13 ‘investible ideas’ to decarbonise region could generate US$150 bil annual revenue by 2030: report

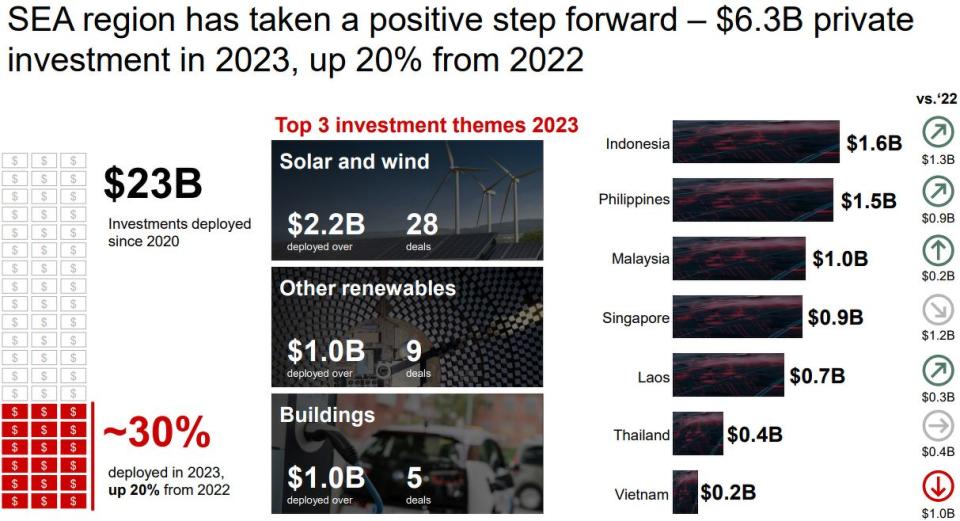

Green investments in the region rose 20% to US$6.3 billion last year, say Bain & Company, GenZero, Standard Chartered and Temasek.

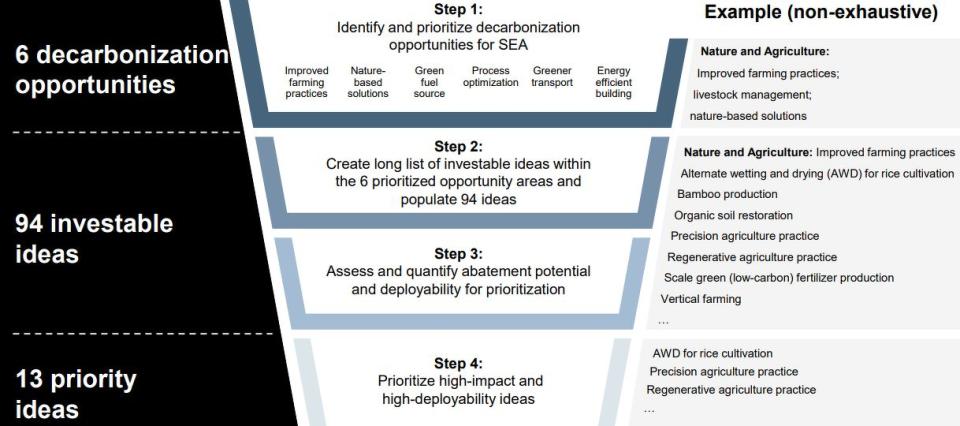

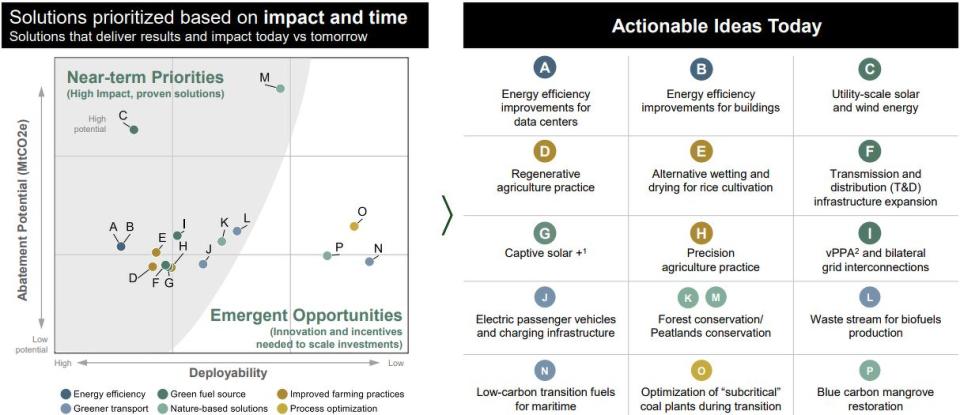

New methods of rice cultivation, precision agriculture and energy efficiency improvements for data centres are among 13 “investible ideas” identified in a new report by Bain & Company, GenZero, Standard Chartered and Temasek.

Individually, these “market-ready” ideas have the potential to reduce carbon emissions above 100 metric tonnes of carbon dioxide equivalent per year (MtCO2e/year) and immediate emissions returns are possible within the next year, say the report’s authors. Together, these 13 ideas could generate US$150 billion ($204.16 billion) in annual revenue by 2030, they add.

The fifth edition of the annual report covers 10 markets: Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar, the Philippines, Singapore, Thailand and Vietnam. Unveiled at Temasek’s Ecosperity Week 2024 on April 15, the Southeast Asia’s Green Economy 2024 – Moving the needle report whittled down an initial pool of 94 investible ideas, identifying four priority areas: nature and agriculture, power, transport and buildings.

Under nature and agriculture, four areas ripe for investment are regenerative agriculture, alternate wetting and drying (AWD), precision agriculture and forest and peatlands conservation.

AWD refers to a water management technique with scheduled draining practices that allows soil to dry between irrigation cycles. This reduces the amount of time the field is flooded to mitigate methane-producing microbial activity and emissions.

Rice is a staple crop, but its production forms the bulk of Southeast Asia’s methane emissions. According to the 171-page report, this is 28 times more potent than carbon dioxide.

Meanwhile, utility-scale solar and wind power, transmission and distribution infrastructure expansion, captive solar and virtual power agreements (vPPA) and interconnections are some ideas within the power sector.

Corporate vPPA is a financial contract that allows trading of renewable energy across borders without physical delivery. Buyers typically receive Renewable Energy Certificates (RECs), which allow them to make claims that they have reduced the emissions from their energy use. With this sale, connecting developers and offtakers in countries with limited renewable energy capacity can enjoy a stable new revenue stream, say the authors.

Under the transport sector, notable areas include electric passenger vehicles and charging infrastructure, as well as agricultural waste stream for biofuels production.

Agricultural waste refers to all parts of crops that are not used for human or animal food. This can be turned into second generation (2G) biofuels for use as sustainable aviation fuels (SAF) and low-carbon transition fuels in the maritime sector.

Finally, energy efficiency improvements for data centres and buildings in general could involve efficient cooling and building automation systems to reduce energy use.

According to the report, data centres are one of the fastest-growing sources of emissions. This is forecast to grow 11% CAGR in the Asia Pacific. The report recommends implementing energy-efficient technology and measures like efficient cooling and building automation systems to reduce energy usage while concurrently increasing the clean energy power mix.

Amid global competition for climate investments, countries that take the lead in charting out their decarbonisation roadmap through clear policy frameworks, supportive regulations and concrete financing plans will be better-positioned to attract private investment and accelerate their transition, says Kimberly Tan, head of investments at GenZero.

“As one of the most vulnerable regions to climate change, Southeast Asia is experiencing a significant increase in greenhouse gas emissions driven by economic development,” she adds. “While climate investments increased by 20% to US$6.3 billion in 2023, significant acceleration is needed to meet the US$1.5 trillion required to achieve 2030 emissions targets.”

Green investments rose 20%

In 2023, green investments in the region rose 20% y-o-y to US$6.3 billion, a spike the report authors attribute to renewables and green data centres. Renewable energy investment in Southeast Asia rose 9% y-o-y in 2023.

This marks a reversal from previous years. Last year’s report, for example, noted that green investments dipped 7% y-o-y to US$5.2 billion in 2022.

However, this remains “far short” of the US$1.5 trillion needed in cumulative investment into the energy and nature sectors to reach nationally determined contribution targets by 2030, says Tan.

“We believe that an acceleration of effort by countries, corporates and investors is imperative as Southeast Asia remains woefully off-track despite significant progress in 2023,” Tan adds. “Emissions increased by 13%, or 400 MtCO2e, in 2023 and will continue to increase as primary energy consumption increases alongside GDP growth.”

Last year, corporates invested in large-size deals while climate funds invested in start-ups. In addition, there were more domestic investments within the region with a consistent decline in foreign investments.

While power, and in particular renewables, remained the largest green investment theme in 2023, it is the increase in investments in green data centres driven by energy efficiency regulations in Malaysia and Singapore, as well as investments in waste management towards water treatment and plastic recycling in the region that drove the largest investment dollars, say the report’s authors.

By country, Malaysia and Laos made the biggest y-o-y jump in green investments, at 326% and 126% respectively. Malaysia attracted large-scale green financing for data centres in Johor and Kulai, while a large-scale project to unlock Laos's renewable potential is being carried out by foreign investors.

Infographics: Bain & Company, GenZero, Standard Chartered, Temasek

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Temasek Trust, DBS Foundation, UBS Optimus Foundation launch new digital impact marketplace

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance