Straits Times Index

3,313.48 +8.49 (+0.26%) Nikkei

38,787.38 -132.88 (-0.34%) Hang Seng

19,553.61 +177.08 (+0.91%) FTSE 100

8,420.26 -18.39 (-0.22%) Bitcoin USD

66,989.88 +1,757.44 (+2.69%) CMC Crypto 200

1,367.68 -6.16 (-0.45%)

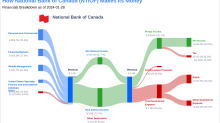

National Bank of Canada (NA.TO)

| Previous close | 115.42 |

| Open | 115.28 |

| Bid | 115.63 x 0 |

| Ask | 115.67 x 0 |

| Day's range | 114.87 - 115.77 |

| 52-week range | 84.27 - 116.81 |

| Volume | |

| Avg. volume | 2,031,546 |

| Market cap | 39.307B |

| Beta (5Y monthly) | 1.12 |

| PE ratio (TTM) | 12.17 |

| EPS (TTM) | N/A |

| Earnings date | N/A |

| Forward dividend & yield | 4.24 (3.67%) |

| Ex-dividend date | 05 Apr 2024 |

| 1y target est | N/A |

- Simply Wall St.

National Bank of Canada And Two More Dividend Stocks For Reliable Income

Amidst a backdrop of fluctuating inflation trends and cautious monetary policy signals from the U.S. Federal Reserve, the Canadian market remains a point of focus for investors seeking stability through dividend stocks. As global economic dynamics influence market sentiments, dividend-paying stocks in Canada may offer a semblance of predictable income in uncertain times.

- GuruFocus.com

National Bank of Canada's Dividend Analysis

National Bank of Canada (NTIOF) recently announced a dividend of $1.06 per share, payable on 2024-05-01, with the ex-dividend date set for 2024-03-22. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into National Bank of Canada's dividend performance and assess its sustainability.

- Reuters

National Bank of Canada denies media report of talks to sell its Cambodian unit

Bloomberg News on Tuesday reported that the lender was exploring options for ABA Bank, including its sale for more than $2 billion. National Bank of Canada is currently not engaged in any process or negotiations for the sale of ABA Bank, nor has it hired any advisers, the bank said in a statement. National Bank of Canada took full control of ABA Bank in 2019, after gradually increasing its stake in the Cambodian lender over the years since 2014.