Singapore markets closed

Straits Times Index

3,426.47 -3.98 (-0.12%) Nikkei

37,667.41 -202.10 (-0.53%) Hang Seng

17,021.31 +16.34 (+0.10%) FTSE 100

8,285.71 +99.36 (+1.21%) Bitcoin USD

69,201.46 +1,269.01 (+1.87%) CMC Crypto 200

1,395.36 +64.75 (+4.87%)

Orpea SA (ORPEF)

OTC Markets OTCPK - OTC Markets OTCPK Delayed price. Currency in USD

Add to watchlist

At close: 04:00PM EDT

| Previous close | 0.00 |

| Open | 0.01 |

| Bid | 12.23 x 0 |

| Ask | 17.23 x 0 |

| Day's range | 0.01 - 0.01 |

| 52-week range | 0.01 - 14.45 |

| Volume | |

| Avg. volume | 23 |

| Market cap | 2.263B |

| Beta (5Y monthly) | 0.71 |

| PE ratio (TTM) | 0.10 |

| EPS (TTM) | 139.96 |

| Earnings date | 26 Jul 2024 |

| Forward dividend & yield | N/A (N/A) |

| Ex-dividend date | 09 Jul 2021 |

| 1y target est | N/A |

Business Wire

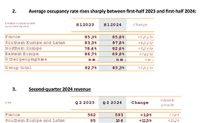

Business Wireemeis: Growth in Revenue in First-Half 2024 at €2,772 Million (Up 9.2%)

PUTEAUX, France, July 26, 2024--Regulatory News: This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240726471228/en/

Business Wire

Business Wireemeis: Half-year review (H1 2024) of the liquidity agreement entered into with Natixis ODDO BHF

PUTEAUX, France, July 19, 2024--Regulatory News: Under the liquidity agreement entrusted by emeis S.A. (the "Company") (Paris:EMEIS) to Natixis ODDO BHF, the following resources were recorded in the dedicated liquidity account as of 30 June 2024:

Business Wire

Business Wireemeis Announces the Signature of a Real Estate Promissory Sales Agreement Concerning Assets in Portugal, worth a Total Value of €24 Million

PUTEAUX, France, July 15, 2024--Regulatory News: emeis (Paris:EMEIS) announces the signature of a real estate promissory sales agreement in Portugal, concerning a portfolio of assets in the Porto and Lisbon regions with a total value of €24 million.