Best Credit Card Promotions in Singapore (May – Jul 2024): Citibank, DBS, HSBC, UOB, and More

This May, we’re giving away Apple iPads (9th Gen), S$450 Lendlease E-Vouchers, up to 85,000 miles…and the list goes on.

Clearly, we’re spoilt for choice when it comes to credit card promotions these days. Lucky for you, banks offering credit cards in Singapore are competing so hard for new customers that they are practically raining Apple products, Nintendo Switches, ergonomic chairs, and other freebies on us. Some welcome gifts are just straight up cold, hard cash!

But which are the best credit card promotions in Singapore? Here are our top picks from Citibank, Standard Chartered, UOB, DBS, and more.

Best Credit Card Promotions in Singapore (May 2024)

An overview: Best credit card promotions in Singapore (May 2024)

This month, credit card promotions are plying you with gifts such as Apple iPads, a Nintendo Switch OLED, Hinomi Q1 Ergonomic Chairs, and more. Here’s a summary:

Credit card | Credit card promotion | Minimum spend | Promotion valid until |

Citi Cash Back+ Mastercard, Citi Cash Back Card, Citi Rewards Card ★ | Your choice of gift: | $500 (within 30 days) | 20 May 2024 |

Your choice of gift: | |||

(1) Tier 1 gifts: | (1) $500 (within 30 days) | 31 May 2024 | |

(1) $100 Cash via PayNow or S$180 eCapita Vouchers | (1) $200 (within 30 days) | 31 May 2024 | |

Up to 45,000 miles (with payment of annual fee) or 25,000 miles (annual fee waived) | $3,000 spend within 60 days. | 30 Jun 2024 | |

$188 cashback | $988 spend within 60 days | 31 Jul 2024 | |

Get S$200 eCapitaVouchers or Samsonite Choca Spinner 68/25 (worth S$700) on top of 135,000 Membership Rewards points (enough for a return trip to USA West Coast) | $6,000 minimum spend and annual fee payment within 60 days | 29 May 2024 | |

American Express Singapore Airlines KrisFlyer Ascend Credit Card | $300 eCapitaVouchers ($150 eCapitaVouchers for existing cardholders) and up to 17,000 KrisFlyer miles | $1,000 spend and annual fee payment within 30 days | 29 May 2024 |

Up to 17,000 KrisFlyer miles | $500 spend within 30 days | 29 May 2024 | |

$400 eCapitaVouchers (up to 58,750 Membership Rewards® points for existing cardholders) + 1,250 Membership Rewards points | $1,000 spend and annual fee payment within 30 days. | 29 May 2024 | |

$130 Cash via PayNow | $500 spend within 30 days | 31 May 2024 | |

The American Express Singapore Airlines Business Credit Card | Up to 30,000 HighFlyer points (worth $285) | $3,000 spend and annual fee payment within 3 months | 31 Jul 2024 |

$350 cash credit (first 200 new-to-UOB customers) | $1,000 spend/month for 2 consecutive months | 31 May 2024 | |

UOB Absolute Cashback Card ☆ | 10% cashback (equivalent to $100) on the first $1,000 spend within 30 days and $350 Cash Credit | $1,000 spend/month for 2 consecutive months | 31 May 2024 |

UOB PRVI Miles Credit Card (MASTERCARD / VISA / American Express) ☆ | Up to 50,000 Welcome Miles | $1,000 spend/month for 2 months, annual fee payment, and SMS registration | 31 May 2024 |

Up to 31,000 miles and first year annual fee waived | $2,000 spend within 60 days | 31 May 2024 | |

3,950 SmartPoints* or S$150 Cash via PayNow | $500 spend from Card Account Opening Date to end of the following month. | 31 May 2024 | |

DBS yuu Card (Visa / American Express) | $388 cashback (new cardmembers) | $800 spend within 60 days. | 31 May 2024 |

DBS Altitude Card (Visa Signature) | Up to 53,000 miles | $3,000 spend and payment of annual fee within 60 days | 19 May 2024 |

