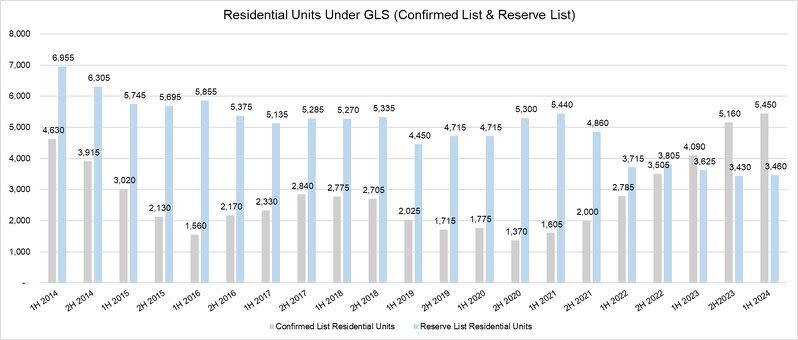

1H2024 GLS: potential 5,450 units on Confirmed List reflects calibrated 5.6% increase in private housing supply

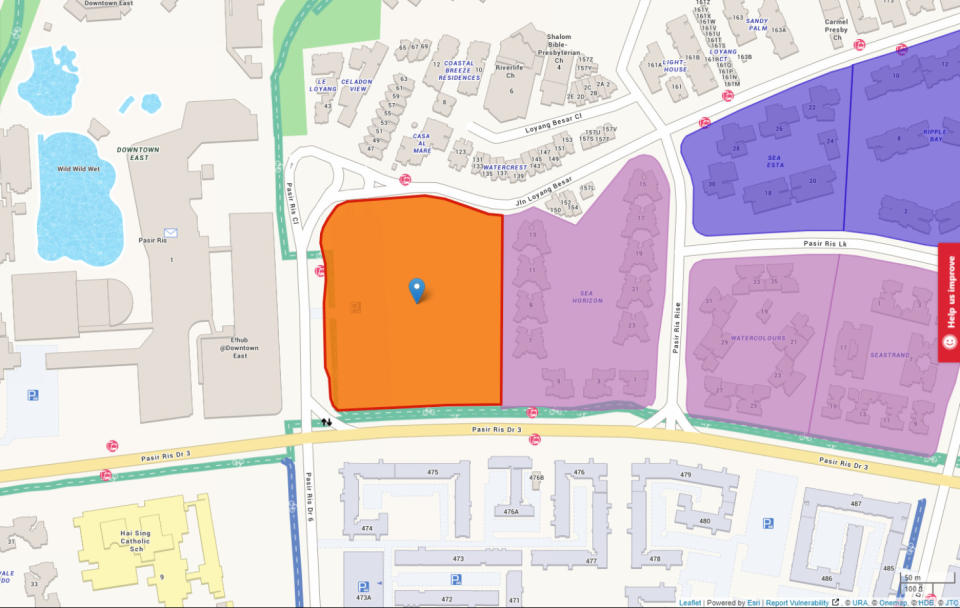

Given the enduring popularity of EC developments among local homebuyers the government might have considered including a second EC site on the Confirmed List, says Gafoor. (Picture: OneMap)

While the latest line up of government land tenders in the 1H2024 Government Land Sales (GLS) programme is the largest half-yearly injection of private residential housing supply by the government in a decade, several market watchers noted that the absolute number of projected units in the upcoming Confirmed List has moderated.

There are 10 sites on the latest Confirmed List. It comprises seven condominium sites, one Executive Condo (EC) site at Jalan Loyang Besar, and a development site for long-stay Serviced Apartments at Media Circle in the one-north precinct. There is also a commercial and residential mixed-use site at Tampines Street 94.

All in, the GLS sites on the upcoming Confirmed List are projected to yield 5,450 private residential units. This represents a 5.6% increase to the 5,160 units that were on the Confirmed List of the 2H2023 GLS programme. It is also the seventh consecutive half-yearly increase in private housing supply by the government.

However, the number of units offered in the 2H2023 GLS Confirmed List was an increase of 26.2% over the 4,090 units offered in the 1H2023 GLS Confirmed List. This was after the government boosted supply by 17% when it offered 3,505 units in the 2H2022 GLS Confirmed List.

Parity in housing supply and demand

Leonard Tay, head of research at Knight Frank Singapore says that the rate of increase in private housing supply from the GLS programme is slowing. It likely signals that the pipeline of supply is coming into balance with prevailing homebuyer demand, he says, adding that the 1H2024 GLS list could encapsulate the peak number of projected private homes going forward.

Source: PropNex Research, MND

“With the prevailing economic uncertainty, clouded business sentiment and elevated interest rates, added to the latest round of cooling measures (implemented in April 2023), the risk from private residential development remains substantial with developer participation in GLS tenders dropping noticeably in the past six months,” says Tay.

Marcus Chu, CEO of ERA Realty, says: “With ten sites slated to release 1H2024, we expect a further dilution of bids from developers. Most notably, developer's interest in land has weakened. Excluding EC, residential sites received an average of 5.2 bids per site in 1H2022 and this has moderated to 3.7 bids per site in 2H2023”.

His sentiments were shared by Ismail Gafoor, CEO of PropNex Realty. “In 2023, we note the more restrained appetite for GLS sites among developers amidst market uncertainties. With more land supply earmarked for 1H2024, developers can be assured that there are sufficient sites to replenish their land inventory – which will also help in moderating land bids,” he says.

Likewise, Chia Siew Chuin, head of residential research at JLL Singapore opines that “the supply count continues to maintain an ample allocation for private housing, but refrains from oversaturating the market, keeping in mind the forthcoming projects in the immediate term”.

Consider boosting EC supply?

Of the 10 plots on the Confirmed List, eight are newly introduced in 1H2024. The new sites are River Valley Green (Parcel A), Canberra Crescent, Jalan Loyang Besar (EC site), Margaret Drive, Media Circle, Dairy Farm Walk, Tengah Garden Avenue, and the mixed-use site at Tampines St 94.

Meanwhile, the Reserve List sites of the 1H2024 GLS programme are Lentor Gardens, Senja Close (EC site), Tampines St 95 (EC site), Zion Road (Parcel B), River Valley Green (Parcel B), Bayshore Road, a commercial site at Punggol Walk, a white site at Woodlands Avenue 2, and a hotel site at River Valley Road.

All in, the list of available development sites for tender and application “provide a good balance of homes for buyers, and offer alternatives for developers, who may otherwise have to tap the collective sale market for prime residential plots,” says Gafoor. However, given the enduring popularity of EC developments among local homebuyers the government might have considered including a second EC site on the Confirmed List, he says.

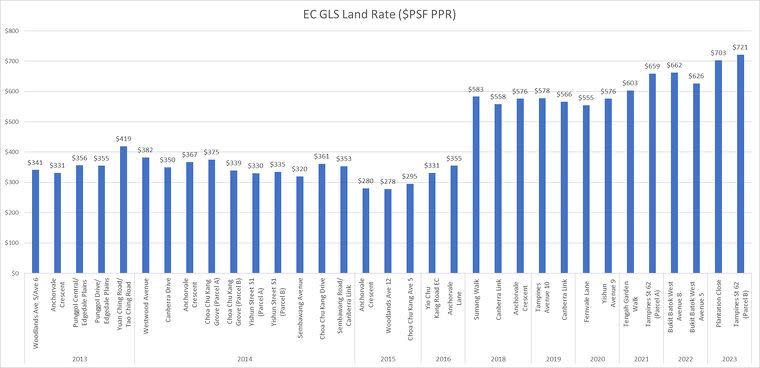

Source: PropNex Research, HDB (based on site award date)

“We have seen EC land rates rising through the years. In 2018, the Sumang Walk EC site set a new record land rate at $583 psf ppf, this record has since been smashed as EC land rates continued to climb. The latest record land rate stands at $721 psf ppr for the EC plot at Tampines St. 62 (Parcel B). Meanwhile, prices of new EC units have hit a fresh benchmark, with the average transacted unit price crossing $1,470 psf at Altura EC in Bukit Batok this year,” says Gafoor.

Chu says that the EC segment will be keenly watched by developers due to its compelling value proposition among local homebuyers. “However, developers will need to be mindful around housing affordability amid the rising land cost since there is an income cap for EC buyers,” he says.

See Also:

Singapore Property for Sale & Rent, Latest Property News, Advanced Analytics Tools

New Launch Condo & Landed Property in Singapore (COMPLETE list & updates)

En Bloc Calculator, Find Out If Your Condo Will Be The Next en-bloc

Yahoo Finance

Yahoo Finance