23 Cities With Housing That Will No Longer Be Affordable on Just Social Security

Planning to pay for housing during retirement with your Social Security check? Where you live might be out of your budget if you’re counting solely on these benefits for the full duration of your retirement years.

To find out which U.S. housing areas will no longer be affordable with just Social Security, GOBankingRates checked the January 2024 average home values for metro U.S. areas via Zillow and calculated the average mortgage, using the 30-year national average fixed rate mortgage, sourced from the Federal Reserve Economic Data. Zillow was also referred to for the forecasted home value for one year in January 2025. Mortgage calculations were included, along with average income received from Social Security benefits.

Ranked in descending order, find out which 23 cities will have the least affordable housing with just a Social Security check.

See More: Housing Market 2024: Avoid Buying a Home in These 10 Florida Cities

Learn More: How To Get $340 Per Year in Cash Back on Gas and Other Things You Already Buy

Lewiston, Idaho

Average home value (Jan. 2024): $337,621

Average home value (Jan 2025): $353,827

YOY home value change: 4.80%

Average mortgage (Jan. 2024): $1,779

Average mortgage (Jan. 2025): $1,864

January 2024 amount left of average Social Security benefits: $81.37

January 2025 amount left of average Social Security benefits: -$4.01

Discover More: 7 Florida Cities That Could Be Headed for a Housing Crisis

That’s Interesting: I’m a Real Estate Agent — 7 House Features That Buyers Always Overpay For

Wealthy people know the best money secrets. Learn how to copy them.

Deltona, Florida

Average home value (Jan. 2024): $336,736

Average home value (Jan 2025): $353,091

YOY home value change: 5.10%

Average mortgage (Jan. 2024): $1,774

Average mortgage (Jan. 2025): $1,865

January 2024 amount left of average Social Security benefits: $86.03

January 2025 amount left of average Social Security benefits: -$4.45

Read Next: Grant Cardone: 7 Best Florida Cities To Buy Real Estate (and 1 To Avoid)

