ZIM Q2 Preview: Can Shares Remain Hot?

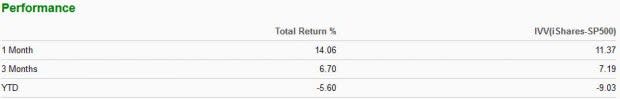

The Zacks Transportation Sector has outperformed the general market over the last month, tacking on a rock-solid 14% in value. In fact, the sector has also outperformed the S&P 500 year-to-date, undoubtedly a major positive.

Below is a table illustrating the sector’s performance vs. the S&P 500 across several timeframes.

Image Source: Zacks Investment Research

A widely-recognized name in the sector, ZIM Integrated Shipping Services ZIM, is on deck to reveal Q2 results on Wednesday, August 17th, before market open.

ZIM Integrated Shipping Services provides container shipping and related services, offering dry, reefer, project, out of gauge, breakbulk and dangerous cargo services.

The company carries a Zacks Rank #3 (Hold) with an overall VGM Score of an A. How do things stack up for the shipping giant heading into the print? Let’s find out.

Share Performance & Valuation

Year-to-date, ZIM shares have been notably strong, increasing by a double-digit 11% in value and extensively outperforming the S&P 500.

Image Source: Zacks Investment Research

Over the last month, however, ZIM shares have lagged the general market’s 12% gain but have still tacked on a substantial 7.5% in value.

Image Source: Zacks Investment Research

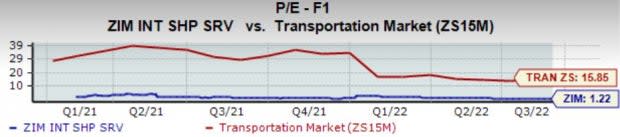

ZIM’s valuation levels are rock-solid. Its forward earnings multiple resides at a tiny 1.2X, well below its median of 1.9X since IPO in January 2021, and represents a steep 92% discount relative to its Zacks Sector.

In addition, the company sports a Style Score of an A for Value.

Image Source: Zacks Investment Research

Quarterly Estimates

A singular analyst has lowered their earnings outlook for the quarter to be reported, with the Consensus Estimate Trend retracing nearly 11%. Still, the Zacks Consensus EPS Estimate of $12.16 reflects a substantial 65% year-over-year uptick in earnings.

Image Source: Zacks Investment Research

In addition, the top-line looks to register remarkable growth as well – ZIM is forecasted to have generated $3.7 billion in revenue throughout the quarter, penciling in a 54% year-over-year uptick.

Quarterly Performance & Market Reactions

ZIM has consistently reported bottom-line results above the Zacks Consensus EPS Estimate, chaining together four consecutive bottom-line beats. Just in its latest print, the company posted a strong 12.2% EPS beat.

Top-line results have also been stellar – ZIM has exceeded quarterly revenue estimates in five consecutive quarters. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

In addition, the market has reacted well to the company’s quarterly prints as of late, with shares moving upwards twice following its last three releases, both by at least 8%.

Putting Everything Together

ZIM shares have been hot year-to-date, easily beating the general market’s performance. Still, shares have lagged over the last month modestly.

The company has solid valuation levels, with shares trading well below their Zacks Sector average and nicely beneath their median since IPO in early 2021.

Quarterly estimates reflect sizable growth on the top and bottom lines, with one analyst lowering their outlook for the quarter.

In addition, the company has consistently beat estimates, and the market has liked what it’s seen from the company following the majority of its latest three prints.

Heading into the release, ZIM Integrated Shipping Services ZIM carries a Zacks Rank #3 (Hold) with straight A’s to round out its overall VGM Score.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ZIM Integrated Shipping Services Ltd. (ZIM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance