down (average mortgage monthly cost): $6,484

8% down (average mortgage annual cost): $77,813

8% down (annual total cost of living): $106,217

Salary needed (needs = 50%): $212,434

Is a $100k salary enough? No

Discover More: Jeff Bezos’ Billion-Dollar Life: A Look at His Mansion Collection

San Jose, California

Population total: 1,001,176

March 2024 3-bedroom home value: $1,403,342

Annual average expenditure cost: $30,353.32

8% down (down payment): $112,267

8% down (loan amount): $1,291,074

8% down (average mortgage monthly cost): $8,668

8% down (average mortgage annual cost): $104,013

8% down (annual total cost of living): $134,366

Salary needed (needs = 50%): $268,732

Is a $100k salary enough? No

San Francisco, California

Population total: 851,036

March 2024 3-bedroom home value: $1,563,558

Annual average expenditure cost: $31,556.15

8% down (down payment): $125,085

8% down (loan amount): $1,438,473

8% down (average mortgage monthly cost): $9,657

8% down (average mortgage annual cost): $115,888

8% down (annual total cost of living): $147,444

Salary needed (needs = 50%): $294,888

Is a $100k salary enough? No

Methodology: For this study, GOBankingRates analyzed the top major cities in the United States to find out if a salary of $100k is enough to buy a three-bedroom home. First GOBankingRates found the average home value for a three-bedroom home in March 2024 as sourced from the Zillow Home Value Index. Assuming an 8% downpayment, as typical for first time homebuyers, and using the 30-year national fixed mortgage rate, as sourced from the Federal Reserve Economic Data, the average mortgage for an 8% down payment can be calculated. The process was then repeated for a 19% downpayment, as typical for repeat homebuyers. The average expenditure cost for each city can be calculated using the cost-of-living indexes, as sourced from Sperling’s BestPlaces, and using the national average cost for expenditures for all residents, as sourced from the Bureau of Labor Statistics Consumer Expenditure Survey. The average expenditure cost and the average mortgage cost can be used to calculate the annual total cost of living for each city. The top 50 most populated cities in the US by total population, as sourced from the US Census American Community Survey, were kept for this study. Using the 50/30/20 rule that states the needs should be no more than 50% of the household income, the annual total cost of living, representing the needs category, was doubled to find the salary needed. The cities were sorted to show the lowest to highest salary needed. All data was collected on and is up to date as of May 10, 2024.

More From GOBankingRates

Don't Buy a House in These 3 Cities Facing a 'Climate Change Real Estate Bubble'

This is One of the Best Ways to Boost Your Retirement Savings in 2024

This article originally appeared on GOBankingRates.com: 23 Cities Where a $100K Salary Can Buy You a 3-Bedroom House — and 27 Cities Where It Doesn’t

Yahoo Finance

Yahoo Finance