11 Financial Gifts For Father’s Day That Dad Would Appreciate

Celebrated around the world on the third Sunday of June each year, this year’s Father’s Day falls on 18 June 2023. It is the one day of the year marked to honour and express your gratitude to your dad or relevant father figure for playing a role in your upbringing and being there for you.

While you could have passed off your “stickman” drawings or “unevenly shaped” handicrafts as special gifts in your adolescent years, the same may not be possible now that you have started working. If you are intending to give something special but dread the tired clichés of “greatest dad” mugs, polka dot ties, and chequered shirts, then this article has got you covered.

Here are 11 financial gift ideas that could be both meaningful and special to give your dad.

#1 Make CPF Contribution Under The CPF Matched Retirement Savings

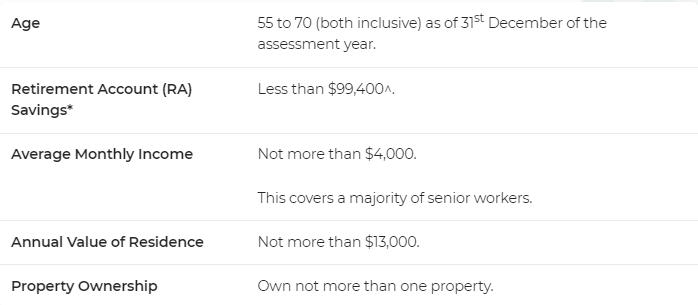

Launched in 2021, the CPF Matched Retirement Savings (MRSS) helps senior Singaporeans with lower retirement savings build up more. Under the scheme, which will last for five years, the government will match every dollar of cash top-up to the Retirement Account (RA) of eligible members for up to $600 per year, or a total of $3,000 over five years.

You can check whether your father is eligible based on the following criteria or here:

Source: CPF

By topping up a maximum of $600 to your father’s RA account at any time of the year, he would receive another $600 from the government in his RA account the following year. This would help to build up his retirement savings for a bigger monthly CPF LIFE payout. Furthermore, you can also receive similar tax relief based on your contribution.

Cost: $600

Read Also: Step By Step Guide To Top Up Your CPF Matched Retirement Savings Scheme (MRSS)

#2 Top Up Your Father’s CPF Account Under The CPF Retirement Sum Topping-Up Scheme

Staying on the topic of CPF, you have another option of making cash contributions to your father’s Special Account (SA) if he’s under 55 years old or RA if he’s above 55 through the Retirement Sum Topping-Up Scheme (RSTU).

If he’s under 55, he would be able to earn an additional 1% per year on the first $60,000 of his combined CPF balances. This additional interest will help grow his retirement savings for a bigger CPF LIFE payout upon his retirement age.

Conversely, if your father is above 55, he could earn up to 6% interest per annum. This comprises an additional 2% interest per annum on the first $30,000 of his combined balances, while the remaining $30,000 would attract an extra 1% on top of the floor interest rate of 4.00%. To further enhance his monthly CPF LIFE payout, you could even contribute up to his Enhanced Retirement Sum limit.

Moreover, you will be eligible to receive tax relief of up to $8,000 on the cash top-ups made towards your father’s Full Retirement Sum (FRS). If you choose this option, it’s best that you top up as early as possible, ideally in January. As the interest is computed monthly, it could result in your dad receiving 20% more interest on your cash top-ups in just 10 years.

Cost: $8,000

Read Also: Pros And Cons Of Making RSTU Top-Ups To Your CPF Account At The Start Of The Year

#3 Maximise Idle Savings With High Interest Savings Accounts

In spite of the current high interest rate environment, most regular savings accounts still only offer 0.05% interest per year, potentially causing us to miss out on maximising our returns from our idle savings.

Instead, you could consider helping your dad switch to other high-interest savings accounts like the UOB Stash and CIMB StarSaver to earn more interest on his idle cash savings. These savings accounts do not have any hoops to jump through, like a minimum spending amount or salary credit requirement, to earn the high interest rate. As such, they are suitable for seniors or retirees who prefer simplicity.

Furthermore, helping your dad make this switch would not only help him accumulate more interest on his savings, leading to his appreciation, but it would also not cost you anything.

Cost: $0

Read Also: Best Savings Accounts In Singapore – If You Don’t Want To Keep Jumping Through Hoops

#4 Earn Regular Income Through Bonds

The Singapore Savings Bond (SSB) needs little introduction given its recent popularity as a long-term savings tool. It is a bond instrument that is issued and fully backed by the Singapore government. One of the unique features of the SSB is its step-up interest rate structure, which ensures that you receive a higher interest rate the longer you hold over the 10-year maturity period. Moreover, you also have the flexibility to redeem the bond in any given month without any penalties.

For the July 2023 issuance (SBJul23 GX23070H), the SSB offers a 2.82% average return over 10 years. You can check out the details of the latest issuance here.

You can buy the SSB under your father’s account for as little as $500 (capped at $200,000). This would enable him to receive the coupon payments twice a year, providing a steady income source while retaining the flexibility to redeem the investments whenever needed.

Cost: $500

Read Also: [2023 Edition] Complete Guide To Buying Singapore Savings Bonds (SSB)

#5 Help With Your Father’s CareShield Life Premiums

In Singapore, we have a three-prong approach to accessing affordable healthcare services. They are:

(i) MediSave: a national medical savings scheme that you can use to pay for your personal or family’s hospitalisations, day surgeries, and selected outpatient treatments;

(ii) MediShield Life: a basic health insurance scheme to help pay for large hospital bills and selected costly outpatient treatments; and

(iii) CareShield Life: introduced in 2020, it’s a new basic long-term care insurance scheme that increases payouts as long as the policyholder remains severely disabled.

As participation in CareShield Life is optional for those born in 1979 or earlier, many may not have joined the scheme yet. However, considering that one in two healthy Singaporeans could, by age 65, become severely disabled in their lifetime, it may be beneficial to get this coverage for your father while he is still in good health.

You could offer to help with the annual premium payments while leveraging the government’s participation incentives of up to $2,500 given to all Singaporeans born in 1979 or earlier who join CareShield Life by 31 December 2023. Furthermore, Merdeka and Pioneer Generation citizens will receive an additional participation incentive of $1,500 if they join by the same deadline.

Cost: Varies (check your personalised CareShield Life premiums here using your Singpass).

#6 Help Dad Create A Lasting Power Of Attorney (LPA)

In addition to making a will and a CPF nomination, creating a lasting power of attorney (LPA) holds equal importance. An LPA is a legally-binding document that allows the donor to voluntarily appoint one or more persons (donee) to make decisions and act on their behalf if they lose mental capacity one day. The appointed donees can act on behalf of the donor in matters relating to personal welfare as well as property & affairs.

With one in 10 people aged 60 and above in Singapore suffering from dementia, it is important for seniors to appoint trusted donees to make decisions on their behalf when they are unable to do so. Administered by the Office of the Public Guardian (OPG), the LPA Form 1 application fee of $75 is waived for Singapore citizens until 31 March 2026.

You could raise awareness of such a scheme and help your father with the online registration and certification of the LPA.

Cost: Free

Read Also: What Is Lasting Power Of Attorney (LPA) And Why All Singaporeans Should Make One

#7 Encourage Dad To Take Up Fitness Routines

Health is wealth, and it is a sentiment that the retirees that we spoke to for a previous article concurred with. As we age, we may tend to live a more sedentary lifestyle, which could increase the risk of heart disease and muscular atrophy. This can be reduced by engaging in regular light exercises.

According to a Norwegian study, half an hour of light exercise six days a week is needed for an elderly person to reduce their chance of mortality and increase their life expectancy by more than 40%.

Encourage your father to take on some light exercises like Zumba, low-impact aerobics, and stretch band exercises through the Active ageing programmes (AAPs) offered within the neighbourhood.

Alternatively, you could also sign up your dad for a ClassPass that offers various exercise options like outdoor cycling, gym passes, and yoga classes. This might not only add more variety to the exercise routines but also motivate him to try out new activities that can be done at his own pace. The lowest membership tier of ClassPass starts at $19 per month.

Cost: $19/month

Read Also: Complete Guide To Maximising Your Fitness & Gym Activities Using ClassPass

#8 Encourage Dad To Learn New Skills By Gifting A Book Or Course

Alongside physical well-being, we must also nurture our mental well-being as part of active ageing, given that over 150,000 people are expected to be affected by dementia by 2030.

One simple way to stimulate our minds is through the joy of reading. Consider gifting your dad an ebook reader, which costs around $180, and preloading it with some books that might interest him or those that can provide new insights. These books can range from topics such as fitness, dieting, spirituality, or even fiction novels. Unlike physical books, an ebook reader makes reading more pleasurable as the fonts can be adjusted to read more comfortably and can be carried anywhere without requiring much storage space.

Alternatively, you could encourage your dad to pick up new skills by signing him up for SkillsFuture Credit-eligible courses. Some of these courses are specific to seniors, such as imparting digital literacy, adopting a healthy diet, and stimulating creativity through art. Tap on the SkillsFuture credit of up to $1,000 to pay for these courses, of which the SkillsFuture credit top-up of $500 will expire on 31 December 2025.

Cost: $180

#9 Give The Timeless Gift Of A Watch

A watch can be a classic gift for dad, especially a Rolex. For the older generation, it is a brand that resonates well as a luxury and status symbol. Furthermore, Rolex watches, depending on the model, such as the Submariner, Daytona, and Day-Date, are able to retain their value well over time, making them a good investment.

But not all of us may be able to afford one of those as a gift. Instead, you could get a smartwatch that complements your father’s exercise routines to monitor and track his fitness and health. Depending on the number of features that a smartwatch has, the price may differ largely between brands. For example, Fitbit carries a model that is able to track 40+ exercise modes with built-in GPS tracking, starting at $358.

Cost: $358

#10 Giving Gold

Another timeless gift that you can give your father is the yellow metal, gold. Gold has always been regarded symbolically as representing both prosperity and longevity in our Asian culture. As an investment, it is also a good store of value.

Depending on your father’s liking, you can choose to gift gold in the form of an exquisite jewellery like a chain, or as an Investment Precious Metal (IPM) gold coin or bar.

Cost:

$2,637/oz (Investment Grade)

$91.10/24kt/gm (Jewellery)

Read Also: Complete Guide To Investing In Gold and Silver With UOB And UOB Gold And Silver Savings Account

#11 Donate To A Charity Or Cause

Lastly, a thoughtful gesture could be to donate on behalf of your father to a charity or fund-raising effort that holds personal significance to him. This could serve as a meaningful way to honour his values, interests, or causes that he deeply cares about.

It’s worth nothing that donations made to any approved institution of public character (IPC), including the community chest, are eligible for a tax deduction of 2.5 times the qualifying donation amount.

Read Also: 8 Ways You Can (Legally) Reduce Your Income Tax For YA 2023

Spending Time With Dad Is More Valuable Than Any Gifts

While gifts can bring joy to our fathers, it’s important to remember that the time we spend with them holds greater significance. Rather than solely focusing on getting expensive gifts once each year, we should aim to spend more time together to create lasting memories and foster stronger bonds. No gift can ever replace these priceless moments.

We have the opportunity to make every single day a Father’s Day by showing our love, respect, and appreciation to our fathers through our interactions.

Read Also: How To Get Financial Assistance And Support As A Single Father

The post 11 Financial Gifts For Father’s Day That Dad Would Appreciate appeared first on DollarsAndSense.sg.

Yahoo Finance

Yahoo Finance