Blackfoot, Idaho

Average home value (Jan. 2024): $332,309

Average home value (Jan 2025): $353,242

YOY home value change: 6.60%

Average mortgage (Jan. 2024): $1,751

Average mortgage (Jan. 2025): $1,866

January 2024 amount left of average Social Security benefits: $109.36

January 2025 amount left of average Social Security benefits: -$6.20

Daphne, Alabama

Average home value (Jan. 2024): $336,265

Average home value (Jan 2025): $354,695

YOY home value change: 5.40%

Average mortgage (Jan. 2024): $1,772

Average mortgage (Jan. 2025): $1,867

January 2024 amount left of average Social Security benefits: $88.52

January 2025 amount left of average Social Security benefits: -$7.16

For You: The Most Expensive City in Every State

Ontario, Oregon

Average home value (Jan. 2024): $330,256

Average home value (Jan 2025): $354,695

YOY home value change: 7.40%

Average mortgage (Jan. 2024): $1,740

Average mortgage (Jan. 2025): $1,869

January 2024 amount left of average Social Security benefits: $120.17

January 2025 amount left of average Social Security benefits: -$8.59

Dover, Delaware

Average home value (Jan. 2024): $337,874

Average home value (Jan 2025): $354,768

YOY home value change: 5.00%

Average mortgage (Jan. 2024): $1,780

Average mortgage (Jan. 2025): $1,869

January 2024 amount left of average Social Security benefits: $80.04

January 2025 amount left of average Social Security benefits: -$8.97

Explore More: 5 Types of Homes That Will Plummet in Value in 2024

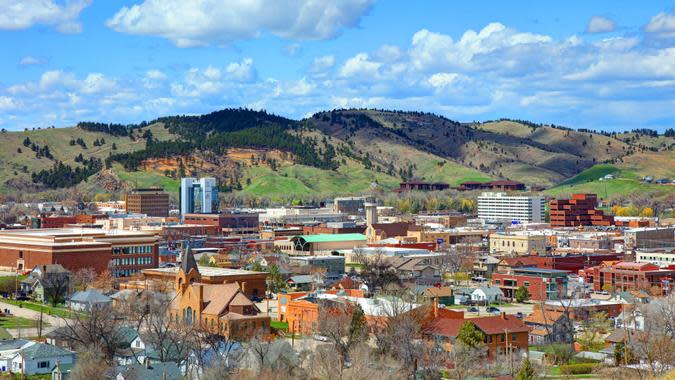

Rapid City, South Dakota

Average home value (Jan. 2024): $336,365

Average home value (Jan 2025): $354,865

YOY home value change: 5.50%

Average mortgage (Jan. 2024): $1,772

Average mortgage (Jan. 2025): $1,870

January 2024 amount left of average Social Security benefits: $87.99

January 2025 amount left of average Social Security benefits: -$9.48

Knoxville, Tennessee

Average home value (Jan. 2024): $327.779

Average home value (Jan 2025): $354,985

YOY home value change: 8.30%

Average mortgage (Jan. 2024): $1,727

Average mortgage (Jan. 2025): $1,870

January 2024 amount left of average Social Security benefits: $133.23

January 2025 amount left of average Social Security benefits: -$10.12

Find Out: 10 Things Frugal People Always Do When They First Buy a House

Keene, New Hampshire

Average home value (Jan. 2024): $334,429

Average home value (Jan 2025): $356,836

YOY home value change: 6.70%

Average mortgage (Jan. 2024): $1,762

Average mortgage (Jan. 2025): $1,880

January 2024 amount left of average Social Security benefits: $98.19

January 2025 amount left of average Social Security benefits: -$19.87

Mountain Home, Idaho

Average home value (Jan. 2024): $328,580

Average home value (Jan 2025): $357,167

YOY home value change: 8.70%

Average mortgage (Jan. 2024): $1,731

Average mortgage (Jan. 2025): $1,882

January 2024 amount left of average Social Security benefits: $129.01

January 2025 amount left of average Social Security benefits: -$21.61

Be Aware: I’m a Real Estate Agent: 5 Cities Where Homes Will Be the Best Bargains in 2024

Crescent City, California

Average home value (Jan. 2024): $348,749

Average home value (Jan 2025): $357,859

YOY home value change: 2.60%

Average mortgage (Jan. 2024): $1,837

Average mortgage (Jan. 2025): $1,885

January 2024 amount left of average Social Security benefits: $22.74

January 2025 amount left of average Social Security benefits: -$25.03

Bakersfield, California

Average home value (Jan. 2024): $340,170

Average home value (Jan 2025): $357,859

YOY home value change: 5.20%

Average mortgage (Jan. 2024): $1,792

Average mortgage (Jan. 2025): $1,885

January 2024 amount left of average Social Security benefits: $67.94

January 2025 amount left of average Social Security benefits: -$25.26

Trending Now: Barbara Corcoran Says, ‘Forget About Florida,’ Move Here for Cheap Homes

Athens, Georgia

Average home value (Jan. 2024): $335,673

Average home value (Jan 2025): $359,170

YOY home value change: 7.00%

Average mortgage (Jan. 2024): $1,769

Average mortgage (Jan. 2025): $1,892

January 2024 amount left of average Social Security benefits: $91.64

January 2025 amount left of average Social Security benefits: -$32.17

Laramie, Wyoming

Average home value (Jan. 2024): $348,637

Average home value (Jan 2025): $359,794

YOY home value change: 3.20%

Average mortgage (Jan. 2024): $1,837

Average mortgage (Jan. 2025): $1,896

January 2024 amount left of average Social Security benefits: $23.33

January 2025 amount left of average Social Security benefits: -$35.45

Read More: 25 Safest and Cheapest Cities To Live in the South

Winchester, Virginia

Average home value (Jan. 2024): $347,034

Average home value (Jan 2025): $360,221

YOY home value change: 3.80%

Average mortgage (Jan. 2024): $1,828

Average mortgage (Jan. 2025): $1,898

January 2024 amount left of average Social Security benefits: $31.78

January 2025 amount left of average Social Security benefits: -$37.70

Fallon, Nevada

Average home value (Jan. 2024): $348,996

Average home value (Jan 2025): $362,606

YOY home value change: 3.90%

Average mortgage (Jan. 2024): $1,839

Average mortgage (Jan. 2025): $1,911

January 2024 amount left of average Social Security benefits: $21.44

January 2025 amount left of average Social Security benefits: -$50.27

Check Out: Housing Market 2024: Zillow Predicts 5 Hottest Home Trends That Homebuyers Will Be Looking For

Pittsfield, Massachusetts

Average home value (Jan. 2024): $343,819

Average home value (Jan 2025): $363,073

YOY home value change: 5.60%

Average mortgage (Jan. 2024): $1,812

Average mortgage (Jan. 2025): $1,913

January 2024 amount left of average Social Security benefits: $48.72

January 2025 amount left of average Social Security benefits: -$52.73

Philadelphia

Average home value (Jan. 2024): $350,083

Average home value (Jan 2025): $365,137

YOY home value change: 4.30%

Average mortgage (Jan. 2024): $1,845

Average mortgage (Jan. 2025): $1,924

January 2024 amount left of average Social Security benefits: $15.71

January 2025 amount left of average Social Security benefits: -$63.60

Richmond, Virginia

Average home value (Jan. 2024): $351,266

Average home value (Jan 2025): $366,370

YOY home value change: 4.30%

Average mortgage (Jan. 2024): $1,851

Average mortgage (Jan. 2025): $1,930

January 2024 amount left of average Social Security benefits: $9.48

January 2025 amount left of average Social Security benefits: -$70.10

Moses Lake, Washington

Average home value (Jan. 2024): $345,662

Average home value (Jan 2025): $366,747

YOY home value change: 6.10%

Average mortgage (Jan. 2024): $1,821

Average mortgage (Jan. 2025): $1,932

January 2024 amount left of average Social Security benefits: $39.01

January 2025 amount left of average Social Security benefits: -$72.09

Learn More: I’m a Self-Made Millionaire: 5 Stocks You Shouldn’t Sell

Whitewater, Wisconsin

Average home value (Jan. 2024): $352,631

Average home value (Jan 2025): $367,793

YOY home value change: 4.30%

Average mortgage (Jan. 2024): $1,858

Average mortgage (Jan. 2025): $1,938

January 2024 amount left of average Social Security benefits: $2.29

January 2025 amount left of average Social Security benefits: -$77.60

Tucson, Arizona

Average home value (Jan. 2024): $351,244

Average home value (Jan 2025): $368,103

YOY home value change: 4.80%

Average mortgage (Jan. 2024): $1,851

Average mortgage (Jan. 2025): $1,939

January 2024 amount left of average Social Security benefits: $9.60

January 2025 amount left of average Social Security benefits: -$79.23

Find Out: If You Had Invested $10K in GameStop and AMC in 2021, Here’s How Much You’d Have Today

Twin Falls, Idaho

Average home value (Jan. 2024): $347,989

Average home value (Jan 2025): $372,696

YOY home value change: 7.10%

Average mortgage (Jan. 2024): $1,833

Average mortgage (Jan. 2025): $1,964

January 2024 amount left of average Social Security benefits: $26.74

January 2025 amount left of average Social Security benefits: -$103.43

Methodology: For this study, GOBankingRates studied metro areas from across the United States to find the housing areas that will no longer be affordable with just a Social Security check. First, GOBankingRates checked the average home values for metro areas across the country for January 2024, as sourced from Zillow Home Value Index, and using the 30-year national average fixed rate mortgage, as sourced from the Federal Reserve Economic Data, the average mortgage can be calculated, assuming a 20% down payment. Next, GOBankingRates found the forecasted home value for one year in January 2025 as sourced from Zillow Home Value Forecast and calculated the mortgage for that home value, as well. The average income received from Social Security benefits was sourced from the Social Security Administration for 2023. To qualify for this study, the average mortgage for the metro area had to fall within the average income from Social Security benefits in 2024 but be above the average income received from Social Security benefits in January 2025. The percentage changed was also included as supplemental information. The dollar amount above Social Security benefits in 2024 and the dollar amount below Social Security benefits in 2025 were also included as supplemental information. The remaining metro areas are sorted to show the most to least out of budget locations. All data was collected and is up to date as of Feb. 29, 2024.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: 23 Cities With Housing That Will No Longer Be Affordable on Just Social Security

Yahoo Finance

Yahoo Finance