Straits Times Index

3,330.77 -0.04 (-0.00%) Nikkei

38,683.93 -19.58 (-0.05%) Hang Seng

18,366.95 -109.85 (-0.59%) FTSE 100

8,261.51 -23.83 (-0.29%) Bitcoin USD

71,469.33 +332.85 (+0.47%) CMC Crypto 200

1,488.20 +9.50 (+0.64%)

Edenred SE (EDEN.PA)

| Previous close | 46.22 |

| Open | 46.37 |

| Bid | 0.00 x 0 |

| Ask | 0.00 x 0 |

| Day's range | 45.84 - 46.57 |

| 52-week range | 41.37 - 62.40 |

| Volume | |

| Avg. volume | 623,082 |

| Market cap | 11.451B |

| Beta (5Y monthly) | 0.66 |

| PE ratio (TTM) | 45.82 |

| EPS (TTM) | N/A |

| Earnings date | N/A |

| Forward dividend & yield | 1.10 (2.38%) |

| Ex-dividend date | 10 Jun 2024 |

| 1y target est | N/A |

- GuruFocus.com

Edenred SE's Dividend Analysis

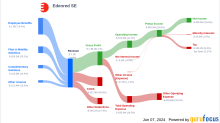

Edenred SE (EDNMY) recently announced a dividend of $0.59 per share, payable on June 27, 2024, with the ex-dividend date set for June 7, 2024. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Edenred SE's dividend performance and assess its sustainability.

- Reuters

Edenred's record annual profit overshadowed by higher financial expenses

Gift and restaurant voucher provider Edenred reported a record annual core profit on Tuesday, but the result was overshadowed by higher financial expenses related to a recent acquisition and rising interest rates, sending its shares lower. The French company, which is known for its "Ticket Restaurant" vouchers, reported earnings before interest, taxes, depreciation and amortization (EBITDA) rose 31% to 1.09 billion euros ($1.18 billion) in 2023, just above a company-compiled consensus of 1.08 billion euros. Like its peer Sodexo, which has just spun off its voucher division, Edenred has seen strong demand for its gift and restaurant vouchers from employers as a way to help staff cope with rising inflation without hiking wages.