Straits Times Index

3,306.02 +6.02 (+0.18%) S&P 500

5,464.62 -8.55 (-0.16%) Dow

39,150.33 +15.53 (+0.04%) Nasdaq

17,689.36 -32.24 (-0.18%) Bitcoin USD

64,084.20 -149.18 (-0.23%) CMC Crypto 200

1,322.25 -38.08 (-2.80%)

Ferrovial SE (0P2N.IL)

| Previous close | 36.40 |

| Open | 37.00 |

| Bid | 33.86 x 0 |

| Ask | 37.42 x 0 |

| Day's range | 36.00 - 37.00 |

| 52-week range | 26.69 - 37.86 |

| Volume | |

| Avg. volume | 969,812 |

| Market cap | 27.059B |

| Beta (5Y monthly) | 0.92 |

| PE ratio (TTM) | 156.96 |

| EPS (TTM) | N/A |

| Earnings date | N/A |

| Forward dividend & yield | 0.67 (2.38%) |

| Ex-dividend date | 25 Oct 2023 |

| 1y target est | N/A |

- Reuters

Ardian, Saudi's PIF to buy 37.6% stake in Heathrow, Ferrovial keeps 5%

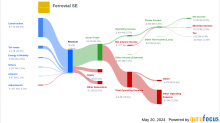

Infrastructure giant Ferrovial said on Friday it had reached a new agreement with French private equity fund Ardian and Saudi Arabia's Public Investment Fund (PIF) to sell the bulk of its 25% stake in Heathrow airport while keeping 5.25%. Under the new agreement that also involves other sellers, Ardian and PIF will acquire 22.6% and 15% respectively of FGP Topco, which is the parent company of Heathrow Airport Holdings Ltd, for a total of 3.26 billion pounds ($4.13 billion). Under an initial agreement announced last year, Ferrovial would have disposed of its entire stake for 2.37 billion pounds, valuing the whole airport at 9.48 billion pounds.

- The Telegraph

Heathrow looks like a Second World War airport, says Emirates boss

Heathrow has been likened to a “Second World War” era airport by the boss of Emirates, who warned urgent investment was required to catch up with rivals.

- GuruFocus.com

Ferrovial SE's Dividend Analysis

Ferrovial SE (NASDAQ:FER) recently announced a dividend of $0.3 per share, payable on 2024-06-21, with the ex-dividend date set for 2024-05-20. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Ferrovial SE's dividend performance and assess its sustainability.