Straits Times Index

3,280.10 -7.65 (-0.23%) Nikkei

37,934.76 +306.28 (+0.81%) Hang Seng

17,651.15 +366.61 (+2.12%) FTSE 100

8,139.83 +60.97 (+0.75%) Bitcoin USD

63,005.99 -1,346.64 (-2.09%) CMC Crypto 200

1,304.48 -92.06 (-6.59%)

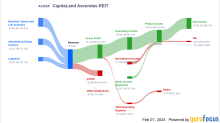

CapitaLand Ascendas REIT (A17U.SI)

| Previous close | 2.6100 |

| Open | 2.6000 |

| Bid | 2.5900 x 0 |

| Ask | 2.6000 x 0 |

| Day's range | 2.5700 - 2.6000 |

| 52-week range | 2.4700 - 3.0500 |

| Volume | |

| Avg. volume | 14,305,408 |

| Market cap | 11.9B |

| Beta (5Y monthly) | 0.48 |

| PE ratio (TTM) | 65.00 |

| EPS (TTM) | N/A |

| Earnings date | N/A |

| Forward dividend & yield | 0.09 (3.47%) |

| Ex-dividend date | 08 Feb 2024 |

| 1y target est | N/A |

- GuruFocus.com

CapitaLand Ascendas REIT's Dividend Analysis

CapitaLand Ascendas REIT (ACDSF) recently announced a dividend of $0.07 per share, payable on 2024-03-06, with the ex-dividend date set for 2024-02-08. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into CapitaLand Ascendas REIT's dividend performance and assess its sustainability.

- EdgeProp

CapitaLand Ascendas REIT to divest three Australian logistics properties for $64.2 mil

77 Logistics Place, one of three logistics properties that CapitaLand Ascendas REIT is divesting (Photo: CapitaLand Ascendas REIT) The manager of CapitaLand Ascendas REIT (CLAR) has announced the proposed divestment of three logistics properties in Queensland, Australia on Dec 20.The total sale consideration for the three properties amounts to $64.2 million (A$73.0 million) and represents a premium of 6.2% over the total market valuation of the properties of $60.4 million as at Aug 31.After dedu

- Reuters SG

CapitaLand, Thai developer launch up to $730 mln healthcare-related fund

Singapore-based real estate firm CapitaLand Investment and Thai property developer Pruksa Holding said they have set up an up to S$1 billion ($730.4 million) wellness and healthcare-related real estate fund targeting Southeast Asia. The companies have together committed an initial equity investment of S$350 million to the fund, called CapitaLand Wellness Fund, according to a joint statement on Tuesday. The fund's target equity size was S$500 million, with an option to upsize to S$1 billion in equity and target asset value of S$2.9 billion when fully deployed, it said.