DBS Altitude Card (American Express) | Up to 60,000 miles | 31 May 2024 | |

Up to 85,000 miles (new cardmembers) / 40,000 miles (existing cardmembers) | $4,000 spend and payment of annual fee within 30 days | 31 May 2024 | |

$388 cashback | $800 spend within 60 days | 31 May 2024 |

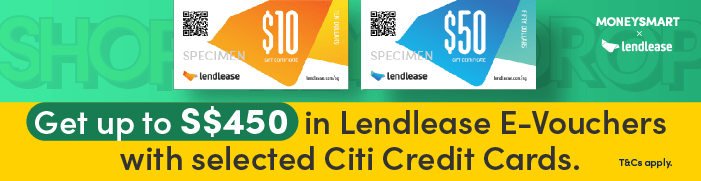

1. Citibank credit card promotion

Looking to sign up for a new Citibank credit card? Well, you’re in luck! This month, Citibank credit card welcome gifts include:

Apple iPad (9th Gen), 64GB (worth S$508.30)

Apple Watch SE (GPS) 40mm + S$80 Cash (worth S$462.50)

S$420 Lendlease E-Vouchers (can be used at 313@somerset, Jem, Parkway Parade, PLQ)

Prefer cold, hard cash? You can also simply opt to receive $300 cash.

All you need to do is sign up for one of the following Citibank credit cards via MoneySmart and spend $500 within 30 days. Once you fulfil the minimum spend criteria, these gifts will be coming to you on the express train—receive your sign-up gift in as fast as 6 weeks!

There are 4 Citibank credit cards on promotion. Our top pick is the Citi Cash Back+ Mastercard, an unlimited cashback card with no monthly minimum spend.

Sponsored

MoneySmart Exclusive

Faster Gift Redemption | Unlimited 1.6% Cashback

Citi Cash Back+ Mastercard®

MoneySmart Exclusive:

[FASTER GIFT FULFILMENT]

Get an Apple iPad (9th Gen), 64GB (worth S$508.30) or a Sony WH-1000XM5 Wireless Noise Cancelling Headphones (worth S$589) or S$420 Lendlease E-Vouchers (can be used at 313@somerset, Jem, Parkway Parade, PLQ) or S$300 Cash via PayNow, in as fast as 6 weeks from meeting the S$500 spend criteria! T&Cs apply.

Valid until 31 May 2024

More Details

Key Features

1.6% cashback on your spend

No minimum spend required and no cap on cash back earned

Cash back earned does not expire

Redeem your cash back instantly on-the-go with Pay with Points or for cash rebate via SMS

With Citi PayAll, you can earn and accumulate Citi Miles, Citi ThankYou PointsSM or Cash Back quickly when you pay your big-ticket bills such as rent, insurance premiums, education expenses, taxes, utilities and more

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

Annual Interest Rate and Fees

Annual Interest Rate |

|---|

S$196.20 |

S$98.10 |

First year annual fee waived |

1% of the current balance plus 1% of any outstanding unbilled instalment amounts plus interest charges plus late payment charge or S$50, whichever is greater |

25 days |

Minimum Income Requirements

Singaporean/PR Minimum Income |

|---|

S$42,000 |

Documents Required

SG Citizens or PRs |

|---|

6 months |

6 months |

With Full Name and Address |

Wireless Payment

MasterCard PayPass |

|---|

Card Association

If you’d prefer a miles card, the Citi PremierMiles Card lets you earn Citi Miles that never expire.

MoneySmart Exclusive

Faster Gift Redemption | Earn 2 Miles per S$1

Citi PremierMiles Card

MoneySmart Exclusive:

[FASTER GIFT FULFILMENT]

Get an Apple iPad (9th Gen), 64GB (worth S$508.30) or a Nintendo Switch OLED + S$60 Cash (worth S$609) or S$450 Lendlease E-Vouchers (can be used at 313@somerset, Jem, Parkway Parade, PLQ) or S$300 Cash via PayNow, in as fast as 6 weeks from meeting the S$500 spend criteria! T&Cs apply.

Valid until 31 May 2024

More Details

Key Features

S$1 = 1.2 Citi Miles on Local spend (no min. spend)

S$1 = 2 Citi Miles on Foreign currency spend

Earn 10,000 Citi Miles upon renewal of annual membership and payment of annual fee

Citi Miles never expire

Principal Cardholder gets to enjoy 2 complimentary visits every year to over 1,300 airport lounges worldwide.

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

Annual Interest Rate and Fees

Annual Interest Rate |

|---|

S$196.20 |

S$98.10 |

1% plus 1% of any outstanding unbilled instalment amounts plus interest charges plus late payment charge or S$50, whichever is higher |

25 days |

Minimum Income Requirements

Singaporean/PR Minimum Income |

|---|

S$42,000 |

Documents Required

SG Citizens or PRs |

|---|

6 months |

6 months |

With Full Name and Address |

Wireless Payment

MasterCard PayPass |

|---|

Card Association

Here’s a summary of all the Citibank credit cards with ongoing promotions:

Citibank credit card | Key features | Promotion | Valid until |

1.6% cashback that never expires. No minimum spend required and no cap on cash back. | Get an Apple iPad (9th Gen), 64GB (worth S$508.30) or an Apple Watch SE (GPS) 40mm + S$80 Cash (worth S$462.50) or S$420 Lendlease E-Vouchers (can be used at 313@somerset, Jem, Parkway Parade, PLQ) or S$300 Cash via PayNow in as fast as 6 weeks! | 20 May 2024 | |

6% cashback on dining, 8% cashback on groceries and petrol. | |||

10X Rewards on online purchases, ride-hailing and shopping. | |||

$1 = 1.2 Citi Miles on Local spend and 2 Citi Miles on Foreign currency spend. Citi Miles never expire. | Get an Apple iPad (9th Gen), 64GB (worth S$508.30) or a Nintendo Switch OLED + S$60 Cash (worth S$609) or S$450 Lendlease E-Vouchers (can be used at 313@somerset, Jem, Parkway Parade, PLQ) or S$300 Cash via PayNow in as fast as 6 weeks! |

The Citibank SMRT Card does not have any ongoing promotions, but it’s a great choice for cashback on groceries, online shopping, and SimplyGo transactions.

2. Standard Chartered credit card promotions

There are a few Standard Chartered credit card promotions ongoing this month that are all very enticing. It’s hard to pick the best, but the Standard Chartered Simply Cash Credit Card promotion comes up top in terms of cash value. This card is an unlimited cashback card with no cashback cap and no minimum spend.

MoneySmart Exclusive

1.5% UNLIMITED CASHBACK

Standard Chartered Simply Cash Credit Card

MoneySmart Exclusive:

Get attractive gifts like a Nintendo Switch OLED (worth S$549) or a Hinomi Q1 Ergonomic Chair (worth S$499) or a Apple Watch SE (worth S$382.50) or a Sony WF-1000XM5 Wireless Headphones (worth S$429) or up to S$370 Cash via PayNow* when you apply and meet the relevant spend criteria! T&Cs apply.

Valid until 31 May 2024

More Details

Key Features

Flat 1.5% cashback rate for all eligible purchases

No cashback cap and no minimum spend

Enjoy dining and shopping discount privileges at over 3,000 outlets in Asia with Standard Chartered’s The Good Life Program

1 year annual fee waiver, no minimum spend required

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

Annual Interest Rate and Fees

Annual Interest Rate |

|---|

S$196.20 |

S$0 |

First 1 year waived |

S$50 OR 1% of principal / interest, fees & charges / overlimit amount / past due amount, whichever is higher |

Available |

Minimum Income Requirements

Singaporean/PR Minimum Income |

|---|

S$60,000 |

Wireless Payment

Visa Contactless |

|---|

Card Association

This month, upgrade your tech with Sony LinkBuds S Earbuds (worth S$309) or a Lenovo Tab M10 Gen 3 (worth S$299.01) when you apply for the Standard Chartered Smart Credit Card or Standard Chartered Rewards+ Credit Card.

MoneySmart Exclusive

Earn up to 10X Rewards Points

Standard Chartered Rewards+ Credit Card

MoneySmart Exclusive:

Get a Sony LinkBuds S Earbuds (worth S$309) or S$180 eCapita Vouchers or up to S$230 Cash via PayNow when you apply and meet the relevant spend criteria! T&Cs apply.

Valid until 31 May 2024

More Details

Key Features

10X Rewards Points per S$1 spent in foreign currency, including online spends

5X Rewards Points per S$1 spent in Singapore Dollars for local dining transactions

1X Rewards Points per S$1 on all other spends

1 year annual fee waiver, no minimum spend required

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

MoneySmart Exclusive

Up to 6% Cashback

Standard Chartered Smart Credit Card

MoneySmart Exclusive:

Get a Sony LinkBuds S Earbuds (worth S$309) or S$180 eCapita Vouchers or up to S$230 Cash via PayNow when you apply and meet the relevant spend criteria! T&Cs apply.

Valid until 31 May 2024

More Details

Key Features

6%* cashback on your everyday spend at your favourite merchants across fast food dining, coffee and toast, digital subscriptions and on your daily commute (Bus/MRT). No minimum spend requirement. *T&Cs apply.

No Annual Fees ever

3-month interest-free instalments with no service fees

Enjoy dining and shopping discount privileges at over 3,000 outlets in Asia with Standard Chartered’s The Good Life Program

Complimentary travel medical insurance - Have a peace of mind when you travel with complimentary travel insurance coverage of up to S$500,000. Simply charge your full travel fare to your card before you go abroad. Terms and conditions apply.

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

Here’s a summary of all Standard Chartered credit card promotions this month:

Standard Chartered credit card | Key features | Promotion | Valid until |

1.5% unlimited cashback with no minimum spend | TIER 1: Spend $500 with 30 days of card approval to get a Tier 1 gift: | 31 May 2024 | |

6% cashback on digital subscriptions, at fast food outlets and daily commutes | TIER 1: Get $100 Cash via PayNow or S$180 eCapita Vouchers when you spend $200 with 30 days of card approval. | 31 May 2024 | |

10X Rewards Points per S$1 spent in foreign currency, 5X Rewards Points per S$1 local dining spend | |||

3 miles per S$1 spent on online Transportation, Food Delivery & Online Grocery transactions | Up to 45,000 miles with payment of annual fee and $3,000 spend within 60 days. | 30 Jun 2024 |

The other Standard Chartered credit cards don’t have ongoing sign-up promotions this month. Wondering what happened to the Standard Chartered X Card, with its infamous 100,00 miles sign-up promotion? The X card got X-ed, and has been replaced by the Standard Chartered Journey Credit Card.

3. CIMB credit card promotion

There are 3 credit cards with an ongoing promotion to get $188 cashback for those new to CIMB credit cards.

The most accessible CIMB credit card is the CIMB World Mastercard, which has a $0 minimum spend per month. Note, however, that you’ll need to hit $1,00 a month to enjoy the card’s higher 2% unlimited cashback rate.

Online Promo

Unlimited 2% Cashback

CIMB World Mastercard

More Details

Key Features

2% Unlimited Cashback on Wine & Dine, Online Food Delivery, Movies & Digital Entertainment, Taxi & Automobile, Luxury Goods.

1%* Cashback on all other spends.

Access to Over 1,000 Airport Lounges via Mastercard® Airport Experiences Provided by LoungeKey

50% Off Green Fees at golf courses across the region

No annual fees for life

Apply for up to 4 supplementary cards and have annual fees waived for all supplementary cards

Access to over 1,000 regional deals & discounts across Singapore, Malaysia and Indonesia

Annual Interest Rate and Fees

Annual Interest Rate |

|---|

S$0 |

Free |

Available |

3% or S$50, whichever is higher |

23 days |

Minimum Income Requirements

Wireless Payment

Card Association

Here are all the CIMB credit card promotions:

CIMB credit card | Key feature(s) | Promotion | Valid until |

2% unlimited cashback on Wine & Dine, Online Food Delivery, Movies & Digital Entertainment, Taxi & Automobile, Luxury Goods. No annual fees for life. | Up to $188 cashback with $988 spend within 60 days. | 31 Jul 2024 | |

10% cashback on Beauty & Wellness, Online Shopping, Groceries and more, capped at S$100 per month and up to S$20 per category. Minimum spend S$800. | |||

2% unlimited cashback on Travel, Overseas, Online Spend in Foreign Currencies with $2,000 minimum monthly spend. |

4. UOB credit card promotions

This month, UOB is full of credit card promotions. Currently, there are 2 main types of UOB credit card promotions—cash credit or welcome miles.

One of the most accessible UOB credit cards is the $0 minimum spend UOB Absolute Cashback Card, which will get you $350 Cash Credit this month. Plus, get a whopping 10% cashback on transactions you charge in the first 2 calendar months.

MoneySmart Exclusive

UOB Absolute Cashback Card

More Details

Key Features

1.7% limitless cashback on everything, including groceries, insurance, school fees, wallet top-ups, healthcare, Utilities & Telco Bills and Rental

No minimum spend

No minimum spend

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

Annual Interest Rate and Fees

Annual Interest Rate |

|---|

S$196.20 |

1st supplementary card free; $98.10 for subsequent cards |

1st year fee waiver |

3% or S$50, whichever is higher |

21 days |

Minimum Income Requirements

Singaporean/PR Minimum Income |

|---|

S$40,000 |

Documents Required

SG Citizens or PRs |

|---|

At least 6 months' validity |

EP or S Pass only with at least 6 months’ validity |

Latest Billing Proof |

N/A |

Yes |

Card Association

With a 50,000 miles bonus, the UOB PRVI Miles Card offers one of the biggest miles promotion this month:

MoneySmart Exclusive

UOB PRVI MASTERCARD Miles Card

More Details

Key Features

Earn 1.4 miles per S$1 local spend (UNI$3.5 per S$5 spend)

Earn 2.4 miles per S$1 overseas spend (UNI$6 per S$5 spend) including online shopping on overseas websites

Earn 6 miles per $1 spend (UNI$15 per S$5 spend) on major airlines and hotels booked through Expedia and Agoda via UOB PRVI Miles website

Earn 1.4 miles per S$1 spend (UNI$3.5 per S$5 spend) on bus and train rides

No minimum spend and no cap on earned miles

Complimentary Public Conveyance Personal Accident cover of S$500,000 and up to S$50,000 Emergency Medical Evacuation & Repatriation including illness due to COVID-19. T&Cs apply.

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

Here’s a summary of all ongoing UOB credit card promotions this month. Plus, when you apply for the UOB credit cards below and meet the spend criteria, you’ll stand a chance to win a Nintendo Switch OLED (worth S$549)!

UOB credit card | Key features | Promotion | Valid until |

Up to 15% rebate on Shopee, Dairy Farm Group, Grab, SP. | Get $350 Cash Credit from UOB with S$1,000 per month for 2 consecutive months (first 200 new-to-UOB customers) | 31 May 2024 | |

8% cashback on Online and Mobile Contactless spend with | |||

S$5 = 10X UNI$ (or 20 miles) in your preferred category with no min. spend required. | |||

UOB Absolute Cashback Card | 1.7% limitless cashback with no minimum spend | 10% cashback (equivalent to $100) for the first 2 calendar months and $350 Cash Credit from UOB with S$1,000 spend per month for 2 consecutive months (first 200 new-to-UOB customers) | 31 May 2024 |

UOB PRVI Miles Credit Card (MASTERCARD / VISA / American Express) | $1 local spend = 1.4 miles; $1 overseas spend = 2.4 miles. No minimum spend and no cap on earned miles. | Up to 50,000 miles with $1,000 spend/month for 2 months, annual fee payment, and SMS registration. | 31 May 2024 |

$1 = 3 KrisFlyer Miles (with $800 annual spend on Singapore Airlines Group) | Up to 31,000 miles and first year annual fee waived with $2,000 spend within 60 days. | 31 May 2024 |

At the time of writing, the UOB Preferred Platinum Visa Card and UOB Visa Infinite Metal Card have no ongoing promotions.

5. HSBC credit card promotions

Check out all the HSBC credit cards for the latest credit card promotions.

Among their cards, our top pick is the HSBC Revolution Credit Card. The most accessible card with $0 minimum spend, this card is great for earning points through everyday spending.

MoneySmart Exclusive

Earn up to 4 miles per S$1 | Instant Activation*

HSBC Revolution Credit Card

MoneySmart Exclusive:

Earn 3,950 SmartPoints or S$150 Cash via PayNow when you apply and spend a min. of S$500 from Card Account Opening Date to end of the following calendar month. T&Cs apply.

With 3,950 SmartPoints, unlock your favourite Apple iPhone 15, iPad 10, Macbook Air and more, at unbeatable prices. We've just restocked hot favourites at our Rewards Store, check them out before it's too late!

Valid until 31 May 2024

More Details

Key Features

10X Reward points (equivalent to 4 miles or 2.5% Cashback) on online purchases and contactless payments.

1X Reward point for all other types of spending.

No min. spend required.

No annual fee

Receive complimentary access to ENTERTAINER with HSBC app, with over 1,000 1-for-1 deals on dining, lifestyle and travel worldwide.

Cap of 10,000 rewards points per calendar month on eligible purchases. Other terms apply.

Annual Interest Rate and Fees

Annual Interest Rate |

|---|

S$0 |

S$0 |

3% or S$50, whichever is greater |

20 days |

Minimum Income Requirements

Singaporean/PR Minimum Income |

|---|

S$40,000 |

Wireless Payment

Visa Contactless |

|---|

Card Association

HSBC credit card | Key feature(s) | Promotion | Valid until |

10X Reward points on online purchases and contactless payments. No minimum. spend and no annual fee. | Your choice of gift: 3,950 SmartPoints or S$150 Cash via PayNow | 31 May 2024 | |

5% cash rebate on local dining and groceries with minimum spend of S$600 monthly in a calendar quarter | |||

1.5% cashback on local and overseas purchases with no min. spend | |||

S$1 local spend = 1.2 miles; S$1 on foreign spend = 2.4 miles |

There’s no current promotion for the HSBC Visa Infinite Credit Card.

6. AMEX credit card promotions

This month, AMEX credit cards are offering up to 135,000 Membership Rewards points with the American Express The Platinum Card—that’s enough for a return trip to Europe, the USA (West Coast), or Canada!

MoneySmart Exclusive

Earn Membership Rewards Points that never expire

American Express The Platinum Card®

More Details

Key Features

Enjoy S$400 Global Dining Credit every year to use at over 2,000 restaurants locally and around the world

Complimentary Access into Tower Club

Complimentary access for you, a supplementary cardholder and one guest each to 1,400 Lounges such as The Centurion Lounge, Priority Pass and International American Express Lounges

Be delighted with special rates and pleasant surprises worth up to S$800 when you stay at over 1,300 Fine Hotels + Resorts properties worldwide

Gain instant status to higher tiers of leading hotel loyalty programs such as the Marriott Bonvoy Gold Elite Status and Hilton Honors Gold Status

™ All Membership Rewards points never expire

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

Here are all the American Express credit card promotions this month:

American Express credit card | Key feature(s) | Promotion | Valid until |

$1.60 spend = 2 Membership Rewards | Get S$200 eCapitaVouchers or Samsonite Choca Spinner 68/25 (worth S$700) on top of 135,000 Membership Rewards points (enough for a return trip to USA West Coast) with $6,000 minimum spend and annual fee payment within 60 days. | 29 May 2024 | |

American Express Singapore Airlines KrisFlyer Ascend Credit Card | $1 local spend = 1.2 KrisFlyer miles; S$1 spend on Grab = 3.2 KrisFlyer miles | $300 eCapitaVouchers and up to 17,000 KrisFlyer miles (enough for a return trip to Bali) with $1,000 spend and annual fee payment within 30 days. | 29 May 2024 |

$1 local spend = 1.1 KrisFlyer miles; S$1 spend on Grab = 3.1 KrisFlyer miles | Up to 17,000 KrisFlyer miles (enough to redeem a return trip to Bali) with a minimum spend of $500 within 30 days. | 29 May 2024 | |

$1.60 spend = 10 Points at participating Platinum EXTRA Partners / 2X Points on all other spend | $400 eCapitaVouchers (up to 58,750 Membership Rewards® points from AMEX for existing cardholders) with $1,000 spend and annual fee payment within 30 days. | 29 May 2024 | |

Unlimited 1.5% cashback (3% for first 6 months with $5,000 spend) | Get $130 Cash via PayNow with $500 spend within 30 days. | 31 May 2024 | |

The American Express Singapore Airlines Business Credit Card | Up to 8.5 HighFlyer Points per S$1 spent on eligible Singapore Airlines Group flights | Up to 30,000 HighFlyer points (worth $285) with annual fee payment and $3,000 spend within 3 months. | 31 Jul 2024 |

This month, the American Express CapitaCard does not have any ongoing promotions.

7. DBS credit card promotions

The juiciest DBS credit card sign-up promotions this month are a $388 cashback promotion and a 85,000 miles promotion. The former applies to the DBS yuu Card:

Online Promo

DBS yuu American Express® Card

More Details

Key Features

Enjoy 5% cash rebates/ 10x yuu Points at yuu merchants with no min. spend no cap

Earn additional bonus 13% cash rebates / 26x yuu Points on your yuu merchant spend when you hit S$600 total Qualified Spend in a calendar month

Earn 0.5% cash rebates / 1x yuu Point on all other spend

Great for daily essentials like groceries, dining, telco and recreation

yuu merchant includes: foodpanda, Gojek, Cold Storage, Giant, Guardian, BreadTalk, Toast Box, Food Republic, Food Junction, Mandai Wildlife Group and many more.

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

Online Promo

DBS yuu Visa Card

More Details

Key Features

Enjoy 5% cash rebates/ 10x yuu Points at yuu merchants with no min. spend no cap

Earn additional bonus 13% cash rebates / 26x yuu Points on your yuu merchant spend when you hit S$600 total Qualified Spend in a calendar month

Earn 0.5% cash rebates / 1x yuu Point on all other spend

Great for daily essentials like groceries, dining, telco and recreation

yuu merchant includes foodpanda,Gojek, Cold Storage, Giant, Guardian, BreadTalk, Toast Box, Food Republic, Food Junction, Mandai Wildlife Group and many more.

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

The DBS Vantage Visa Infinite Card comes with a fat miles welcome gift this month, but do note that this is not an entry-level miles card:

Online Promo

Miles or Cashback – you decide

DBS Vantage Visa Infinite Card

More Details

Key Features

1.5 miles or 1.5% cashback for every S$1 local spend

2.2 miles or 2.2% cashback for every S$1 overseas spend

Switch your rewards flexibly between up to 2.2 miles per S$1 or 2.2% Cashback

Receive 25,000 bonus miles (in the form of 12,500 DBS Points) when you pay the annual fee of S$599.50 (inclusive of GST)

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

Here’s the full list of ongoing DBS credit card promotions:

DBS credit card | Key feature(s) | Promotion | Expiry |

DBS yuu Card (Visa / American Express) | 5% Cash Rebate / 10x yuu Points with no minimum spend and no cap. | $388 cashback (new cardmembers) with $800 minimum spend within 60 days. | 31 May 2024 |

5% cashback on Online & Visa contactless spend with $600 minimum monthly spend | |||

DBS Altitude Card (Visa Signature) | $1 spend at Expedia & Kaligo = 10 miles that never expire | Up to 53,000 miles with $3,000 spend and payment of annual fee within 60 days | 19 May 2024 |

DBS Altitude Card (American Express) | Up to 60,000 miles with $3,000 spend and payment of annual fee within 60 days | 31 May 2024 | |

1.5 miles or 1.5% cashback per S$1 local spend; 2.2 miles or 2.2% cashback per S$1 overseas spend | Up to 85,000 miles (new cardmembers) / 40,000 miles (existing cardmembers) with $4,000 minimum spend and payment of annual fee within 30 days | 31 May 2024 |

These other DBS credit cards do not have ongoing sign-up promotions:

A word on the DBS Woman’s and Woman’s World Card: Don’t be fooled by the name. You can apply for these cards no matter your gender.

8. POSB Credit Card Promotion

The POSB Everyday Card is a straightforward cash rebates card with (strictly speaking) no minimum spend; certain bonus reward categories require you to spend above $800/month.

As the name suggests, you can apply for the POSB Everyday Card to make the most out of your day-to-day spending. The latest POSB Everyday Card promotion is as fuss-free as the card—$388 cashback when you apply and spend $800 within 60 days.

Online Promo

Earn Cash Rebates that Never Expire

POSB Everyday Card

More Details

Key Features

Up to 10% cash rebates on your daily essentials when you dine, shop online or purchase groceries

50% off family attractions and other exclusive deals

Save up to 20.1% on fuel at SPC

At MoneySmart, we strive to keep our information accurate and up to date. This information may be different from what you see when you visit a financial institution, service provider, or specific product site. MoneySmart shall not be liable to compensate the Customer should the information is not as updated as our Partner.

Annual Interest Rate and Fees

Annual Interest Rate |

|---|

S$196.20 |

S$98.10 |

First year waived |

3.00% or S$50, whichever is higher |

25 days |

Minimum Income Requirements

Singaporean/PR Minimum Income |

|---|

S$45,000 |

Wireless Payment

MasterCard PayPass |

|---|

Card Association

9. OCBC credit card promotions

At the time of writing, there are no ongoing OCBC credit card sign-up promotions. Watch this space for future promotions!

Credit card promotions—is there a catch?

With free AirPods Pro, ergonomic standing desks and thousands of miles raining down on us, you might be wondering: Is there a catch to all these freebies?

Truth is, there is one drawback to signing up for credit card promotions: You won’t be eligible for more freebies in the future. Well, at least for a year. Here’s how it works:

Banks and comparison sites like MoneySmart usually offer the best giveaways for new sign ups. Usually this is defined as people who either:

Have never ever owned a credit card from that bank, OR

Cancelled their card at least 12 months ago

If you’re thinking of gaming the system by cancelling your card and re-applying, tough luck!

Another thing to note is that you must hit the minimum spend to get your reward. If you’re really lucky, you’ll get your shiny new iPad or cashback immediately upon card approval. However, most banks require you to spend a minimum sum (say, $1,000 in the first month) and sometimes even fork out the first year’s annual credit card fee (goodbye, fee waiver!). After all that, banks will make you wait a few months before you can even smell the freebie.

So what’s the lesson here? Read the T&Cs carefully, and only sign up when you’re confident you can hit the minimum spend.

Psst, we also review credit card promos in Hong Kong! Check out our guide to the Best HK Credit Card Welcome Offers.

Read more about the best air miles, cashback, and rewards credit cards! Plus, learn the differences between air miles vs cashback vs rewards credit cards.

About the author

Vanessa Nah is a personal finance content writer who pens articles on the ins and outs of personal loans, the T&Cs of credit cards, and the ups and downs of alternative investments. She’s a researcher at heart and leaves no stone unturned when it comes to breaking down complex finance concepts and making them easy to understand for the everyday Singaporean. When Vanessa’s not debunking finance myths, you’ll find her attending dance classes, fingerpicking a guitar, or (most impawtently) fulfilling her life mission to make her one-eyed cat the most spoiled and loved kitty in the world.

The post Best Credit Card Promotions in Singapore (May – Jul 2024): Citibank, DBS, HSBC, UOB, and More appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

The post Best Credit Card Promotions in Singapore (May – Jul 2024): Citibank, DBS, HSBC, UOB, and More appeared first on MoneySmart Blog.

Original article: Best Credit Card Promotions in Singapore (May – Jul 2024): Citibank, DBS, HSBC, UOB, and More.

© 2009-2018 Catapult Ventures Pte Ltd. All rights reserved.

Yahoo Finance

Yahoo Finance