Zynex Inc (ZYXI) Q1 2024 Earnings: Revenue Meets Expectations, EPS Falls Short

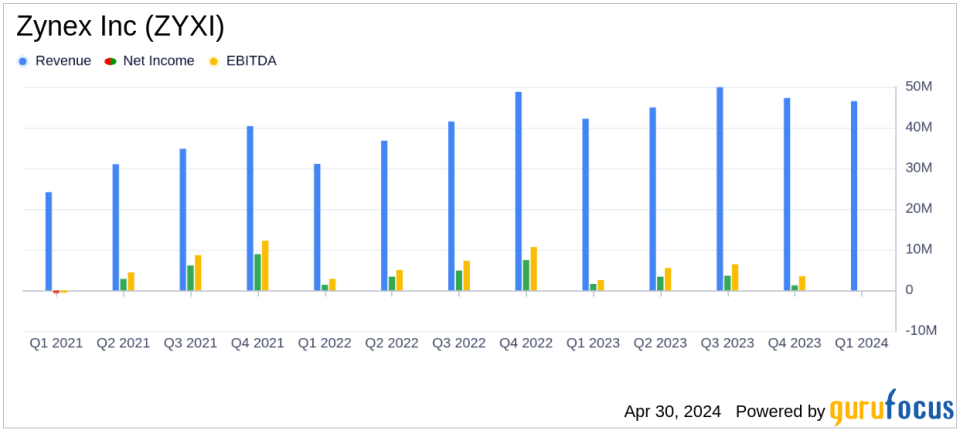

Revenue: Reported at $46.5 million for Q1 2024, a 10% increase year-over-year, falling slightly short of the estimated $47.69 million.

Net Income: Stood at $10,000 in Q1 2024, significantly below the estimated $1.09 million and down from $1.6 million in Q1 2023.

Earnings Per Share (EPS): Recorded at $0.00, missing the estimated $0.03 and down from $0.04 in the prior year's quarter.

Gross Profit: Increased to $37.2 million, or 80% of revenue, up from 78% in Q1 2023, indicating improved profitability.

Operating Cash Flow: Slightly improved to $2.1 million from $1.9 million in the comparable period last year.

Stock Repurchase: Continued aggressive share buyback with $13.4 million repurchased in Q1 2024, totaling $78.5 million over the last 24 months.

Adjusted EBITDA: Rose to $1.7 million from $1.0 million in Q1 2023, reflecting a more efficient operation.

Zynex Inc (NASDAQ:ZYXI) disclosed its financial results for the first quarter of 2024 on April 30, 2024, through its 8-K filing. The company, known for its non-invasive medical devices for pain management, rehabilitation, and patient monitoring, reported a quarterly revenue of $46.5 million, aligning closely with analyst expectations of $47.69 million. However, the earnings per share (EPS) of $0.00 significantly missed the estimated $0.03.

Zynex Inc operates primarily in the Electrotherapy and Pain Management Products segment, designing and marketing devices that address chronic and acute pain and muscle rehabilitation. The company's portfolio includes products like NexWave, NeuroMove, and InWave E-Wave, among others.

Financial Highlights and Challenges

The first quarter saw a 10% increase in revenue year-over-year, from $42.2 million in Q1 2023 to $46.5 million in Q1 2024. This growth was slightly offset by a cyber incident impacting insurer payments, which delayed approximately $1.0 million in revenue. Despite these challenges, the company maintained a strong gross profit margin of 80%, up from 78% in the previous year.

Operating expenses also saw an uptick, with sales and marketing expenses rising to $23.4 million from $21.2 million, and general and administrative expenses increasing to $13.3 million from $11.4 million year-over-year. These increases reflect the company's aggressive expansion and marketing strategies.

Operational and Strategic Developments

During the quarter, Zynex continued to innovate, receiving FDA approval for its next-generation M-Wave NMES device and launching new therapy products like the Zynex Pro Hybrid LSO and Zynex DynaComp Cold Compression. These initiatives are part of a broader strategy to diversify the company's revenue streams and enhance its competitive stance in the market.

The company also highlighted its ongoing share repurchase program, having bought back $13.4 million of its common stock in Q1 2024, demonstrating confidence in its financial health and commitment to delivering shareholder value.

Future Outlook and Guidance

Looking ahead, Zynex expects a significant increase in its financial performance for 2024, projecting a net revenue of at least $227 million, which would represent a 23% increase from 2023. The company also anticipates a substantial rise in diluted EPS to at least $0.50, marking an 85% increase from the previous year.

These projections are supported by the company's robust product pipeline and strategic initiatives aimed at capturing a larger market share and enhancing operational efficiencies. Zynex's management remains optimistic about its growth trajectory and its ability to navigate the challenges posed by external factors such as the cyber incident.

Investor Considerations

While the Q1 earnings per share did not meet analyst expectations, Zynex's consistent revenue growth and strategic expansions could present a compelling case for potential investors. The company's focus on innovation and market diversification, coupled with its strong gross profit margins, suggest a resilient operational model. However, investors should also consider the increased operational expenses and the potential impacts of external disruptions like cyber incidents.

For a deeper dive into Zynex's financial details and future prospects, stakeholders and potential investors are encouraged to review the full earnings report and stay tuned for updates on the company's strategic initiatives and market performance.

Explore the complete 8-K earnings release (here) from Zynex Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance