12 Best Cashback Credit Cards in Singapore (Jun 2024)

Collecting air miles for your jet setting lifestyle admittedly sounds sexier than trying to scrounge for cash rebates. But if you’re still one of those people who believe that cash is king, getting card benefits in cold, hard cash is just as appealing.

You literally get free money when you use a cashback credit card (on top of welcome gifts!), and given that’s there’s no free lunch in Singapore, there’s no way we’re saying no to that.

So let’s take a look at the best cashback credit cards in Singapore in Jun 2024.

Best cashback credit cards Singapore 2024

1. Best cashback credit cards in Singapore 2024

Here are our top picks for cashback cards with the highest cashback rates.

Best for | Best cashback credit cards |

Unlimited cashback | Citi Cash Back+, Standard Chartered Simply Cash, Amex True Cashback, UOB Absolute Cashback, OCBC INFINITY Cashback Card, CIMB World Mastercard |

Regular expenses | |

Online Shopping | |

Low or no minimum spend | Citi Cash Back+, Standard Chartered Simply Cash, Amex True Cashback, UOB Absolute Cashback, OCBC INFINITY Cashback Card |

2. UOB Absolute Cashback Card

Online Promo

1.7% Unlimited Cashback

UOB Absolute Cashback Card

More Details

Cash Back Features

Enjoy 1.7% limitless cashback across all your overseas spend and local retail spend including groceries, insurance, as well as big purchases such as home furnishings, electronics and luxury shopping.

Enjoy 0.3% limitless cashback on generally excluded spend such as Grab mobile wallet top-up, school fees, healthcare and government services.

Among the small pool of unlimited cashback cards out there, the best card on the market is UOB’s Absolute Cashback card. This card edges out the competition (namely, the Citi’s Cash Back+ Card and the OCBC INFINITY Card) by adding a 0.1 percentage point to its rebates for a total of 1.7% unlimited cashback. That’s the highest unlimited, $0 minimum spend cashback rate you can find in Singapore.

The only downside? It’s an Amex card, which means that it might be a challenge to find smaller merchants that accept it.

On the other hand, the UOB Absolute Cashback Card has a big plus—expenses like bills and insurance can earn cashback. So if you do stick to large merchants and put all your spending there, as well as bills, insurance premiums, and the like, you’ll be able to get more mileage than the cards listed below.

The UOB Absolute Card got nerfed on 6 May 2024, with UOB slashing cashback from 1.7% to 0.3% on categories like:

Education

Tax payments

Pet stores and veterinary services

Medical services and hospitals

Utilities

and more.

Despite the nerf, it remains a relatively solid unlimited cashback card to have because most of these exclusions above are also on the exclusion list for other unlimited cashback cards. It isn’t “absolute” nor truly “limitless” as advertised, but is the most limitless available on the market.

3. Citi Cash Back+ Card

Sponsored

MoneySmart Exclusive

FLASH DEAL | Unlimited 1.6% Cashback

Citi Cash Back+ Card

MoneySmart Exclusive:

[FLASH DEAL | FASTER GIFT FULFILMENT]

Earn 5,040 SmartPoints or S$300 Cash via PayNow, in as fast as 5 weeks from meeting the S$500 spend criteria! T&Cs apply.

OR get a COMPLIMENTARY GIFT UPGRADE to a ECOVACS DEEBOT T20e OMNI Robot Vacuum Cleaner (worth S$1,199) when you are the first 5 customers to submit the claim form at 2PM & 9PM daily!

Use 5,040 SmartPoints to fully redeem a product from our Rewards Store. If the product costs more, redeem with your points and top up the rest by purchasing additional SmartPoints e.g. get an Apple 10.9-inch iPad Wi‑Fi 64GB (10th Generation) at only S$110 on top of your earned SmartPoints.

Valid until 21 Jun 2024

More Details

Key Features

1.6% cashback on your spend

No minimum spend required and no cap on cash back earned

Cash back earned does not expire

Redeem your cash back instantly on-the-go with Pay with Points or for cash rebate via SMS

With Citi PayAll, you can earn and accumulate Citi Miles, Citi ThankYou PointsSM or Cash Back quickly when you pay your big-ticket bills such as rent, insurance premiums, education expenses, taxes, utilities and more

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

Unlike some cards which benefits look like they’ll require a PhD to figure out, anyone with half a brain cell can successfully earn cashback on the Citi Cash Back+ Card.

Unlimited cashback cards like Citi Cash Back+ give you a flat cashback rate with no minimum spend on everything with no cashback cap. This makes them ideal for big-ticket spending like wedding banquets or home renovations, which would bust the cashback cap on most other cards.

The Citi Cash Back+ Card currently plays second fiddle to UOB’s Absolute Cashback card, offering 1.6% cashback on all spending.

There’s almost nothing that would disqualify you from the 1.6% cashback, but some exclusions include insurance and tax payments. On the flipside, I noticed that the UOB Absolute Cashback Card has MCC 0742, Pet stores and Veterinary Services on its exclusion list, but the Citi Cash Back+ Card doesn’t have this exclusion. Pawrents, take notes!

The Citi Cash Back+ Card also has 1 more advantage—unlike the UOB Absolute Cashback Card, which is an Amex card, its association is Mastercard. That opens up a wider range of merchants who’ll accept it.

ALSO READ: Visa vs Mastercard vs American Express – Which is Best?

4. HSBC Visa Platinum Credit Card

MoneySmart Exclusive

Earn up to 5% Cash Rebate | Instant Activation*

HSBC Visa Platinum Credit Card

MoneySmart Exclusive:

Earn 3,950 SmartPoints or S$150 Cash via PayNow when you apply and spend a min. of S$500 from Card Account Opening Date to end of the following calendar month. T&Cs apply.

Use 3,950 SmartPoints to fully redeem a product from our Rewards Store. If the product costs more, redeem with your points and top up the rest by purchasing additional SmartPoints e.g. get an Apple 10.9-inch iPad Wi‑Fi 64GB (10th Generation) at only S$219 on top of your earned SmartPoints.

Valid until 20 Jun 2024

More Details

Cash Back Features

5% cash rebate on dining, groceries and petrol with min. S$600 spend/month for all 3 months in a calendar quarter

S$250 cash rebate cap per calendar quarter

The HSBC Visa Platinum Credit Card is a great cashback card if you regularly spend at least $600 a month on dining, groceries, and petrol. That’s because it offers up to 5% cashback on those categories only if you hit this minimum amount.

On top of that, you’ll receive complimentary access to Entertainer with HSBC—a food rewards app with 1-for-1 deals on dining, lifestyle, and travel worldwide.

There is a rebate cap of $250 per calendar quarter, which means that you will max out your cash rebates at a total spending of $5,000. Going to spend more than that in a quarter? Opt for an unlimited cashback card instead, such as the UOB Absolute Cashback Card, Citi Cash Back+ Mastercard or Standard Chartered Simply Cash Credit Card.

5. Standard Chartered Simply Cash Credit Card

MoneySmart Exclusive

1.5% UNLIMITED CASHBACK

Standard Chartered Simply Cash Credit Card

MoneySmart Exclusive:

Earn 4,250 SmartPoints or up to S$350 Cash via PayNow when you apply and spend a min. of S$1,000 in eligible transactions within 60 days from card approval date! T&Cs apply.

Use 4,250 SmartPoints to fully redeem a product from our Rewards Store. If the product costs more, redeem with your points and top up the rest by purchasing additional SmartPoints e.g. get an Apple 10.9-inch iPad Wi‑Fi 64GB (10th Generation) at only S$189 on top of your earned SmartPoints.

Valid until 30 Jun 2024

More Details

Key Features

Flat 1.5% cashback rate for all eligible purchases

No cashback cap and no minimum spend

Enjoy dining and shopping discount privileges at over 3,000 outlets in Asia with Standard Chartered’s The Good Life Program

1 year annual fee waiver, no minimum spend required

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

As far as $0 minimum spend unlimited cashback cards go, the Standard Chartered Simply Cash Credit Card is in third place after the UOB Absolute Cashback Card (1.7%) and Citi Cash Back+ Mastercard/OCBC INFINITY Cashback Card (1.6%). It gives you 1.5% cashback on all eligible spending with no cashback cap and no minimum spending. Here, “eligible spending” refers to pretty much everything barring the usual exceptions—bills, taxes, insurance premiums and any top-ups to prepaid cards or accounts.

Despite a slightly lower cashback rate than the Citi Cash Back+ Card, the Standard Chartered Simply Cash Credit Card has some advantages: for instance, its annual fee is waived for the first 2 years instead of only the first year. It’s also worth comparing their limited-time sign-up promotions to see which gets you a better welcome gift.

6. American Express True Cashback Card

MoneySmart Exclusive

Unlimited Cashback

American Express True Cashback Card

MoneySmart Exclusive:

Get S$130 Cash via PayNow when you apply for an American Express True Cashback Card and spend a min. of S$500 in Qualifying Spends within the first month of card approval! T&Cs apply.

Valid until 30 Jun 2024

More Details

Key Features

Unlimited & Immediate Cashback - No min spend and no cap on how much you earn. Get your cashback in the same month's statement.

3% Cashback on all eligible purchases, up to $5,000 spend in the first 6 months for new Card Members.

1.5% unlimited Cashback on all subsequent eligible purchases with no minimum spending and no earn cap.

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

The Amex True Cashback Card is one of the longest-standing unlimited cashback cards around. It doles out 1.5% cashback on all spending with no minimum spending requirement and no cashback cap. The card also offers 3% cashback on up to $5,000 worth of spending in your first 6 months of use.

While the Amex True Cashback Card sounds like a better deal than the Standard Chartered Simply Cash Credit Card we just talked about, it’s harder to get. The Standard Chartered Simply Cash has a minimum income requirement of $30,000 (Singaporean) or $60,000 (Non-Singaporean), which is standard for an entry-level credit card. That’s what the Amex True Cashback Card is NOT—its income requirements aren’t even published, so it’s up to Amex’s discretion.

Do also note that the Amex True Cashback Card comes with an annual fee of $174.40. This is waived for the first year, but Amex is one provider that may not waive the card fee thereafter—no matter how nicely you ask.

7. OCBC INFINITY Cashback Card

Earn up to 1.8% unlimited cashback

OCBC INFINITY Cashback Card

More Details

Key Features

Earn 1.6% in unlimited cashback on transactions made in stores or online, locally or overseas.

No minimum spending required to earn cashback

No limit to the cashback you can earn

Cashback willl be credited automatically to your card account

The OCBC INFINITY Cashback Card is yet another no minimum spend, unlimited cashback card. What sets it apart from its fellow $0 minimum spend contenders?

Well, it used to offer (for a limited time) the highest unlimited cashback rate in town—1.8%. Now that that 1.8% promotion has ended, the OCBC INFINITY Cashback Card is pretty much on par with its 1.6% unlimited cashback counterpart, the Citi Cash Back+ Card.

However, one difference between them is in the way that the cashback is applied. The OCBC INFINITY Cashback Card has an ideal cashback mechanism for lazy folks like myself—the cashback is automatically offset in the same month’s statement. There’s no need to log in to an app and redeem it, which Citi Cash Back+ Card members have to do.

The OCBC INFINITY Cashback Card also gives drivers extra savings on petrol:

Up to 16% off fuel savings at Caltex Petrol Stations

14% off fuel savings at Esso Petrol Stations

8. CIMB World Mastercard

Online Promo

Unlimited 2% Cashback

CIMB World Mastercard

More Details

Key Features

2% Unlimited Cashback on Wine & Dine, Online Food Delivery, Movies & Digital Entertainment, Taxi & Automobile, Luxury Goods.

1%* Cashback on all other spends.

Access to Over 1,300 Airport Lounges via Mastercard Travel Pass App provided by Dragonpass

50% Off Green Fees at golf courses across the region

No annual fees for life

Apply for up to 4 supplementary cards and have annual fees waived for all supplementary cards

Access to over 1,000 regional deals & discounts across Singapore, Malaysia and Indonesia

As far as unlimited cashback cards go, one that’s often forgotten is the CIMB World Mastercard. No, despite its name, it’s not a miles card. The CIMB World Mastercard is actually quite a cashback heavyweight, bringing 2% unlimited cashback to the table.

Wait, isn’t that higher than the UOB Absolute Cashback Card and Citi Cash Back + Card? It is, but there are 2 catches.

First, the CIMB World Mastercard is an unlimited cashack card, but not a no minimum spend one. You need to charge $1,000 a month to this card to enjoy the 2% cashback.

Secondly, the 2% unlimited cashback applies only to selected categories: Wine & Dine, Online Food Delivery, Movies & Digital Entertainment, Taxi & Automobile, and Luxury Goods. On all other spends, you earn 1% unlimited cashback.

If credit card fees—or rather, calling up the bank to get them waived—bother you, you’ll be pleased to know that the CIMB World Mastercard promises no annual fees for life.

9. UOB One Card

Online Promo

Up to 10% Cashback

UOB One Card

More Details

Key Features

Up to 10% cashback on McDonald's (including McDelivery®)

Up to 10% cashback at Shopee Singapore (excludes ShopeePay)

Up to 10% cashback at DFI Retail Group (Cold Storage, CS Fresh, Giant, Guardian, 7-Eleven & more)

Up to 10% cashback at Grab (including GrabFood, excludes Grab mobile wallet top-ups)

Up to 10% cashback (bus and train rides)

Up to 10% cashback on UOB Travel

Up to 4.33% cashback on Singapore Power utilities bill.

Up to 3.33% cashback on all retail spend (based on S$500, S$1,000 or S$2,000)

Fuel savings of up to 22.66% at Shell and SPC

Exclusions and T&Cs at uob.com.sg/onetncs

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

Once upon a time, he UOB One Card offered a generous maximum cashback of 15% at selected merchants. Sounds too good to be true? Now it is. The UOB One Card now only earns you a maximum of 10% cashback at selected partners like Cold Storage, Giant, Shopee, Guardian, and more.

Aside from its reduced cashback, the card also scares people off because of its complex as hell mechanism. Suitable only for those who like a challenge.

We can’t help that UOB has lowered their rates on the UOB One Card. But at least we can help you with understanding how their cashback mechanism works.

Cashback | $500/month and $1,000/month | $2,000/month |

Base cashback per quarter | 3.33% | 3.33% |

Additional cashback at selected partners | 5% | 6.67% |

TOTAL | 8.33% | 10% |

Base cashback per quarter: The card gives you up to 3.33% on all retail spending if you spend $2,000 / $1,000 / $500 per month (at least 5 transactions) for 3 consecutive months. That’ll earn you a lump sum of $200/$100/$50 max cashback at the end of the quarter, which works out in all cases to up to 3.33% cashback.

Note the maximum cashback amounts for each of the 3 spend tiers. For example, if you spend more than $500 but still less than $1,000 for 3 months, you’ll still only earn $50 by the end of the quarter.

Does UOB pro-rate the quarterly cashback? Yes, but only for the first quarter. So if you only meet the minimum spend on 1 or 2 of your first 3 months with the UOB One Card, UOB will prorate the cashback and give you 1 or 2 thirds of the $50 quarterly cashback for that respective tier.

Additional cashback at selected partners: In order to get additional cashback of 6.67% (making for a total of 10%) at partners like McDonald’s, Grab, Cold Storage, Shopee, 7-Eleven and SimplyGo, you need to hit a $2,000 monthly spend. If you only spend $500 or $1,000 a month, your additional cashback is only 5%.

The additional cashback stacks on top of the base cashback. It has a monthly limit of $100 for all spending tiers.

Total cashback: If you add up the base retail spending cashback (3.33%) and additional cashback at selected partners (5% or 6.67%), you get:

8.33% total cashback if you spend $500 or $1,000 a month for 3 consecutive months

10% cashback if you spend $2,000 a month for 3 consecutive months

How’s your brain doing? Tired? Then perhaps the UOB One Card with its complex cashback mechanism isn’t for you. Opt for one of the unlimited cashback cards above instead.

On the other hand, if you’re up for the challenge and know that you spend $2,000 a month, enjoy your 10% cashback with the UOB One Card.

10. Citi Cash Back Card

MoneySmart Exclusive

FLASH DEAL | Up to 8% Cashback

Citi Cash Back Card

MoneySmart Exclusive:

[FLASH DEAL | FASTER GIFT FULFILMENT]

Earn 5,040 SmartPoints or S$300 Cash via PayNow, in as fast as 5 weeks from meeting the S$500 spend criteria! T&Cs apply.

OR get a COMPLIMENTARY GIFT UPGRADE to a ECOVACS DEEBOT T20e OMNI Robot Vacuum Cleaner (worth S$1,199) when you are the first 5 customers to submit the claim form at 2PM & 9PM daily!

Use 5,040 SmartPoints to fully redeem a product from our Rewards Store. If the product costs more, redeem with your points and top up the rest by purchasing additional SmartPoints e.g. get an Apple 10.9-inch iPad Wi‑Fi 64GB (10th Generation) at only S$110 on top of your earned SmartPoints.

Valid until 21 Jun 2024

More Details

Key Features

8% cash back on petrol and private commute spend

6% cash back on dining and groceries spend

0.2% cash back on all other retail spend

20.88% savings at Esso and Shell

Up to S$1,000,000 coverage when you charge your travel tickets to the card

With Citi PayAll, you can earn and accumulate Citi Miles, Citi ThankYou PointsSM or Cash Back quickly when you pay your big-ticket bills such as rent, insurance premiums, education expenses, taxes, utilities and more

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

Not to be confused with the Citi Cash Back+ Card, the Citi Cash Back Card without-a-plus gives you 8% cashback on groceries and petrol and 6% cashback on dining, provided you meet the minimum spending requirement of $800 in a month. Cashback on retail spending is a a meagre 0.25%.

The total amount of cashback you can earn is capped at $80 each month, which means it’s only worth spending $1,200 to $1,440 to earn maximum cashback.

11. DBS Live Fresh Card

Online Promo

Shopping and Transportation

DBS Live Fresh Card

More Details

Key Features

Score up to 6% cashback on your shopping sprees & daily commutes

Up to 6% cashback on Shopping & Transport Spend

0.3% unlimited cashback on All Spend

Enjoy first year annual fee waiver

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

The DBS Live Fresh card’s biggest selling point is its 6% cashback on shopping (online and in-store) and transport spend, capped at $50 and $20 per month respectively. It’s a great choice if you’re big on retail therapy and need a ride to carry home your purchases after.

Is there a catch? Yes. In fact, we can think of 2.

Firstly, the 6% cashback comes with a minimum spend requirement of $800 a month.

Secondly, at the 6% rate, the cashback maxes out at a shopping expenditure of $833 and a transport expenditure of $333. So if you’re thinking of getting the DBS Live Fresh Card for your transport spend only, you may want to reconsider. You’ll need to spend $800 to earn cashback on only $333 of that sum.

On the other hand, the math works out great for the shopping category. Spend $833 a month (just over the $800 minimum requirement) and earn $50 back in cashback.

What happens if you don’t hit the $800 minimum spend? You’ll earn 0.3% on your spending. This is the unlimited cashback rate that DBS allocates to all other spending with the DBS Live Fresh Card.

12. OCBC FRANK Credit Card

Earn up to 10% cashback

OCBC Frank Card

More Details

Key Features

Earn 8% cashback on online/ contactless mobile transactions in SGD

Earn 8% cashback on Foreign Currency transactions

Earn 2% bonus cashback at selected Green Merchants: SimplyGo, BlueSG, Scoop Wholefoods and more.

0.3% cashback on other eligible spends

To enjoy the cashback, you need to spend a minimum of S$800 based on posted transactions in a calendar month

If you spend less than S$800, a flat 0.3% cashback is awarded

Min. annual spend of S$10,000 from date of approval to qualify for automatic annual fee waiver

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

I always thought anyone or anything named Frank sounded like the butt of a joke, but the OCBC Frank Credit Card is actually a very decent cashback card. It offers 8% cashback on foreign spending and all types of local online/contactless mobile spending, whether for clothes shopping, grocery purchases or your Netflix subscription.

The OCBC FRANK Credit Card is also offering higher cashback if you go green. You can enjoy an additional 2% cashback when you shop at selected eco-friendly merchants, such as Scoop Wholefoods, Little Farms, SimplyGo, and BlueSG. That means you’ll earn 10% cashback at these merchants.

The minimum spending requirement is $800 in a month, with a monthly cap of $1oo cashback. To further break down the $100 cap, it’s actually a $25 cap per category among these 4 spend categories:

Foreign spending (8% cashback, capped at $25)

Local online transactions and mobile payment (8% cashback, capped at $25)

Spending at green merchants (additional 2% cashback, capped at $25)

All other spending (0.3% based cashback, capped at $25)

13. POSB Everyday Card

Online Promo

Earn Cash Rebates that Never Expire

POSB Everyday Card

More Details

Key Features

Up to 10% cash rebates on your daily essentials when you dine, shop online or purchase groceries

50% off family attractions and other exclusive deals

Save up to 20.1% on fuel at SPC

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

The POSB Everyday Card doesn’t look very alluring, but it’s good enough for life’s basic needs. There is no minimum spending requirement for you to earn 5% cashback at Sheng Siong. For pet owners, use this card at Pet Lovers Centre for 3% cashback on regular-priced items, provided you hit the $15 minimum purchase amount.

If you drive, it also gets you 20.1% savings at SPC—everyone’s favourite cheap petrol kiosk.

On top of that, if you do spend at least $800 a month, you can unlock rebates of 10% on foodpanda and Deliveroo delivery, 8% on selected online shopping merchants such as Amazon.sg, Lazada, Shopee, RedMart, Popular and iHerb, as well as 3% at Watsons and on dining expenses.

Bottom line: The POSB Everyday Card is a great choice if you have a family. Each up to 10% on food delivery, groceries, school supplies, and general online shopping. You do have to spend $800 a month, but those supporting a little one at home shouldn’t have a problem meeting this spend requirement anyway.

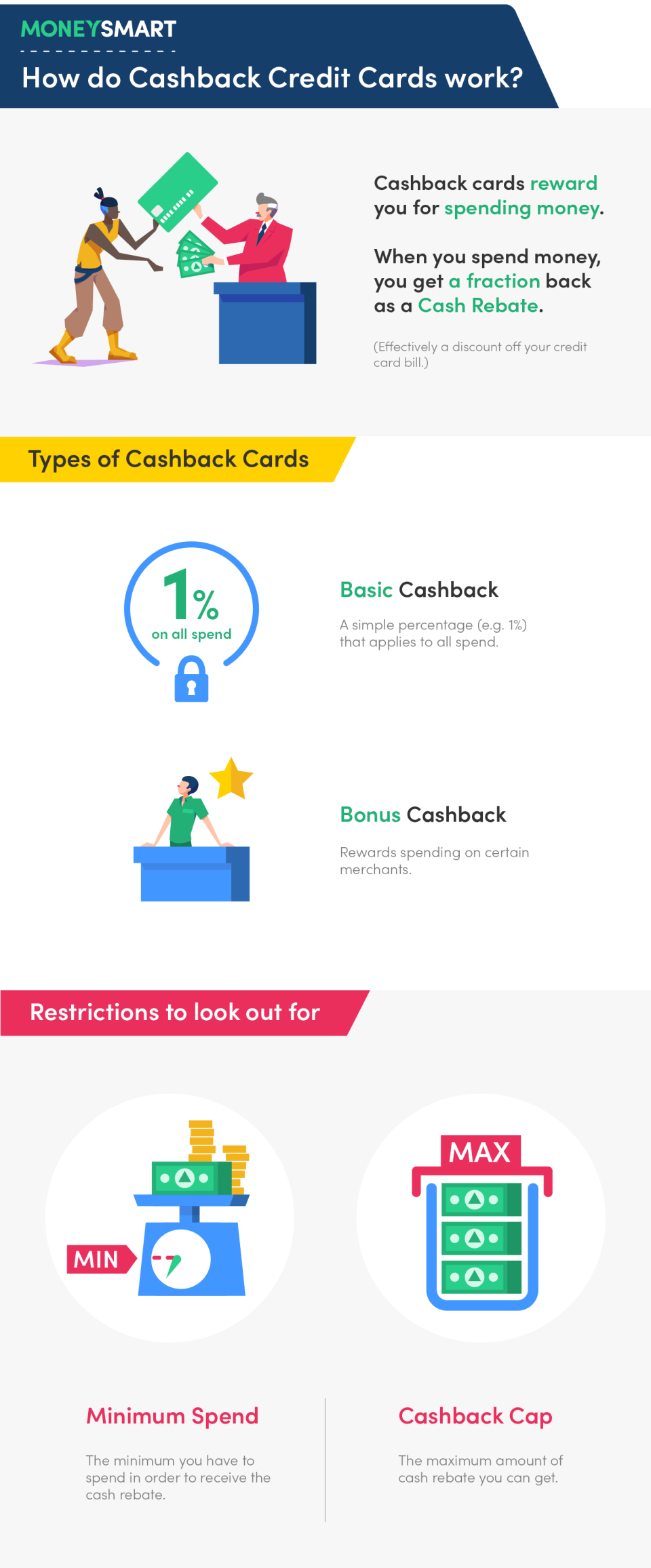

14. How do cashback credit cards work?

Before you get too excited about that hefty bonus cash rebate, remember that banks aren’t charities. They have to impose minimum spend requirements and cashback caps, or else they’ll just bleed money. So don’t get led astray by big fat cashback promises—the important details are usually in the T&Cs.

Here’s how they work:

Want to find out more about the best cash back credit cards in Singapore? Compare and apply on MoneySmart!

We also have a comparison tool for the best cash back credit cards in Hong Kong!

About the author

Vanessa Nah is a personal finance content writer who pens articles on the ins and outs of travel insurance, the T&Cs of credit cards, and the ups and downs of alternative investments. She’s a researcher at heart and leaves no stone unturned when it comes to breaking down complex finance concepts and making them easy to understand for the everyday Singaporean. When Vanessa’s not debunking finance myths, you’ll find her attending dance classes, fingerpicking a guitar, or (most impawtently) fulfilling her life mission to make her one-eyed cat the most spoiled and loved kitty in the world.

The post 12 Best Cashback Credit Cards in Singapore (Jun 2024) appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

The post 12 Best Cashback Credit Cards in Singapore (Jun 2024) appeared first on MoneySmart Blog.

Original article: 12 Best Cashback Credit Cards in Singapore (Jun 2024).

© 2009-2018 Catapult Ventures Pte Ltd. All rights reserved.

Yahoo Finance

Yahoo Finance