Singapore markets closed

Straits Times Index

3,300.04 -3.15 (-0.10%) S&P 500

5,195.31 +14.57 (+0.28%) Dow

38,965.85 +113.58 (+0.29%) Nasdaq

16,376.25 +27.00 (+0.17%) Bitcoin USD

64,246.28 +1,087.15 (+1.72%) CMC Crypto 200

1,316.48 -48.65 (-3.57%)

First Real Estate Investment Trust (AW9U.SI)

SES - SES Delayed price. Currency in SGD

Add to watchlist

At close: 05:10PM SGT

| Previous close | 0.2440 |

| Open | 0.2450 |

| Bid | 0.2400 x 0 |

| Ask | 0.2500 x 0 |

| Day's range | 0.2400 - 0.2450 |

| 52-week range | 0.2050 - 0.2700 |

| Volume | |

| Avg. volume | 1,255,364 |

| Market cap | 511.028M |

| Beta (5Y monthly) | 0.48 |

| PE ratio (TTM) | 8.17 |

| EPS (TTM) | 0.0300 |

| Earnings date | 30 Jul 2024 - 31 Jul 2024 |

| Forward dividend & yield | 0.02 (9.84%) |

| Ex-dividend date | 07 May 2024 |

| 1y target est | 0.29 |

GuruFocus.com

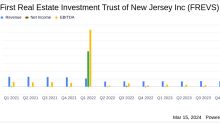

GuruFocus.comFirst Real Estate Investment Trust of New Jersey Inc Reports Mixed Q1 2024 Results

Challenges in Commercial Occupancy Offset by Residential Revenue Stability