YUM! Brands' (YUM) Stock Down on Q1 Earnings & Revenues Miss

YUM! Brands, Inc. YUM reported first-quarter 2024 results, with earnings and revenues missing the Zacks Consensus Estimate. Revenues missed the consensus estimate for the fourth straight quarter.

Following the results, shares of the company declined 4.4% in the pre-market trading session on May 1.

Earnings and Revenue Discussion

YUM’s adjusted earnings per share (EPS) came in at $1.15, lagging the Zacks Consensus Estimate of $1.20. However, the metric increased 9% year over year.

Quarterly revenues of $1,598 million missed the consensus mark of $1,721 million. The top line decreased 3% year over year.

Worldwide system sales — excluding foreign currency translation — increased 2% year over year, with Taco Bell and KFC rising 4% each. The metric declined 4% year over year at Pizza Hut.

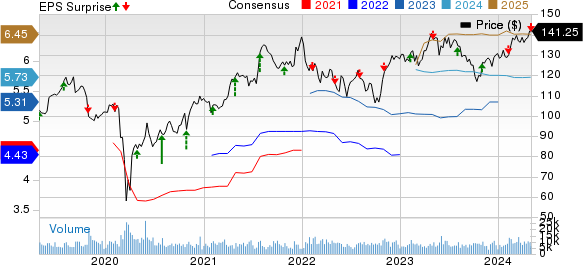

Yum! Brands, Inc. Price, Consensus and EPS Surprise

Yum! Brands, Inc. price-consensus-eps-surprise-chart | Yum! Brands, Inc. Quote

Divisional Performance

YUM! Brands primarily announces results under four divisions — KFC, Pizza Hut, Taco Bell and Habit Burger Grill.

Revenues from KFC totaled $632 million, down 8% year over year. Our model predicted the metric to increase 7.1% from a year ago. Comps decreased 2% year over year against a gain of 9% reported in the prior-year quarter.

The segment's operating margin increased 510 basis points (bps) year over year to 49.5%. In the quarter under review, the KFC division opened 509 gross new restaurants across 43 countries.

At Pizza Hut, revenues amounted to $238 million, down 6% year over year. Our model predicted the metric to decrease 2.5% from the prior-year levels. Comps decreased 7% year over year against growth of 7% in the year-ago quarter.

The segment's operating margin decreased 220 bps year over year to 39%. Pizza Hut division opened 240 gross new restaurants.

Taco Bell's revenues were $598 million, up 5% year over year. Our model precited the metric to increase 3.8% from the year-earlier levels. Comps increased 1% year over year compared with 8% in the prior-year quarter. Its operating margin contracted 80 bps year over year to 34.8%.

Taco Bell opened 56 gross new restaurants in the quarter under review.

The Habit Burger Grill division’s revenues amounted to $130 million, down 1.5% year over year. Our model predicted the metric to increase 17.7% year over year. Comps declined 8% year over year. In the quarter under review, the division opened 3 gross new restaurants.

Other Financial Details

As of Mar 31, 2024, cash and cash equivalents totaled $652 million compared with $512 million at 2023-end. Long-term debt, as of Mar 31, 2024, was $11.13 billion compared with $11.14 billion as of 2023-end.

Zacks Rank

YUM currently carries a Zacks Rank #3 (Hold).

Key Picks

Some better-ranked stocks in the Zacks Retail – Restaurants industry are:

Chipotle Mexican Grill, Inc. CMG carries a Zacks Rank #2 (Buy) at present. CMG has a trailing four-quarter earnings surprise of 8.3%, on average. CMG’s shares have gained 38.2% year to date. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for CMG’s 2024 sales and EPS indicates a rise of 14.8% and 22.8%, respectively, from the year-ago period’s levels.

Wingstop Inc. WING carries a Zacks Rank #2 at present. WING has a trailing four-quarter earnings surprise of 21.3%, on average. The stock has risen 49.1% year to date.

The Zacks Consensus Estimate for WING’s 2024 sales and EPS suggests growth of 21.7% and 22.2%, respectively, from the year-ago period’s levels.

Yum China Holdings, Inc. YUMC carries a Zacks Rank #2 at present. The company has a trailing four-quarter earnings surprise of 40.7%, on average. Shares of YUMC have fallen 6.5% year to date.

The Zacks Consensus Estimate for YUMC’s 2024 sales and EPS suggests growth of 8.7% and 10.5%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Yum! Brands, Inc. (YUM) : Free Stock Analysis Report

Chipotle Mexican Grill, Inc. (CMG) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report

Yum China (YUMC) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance