Do Boston Beer's (SAM) Strategies Position It Well Among Peers?

The Boston Beer Company Inc. SAM is positioned to benefit from its strong portfolio of globally recognized brands, the progress of its Beyond Beer strategy, the premiumization of the beer industry and robust trends for its twisted tea brand. Additionally, we expect Boston Beer’s continued focus on pricing, product innovation, and growth of non-beer categories alongside brand development to boost its operational performance and position in the market.

Benefits from these were well demonstrated in the company’s first-quarter 2024 results. The company reported top and bottom-line beat, along with year-over-year growth in the reported quarter. Results benefited from improved volumes, favorable pricing, recovery in shipments and depletions, and a robust margin performance.

However, weak depletions, along with continued challenges in the hard seltzer category, acted as deterrents. The slowed consumer demand for hard seltzers has been hurting the company’s performance, with marked declines noted for the Truly brand in recent quarters.

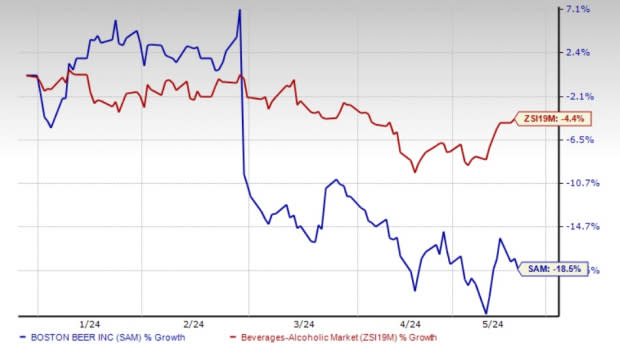

Consequently, shares of the Zacks Rank #3 (Hold) company have lost 18.5% in the year-to-date period compared with the industry’s decline of 4.4%.

Image Source: Zacks Investment Research

Strategies in Focus

Boston Beer is the largest premium craft brewer in the United States and commands a strong portfolio of globally recognized brands. The company is on track with growth of its Beyond Beer category. Beyond Beer is growing faster than the traditional beer market, and SAM expects this trend to continue for the next few years.

Boston Beer’s innovation, intensified attention to pricing and product portfolio expansion efforts bode well. The company has been benefiting from strong price realization and procurement savings, which more than offset increased inflationary costs. The gross profit margin expanded 570 basis points (bps) in first-quarter 2024. Moreover, the company estimates a price increase of 1-2% and anticipates a gross margin of 43-45% for 2024.

Although the Truly brand has witnessed a downside in recent quarters due to the slowdown in the hard seltzer category, Boston Beer is keen on bringing new excitement to the brand’s core flavors through innovation. The company expects to improve Truly brand trends through a renewed focus on core business, smart brand innovation, and strong distributor support and retail execution. Regarding revisiting the core flavors, the company announced the reformulation and improvement of core Truly flavors, including the addition of real fruit juice for an even smoother, easy-to-drink and refreshing taste.

Additionally, Twisted Tea is one of the fastest-growing brands in the industry. The brand is particularly benefiting from physical availability, improved geographic, channel and package distribution, as well as effective brand-building campaigns, increased media investment and optimized packaging design. The company’s Twisted Tea brand continued to perform well in the first quarter, with dollar sales growth of 21% in the measured channels.

What Hinders Growth?

Boston Beer’s first-quarter 2024 results reflected continued softness in depletions and challenges in the hard seltzer category. The hard seltzer category’s decelerating trend has mainly been attributed to the loss of novelty among consumers due to the entry of several beyond beer products in the marketplace. The decline has also resulted from the ongoing dismal macroeconomic environment, which has caused a volume shift from hard seltzers back to premium light beers due to their lower pricing. The slowed hard seltzer sales continued to impact the company’s Truly hard seltzer performance.

In 2024, the hard-seltzer category is likely to remain under pressure and management anticipates category volume declines in the low teens. Depletions and shipments are expected between a low-single-digit decline and a low-single-digit increase in 2024.

Key Picks

We have highlighted three better-ranked stocks from the Consumer Staple sector, namely Vita Coco Company COCO, PepsiCo Inc. PEP and The J. M. Smucker Co. SJM.

Vita Coco, which develops, markets and distributes coconut water products in the United States, Canada, Europe, the Middle East and the Asia Pacific, currently sports a Zacks Rank #1 (Strong Buy). It has a trailing four-quarter earnings surprise of 25.3%, on average. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for COCO’s current financial-year sales and earnings indicates growth of 3.5% and 37.8%, respectively, from the year-earlier reported figures. The consensus mark for COCO’s EPS has moved up 7.4% in the past 30 days.

PepsiCo, one of the leading global food and beverage companies, currently carries a Zacks Rank of 2 (Buy). PEP has a trailing four-quarter earnings surprise of 5.1%, on average.

The Zacks Consensus Estimate for PepsiCo’s current financial year’s sales and EPS indicates growth of 3.4% and 7.1%, respectively, from the year-ago reported figures. The consensus mark for PEP’s EPS has moved up by a penny in the past 30 days.

The J. M. Smucker, a leading marketer and manufacturer of consumer food and beverage products, and pet food and pet snacks in North America, currently carries a Zacks Rank #2. SJM has a trailing four-quarter earnings surprise of 7.5%, on average.

The Zacks Consensus Estimate for The J. M. Smucker’s current financial-year EPS indicates growth of 7.6% from the year-ago reported number. The consensus mark for SJM’s EPS has been unchanged in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Vita Coco Company, Inc. (COCO) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

The Boston Beer Company, Inc. (SAM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance