Zimmer Biomet (ZBH) Gains From Market Recovery, Global Growth

Zimmer Biomet's ZBH strategic focus on emerging markets and procedure recovery bolstered our confidence in this stock. The stock carries a Zacks Rank #2 (Buy).

In the past year, Zimmer Biomet has outperformed its industry. The stock has lost 3.8% compared with 44% decline of the industry.

Zimmer Biomet ended the fourth quarter of 2022 with better-than-expected earnings and revenues. Each of the company’s geographic segments and product divisions recorded year-over-year sales growth at CER.

The company registered strong elective procedure recovery and commercial execution, especially in the knee and hip businesses. In addition, the U.S. business saw strength across the three priority areas within SET.

In Q4, U.S. sales grew 6.2%, driven by strong elective procedure recovery and commercial execution, especially in Zimmer Biomet’s Knee and Hip businesses. The global knees business grew 10.2%, with U.S. knees up 10.8% and international knees up 9.3%. The strong performance was driven by knee procedure recovery across most regions and easier comps outside the United States.

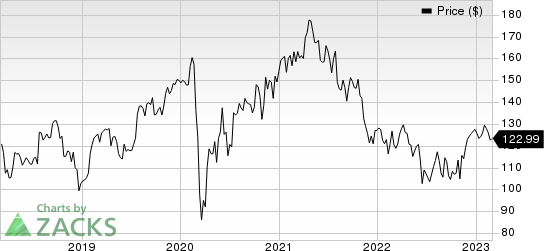

Zimmer Biomet Holdings, Inc. Price

Zimmer Biomet Holdings, Inc. price | Zimmer Biomet Holdings, Inc. Quote

Global hips grew 8.4%, with U.S. hips up 9.5% and international hips up 10.8%, driven by strong international procedure recovery and easier comps outside the United States. The company witnessed continued traction across hip products, including the G7 revision system, and Avenir Complete primary hip, which is focused on the direct anterior surgical approach.

The sports extremity and trauma category grew 7.6% in the fourth quarter, driven by continued strong performance across the key focus areas of CMFT, sports medicine and upper extremities.

Even amid the challenging macroeconomic conditions, expansion in the company’s adjusted gross and operating margins is encouraging.

On the flip side, the company continued to face significant challenges in terms of unfavorable foreign exchange, supply, inflation and staffing shortage. Further, reimbursement headwinds in the United States restorative therapies dented revenue growth. APAC was impacted by COVID-19 surges and lockdowns in China. SET was also impacted by a comp tailwind from China VBP.Moreover, research and development expenses rose 12.5% during the fourth quarter.

Through the fourth quarter of 2022, Zimmer Biomet recognized customer staffing shortages and an impact of China VBP both of which dented growth. COVID surges in EMEA and China during the months of Q4, resulted in an overall procedure cancellation.

Zimmer Biometalso witnessedsignificant headwinds from inflationary pressure in the fourth quarter, led to an increase in adjusted operating expense versus the prior year.

Other Key Picks

A few other top-ranked stocks in the overall healthcare sector include Haemonetics Corporation HAE, TerrAscend Corp. TRSSF and Akerna Corp. KERN. Haemonetics and TerrAscend both sport a Zacks Rank #1 (Strong Buy) while Akerna carries a Zack Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Haemonetics’ stock has risen 42.1% in the past year. Earnings estimates for Haemonetics have increased from $2.87 per share to $2.91 for 2023 and from $3.02 per share to $3.28 for 2024 in the past 30 days.

HAE’s earnings beat estimates in each of the last four quarters, delivering an average surprise of 10.98%. In the last reported quarter, it delivered an earnings surprise of 7.59%.

Estimates for TerrAscend in 2023 have remained constant at a loss of 10 cents per share in the past 30 days. Shares of TerrAscend have declined 70.6% in the past year.

TerrAscend’s earnings beat estimates in one of the last three quarters and missed the mark in the other two, with the average negative surprise being 136.11%. In the last reported quarter, TRSSF delivered an earnings surprise of 216.67%.

Akerna’s stock has declined 95.7% in the past year. Estimates for 2023 have remained constant at a loss of $1.91 per share over the past 30 days.

Akerna missed earnings estimates in each of the last four quarters, delivering a negative earnings surprise of 15.49% on average. In the last reported quarter, KERN delivered a negative earnings surprise of 13.33%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Zimmer Biomet Holdings, Inc. (ZBH) : Free Stock Analysis Report

Akerna Corp. (KERN) : Free Stock Analysis Report

TerrAscend Corp. (TRSSF) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance