100 Things You Didn’t Know About Warren Buffett’s Billion-Dollar Investment Strategy

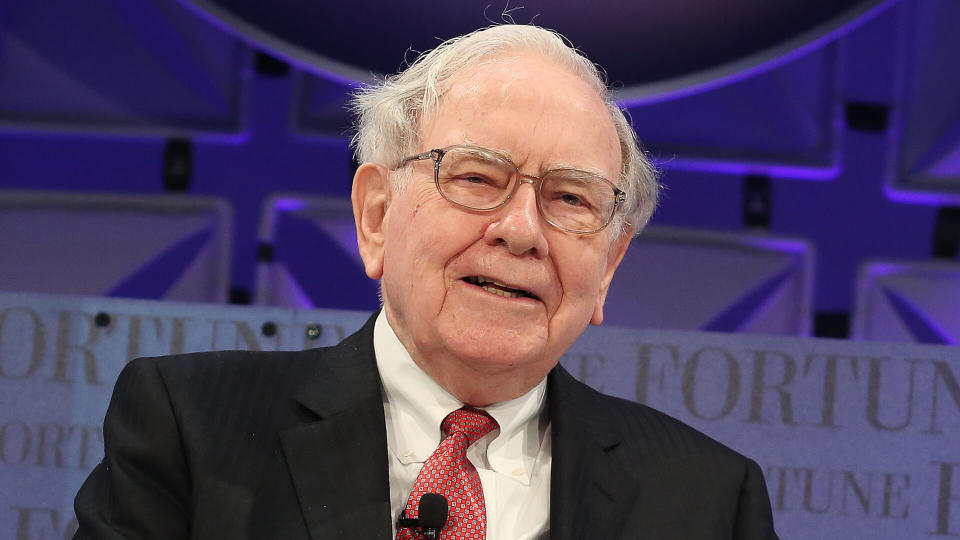

There have been many wise investors over the years who analysts have attempted to study. One investor who has been providing returns for decades is none other than Warren Buffett. The CEO of Berkshire Hathaway was born in 1930, and his net worth is currently estimated at about $118 billion. This makes him the fifth richest man in the world at 92 years old.

Money Expert Jaspreet Singh: Get Rich Through These 3 Investments

See: 3 Things You Must Do When Your Savings Reach $50,000

In order to maybe improve your own investments and bank account, we have gathered 100 things you may not know about Warren Buffett’s billion-dollar investing strategy.

What Are 100 Things You Didn’t Know About Warren Buffett’s Billion-Dollar Investment Strategy?

Here are 100 things you may not know about Warren Buffett’s investing strategy:

1. Rule No. 1 is that you shouldn’t lose money.

We couldn’t write about Buffett without sharing his popular line about not losing money.

2. The second rule is to remember the first rule.

When in doubt, Buffett wants you to remember that the whole point of investing is to make money in the long run and not panic in the short term.

3. Buffett believes in holding stocks for at least 10 years.

Buffett is historically known as an investor who has held on to stocks for decades and doesn’t day trade by any means.

4. Buffett commits to the companies that he invests in.

Buffett will study the company before investing to commit to the long haul.

5. You have to do your due diligence.

Buffett has been known for studying companies for a long time before investing a dollar into them.

6. Never rely on one source of income.

Warren Buffett believes in investing to give yourself another stream of money coming in.

Grant Cardone Says Passive Income Is the Key To Building Wealth: Here’s His No. 1 Way To Get It

7. Value investing is the way to go.

Instead of investing in already established companies, Buffett looks for undervalued companies with long-term potential.

8. Buffett avoids fads and trends.

You won’t see him discussing the recent trends that take over the market.

9. Buffett only invests in what he understands.

Buffett wants to understand the business before he invests in the company.

10. Frugality is the way to go for Buffett.

Buffett is known for living in the same home he purchased in 1958.

11. The best investment is in yourself.

Buffett has been known to promote the idea of investing in yourself because this can’t be taxed.

12. Buffett doesn’t invest in stocks.

While many invest in stocks, this isn’t how Buffett sees it.

13 Instead, he invests in the business.

Buffett will invest in the business, the management team and the company.

14. Buffett takes pride in his research.

While some investors follow the news and headlines, Buffett does extensive research.

15. Day trading isn’t a strategy.

Buffett doesn’t believe in trying to time the market.

16. The management team is very important.

Buffett will analyze the management team of the company that he invests in.

17. Apple is Berkshire’s best business.

Berkshire has invested heavily in Apple and stated that this is the best business it has invested in.

18. Buffett believes that Apple is a consumer products company, not a tech company.

Buffett is a believer in the products that Apple makes.

19. Buffett’s bet on Apple has paid off tremendously.

Berkshire Hathaway purchased about 916 million shares of Apple for $31 billion, which skyrocketed to $180 billion this summer.

20. Buffett sees volatility as an opportunity to buy more stocks at a lower price.

Buffett isn’t afraid of price fluctuations, as they’re to be expected.

21. Buffett doesn’t invest in cryptocurrency.

Buffett is one investor who has never been interested in investing in crypto.

22. Buffett doesn’t invest in NFTs.

Buffett has also never invested in NFT projects.

23. Buffett wouldn’t spend $25 on all of the Bitcoin in the world.

This is how adamant he is against crypto.

24. Buffett doesn’t believe that Bitcoin produces anything.

He doesn’t see any value at all in the crypto.

25. Buffett owns 218,237 Class A shares of Berkshire Hathaway.

Buffett is heavily invested in his own company.

26. Berkshire Hathaway was started in Omaha, Nebraska, in 1965.

This is how long he has been at it.

27. When the market panics and sells, Buffett looks for opportunities in companies he has been tracking.

Buffett doesn’t react like the rest of the market.

28. Buffett has famously said that you should be fearful when others are greedy.

He doesn’t get greedy when he sees others doing so.

29. Conversely, Buffett believes you should be greedy when others are fearful.

It’s important to be curious when others are worried about investing.

30. Before investing in a company, he will read as many annual reports as possible.

These annual reports will show how the business is performing.

31. Buffett once remarked that you should invest in a business that even a fool can run.

It’s important for Buffett for the actual business to make sense.

32. Buffett has stated that 99% of his net worth will be donated to charity.

He’s heavily involved in donating to charities.

33. Buffett recently donated $27 million worth of Berkshire Hathaway stock to an undisclosed charity.

This is how dedicated he is to giving away his money.

34. Buffett has donated over $51 billion to the Bill & Melinda Gates Foundation since 2006.

This is how much money he has donated to them and he plans on giving most of his money away.

35. Buffett believes people would relinquish their second car before parting ways with an iPhone.

He feels strongly about the Apple product.

36. Buffett feels he knows where Apple will be in five to 10 years.

He’s so invested in the company because he knows where it’s going.

37. Buffett isn’t certain about what the future of the auto industry is.

He’s not so certain about what will happen with vehicles.

38. Berkshire owns 22 million shares of General Motors stock after cutting its position by 45% in 2023.

He’s moving toward exiting his positions in the auto industry.

39. Buffett believes that diversification is for those who don’t know what they’re doing.

While some swear by diversification, Buffett has a few stocks he heavily invests in.

40. Seventy-eight percent of Berkshire’s portfolio is invested in six popular companies.

Buffett doesn’t day trade as he researches the best companies to invest in.

41. The six stocks with the most weight in the investment portfolio are Apple, Bank of America, American Express, Coca-Cola, Chevron and Occidental Petroleum.

Buffett has invested heavily in these conglomerates.

41. Buffett invests in brand name companies because they’re established in the market.

Buffett will go for the trusted names in the market.

42. Buffett invested in Capital One Financial during the second quarter of 2023 as banks faced multiple issues.

Buffett wasn’t afraid of investing in banking.

43. Buffett also recently invested in the housing industry by purchasing shares of homebuilders like NVR and Lennar.

He has given the housing market a vote of confidence.

44. Buffett sold recently sold shares of Activision Blizzard after the deal with the company to be sold to Microsoft was approved.

This was a highly publicized exit of his in recent times.

45. Buffett repurchased around $1.4 billion of Berkshire stock in the second quarter.

He has been a believer in share buybacks.

46. Buffett has been repurchasing shares as a sign that he believes they’re undervalued.

Buffett feels that the shares are undervalued.

47. Buffett’s investment moves are closely monitored, so you can read reports online if you wish to mimic his style.

You could also make similar investments.

48. Buffett wants you to pay attention to fees.

Management fees are important to pay attention to.

49. Buffett advises against picking one stock and investing in the best companies with an index fund.

If you don’t have time, this is the best way to invest for your retirement.

50. Buffett isn’t a fan of high management fees.

He doesn’t feel that they’re justified because you can get better results.

51. Buffett doesn’t see management fees as being worth it.

He believes that you could invest this money instead of spending it on fees.

52. He wants you to start investing as young as possible.

He has stated that you should start investing as early as possible.

53. Buffett doesn’t let others’ opinions dissuade him.

You have to do your own research and drown out the noise.

54. Buffett wants you to be confident about your investments.

You shouldn’t invest if you don’t believe in the company.

55. Buffett believes in a long-term view.

When you do invest, it’s for the long run.

56. Buffett advises against using credit cards.

Buffett once stated that credit cards should be avoided because borrowing money at 20% is an easy way to go broke.

57. He believes in leaving cash on hand.

He wants you to hold on to some cash just in case.

58. He wants you to learn about personal finance and managing money actively.

Buffett is a firm believer in learning the basics of money management.

59. Buffett believes in acting quickly and decisively when you see an opportunity.

When you’ve done your research, you have to be ready to jump at an opportunity.

60. Buffett doesn’t just invest in companies through Berkshire as it also purchases companies fully.

Berkshire owns many companies.

61. Buffett selects CEOs to run the companies that he purchases.

Buffett has a hand in choosing who will run the business.

62. In 1994, Berkshire officially purchased 400 million shares of Coca-Cola with a total cost of $1.3 billion.

This investment has grown tremendously over the years.

63. The cash dividend from Coca-Cola was $75 million back in 1994.

The dividend payments started back in 1994.

64. The cash dividend from Coca-Cola was $704 million by 2022.

While the dividend wasn’t that high in 1994, it has grown since.

64. Buffett expects that Coke’s quarterly dividend payment will likely continue to grow.

The company will only keep on sending more dividends.

65. Berkshire’s annual dividend payment from America Express reached $302 million in 2022.

The company collects various dividend payouts.

66. Buffett has stated that it only takes a few winning investments to work wonders to look like an amazing investor.

Buffett isn’t always right, but he has big winners.

67. Buffett has promised that Berkshire will hold on to “boatloads” of cash and Treasury bills.

The company will always keep cash on hand.

68. Buffett believes that the CEO of Berkshire should also be the chief risk officer.

Buffett wants the person running the company to be responsible for the risk levels.

69. Buffett believes that all future CEOs of Berkshire should have a hefty amount of their net worth tied into the company.

Buffett wants to work with people who are accountable for their actions.

70. Buffett isn’t against taxes. He has stated that he hopes and expects Berkshire to pay more taxes in the future.

Buffett believes in supporting the economy with taxes.

71. Buffett feels temperament is more important than intellect as an investor.

You don’t have to be the smartest person to be a decent investor with substantial returns.

72. Buffett considers stock market investing a “no-called-strike game.”

You don’t have to swing if you’re not ready.

73. He considers picking individual stocks as working against the professionals who have more time to devote to this.

You’re better off finding index funds if you’re an individual investor.

74. Buffett realizes that you don’t get paid for activity.

Just because you actively trade stocks, it doesn’t mean you’ll make money.

75. Buffett believes that your portfolio should be designed to survive a bear market.

Your portfolio shouldn’t be filled with speculative assets.

76. Buffett stated that many Berkshire investors donate money through philanthropic ventures.

This is one common trait of those who invest in the company.

77. Buffett has declared that stocks can trade at foolish prices (in both directions).

Stock prices won’t always make sense.

78. Buffett believes that “efficient” markets are only in textbooks.

The stock market won’t always make sense as a whole.

79. Buffett understands that you can buy a company’s shares on sale but that you have to pay the price actually to buy a decent business.

When he buys an actual business, he doesn’t look for discounts because he understands that only a desperate company would do that.

80. Buffett may be one of the richest men in the world, but he has often had a simple Mcdonald’s breakfast to start his day.

You don’t have to spend a fortune on fueling your body.

81. He has never purchased an expensive vehicle and will keep one until the end.

He’s not known for spending money on luxurious vehicles ever.

82. He enjoys playing bridge and doesn’t have any expensive hobbies like other rich people.

Buffett enjoys simple hobbies like playing bridge with his friends.

83. Buffett had a flip phone long after most were using an iPhone.

You don’t have to spend your money on the newest technology and gadgets.

84. He doesn’t splurge on fancy suits but spends the money on quality fits.

You’ll never see Buffett with a brand-name suit.

85. Buffett once used a coupon while eating dinner with Bill Gates.

Even when spending time with other wealthy friends, Buffett will use a coupon.

86. Berkshire has been in the same building since the 1960s.

Even though the company has grown, it has remained in the same building.

87. Buffett believes that once a saver, always a saver.

He doesn’t believe that savers end up splurging in their golden years.

88. Buffett doesn’t splurge even in his golden years.

Even now that he’s pushing 93, Buffett remains frugal with his money.

89. Buffett passed on investing in Tesla back in 2008.

Buffett could’ve gotten involved with Tesla at the very bottom.

90. Since Buffett only invests in profitable companies, he doesn’t take chances on startups.

You won’t see Buffett investing in startups or risky companies.

91. Buffett chose to invest in BYD, the Chinese EV maker, back in 2008.

Buffett did take a chance on the EV market in 2008.

92. Buffett doesn’t want to compete with Tesla and has divested from BYD recently.

Buffett isn’t looking to compete with Elon Musk or Tesla.

93. Buffett isn’t a fan of the auto industry with the recent transition toward electric and greener sources.

Buffett isn’t sure what will happen to the auto industry.

94. Buffett’s Berkshire is often considered the barometer for the economic health of the nation.

The conglomerate is so powerful that it’s a barometer for economic health in the country.

95. Buffett has stated that nothing is sure regarding business or economic forecasts.

He doesn’t consider anything a guarantee when it comes to the economy.

96. Buffett has been investing his money for over 80 years now.

Part of his success is attributed to his time in the market.

97. When Buffett first started Berkshire, the company only invested in one textile business, which was failing. Berkshire shifted to insurance in 1967.

The investing journey for Buffett had humble beginnings.

98. Buffett has stated that living into your 90s helps with your investment horizon.

Buffett jokingly has brought up how living so long has helped out his investing career.

99. When in doubt, invest in a low-cost index fund.

If you want to save for retirement, allocate your money to index funds.

100. He once referred to Bitcoin as a “gambling token.”

This last one summarizes the investing philosophy of Warren Buffett, who believes in finding strong companies at a fair price point.

Closing Thoughts

Warren Buffett can be considered one of the greatest stock investors ever. While you likely can’t apply all of these rules to your investing style, there’s something that you can pick up from him.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: 100 Things You Didn’t Know About Warren Buffett’s Billion-Dollar Investment Strategy

Yahoo Finance

Yahoo Finance