Yum Brands Inc (YUM) Q1 Earnings: Aligns with EPS Projections Amidst Market Challenges

EPS Excluding Special Items: Reported at $1.15, slightly below the estimated $1.20.

GAAP EPS: Increased to $1.10 from $1.05 year-over-year, showing a growth of 5%.

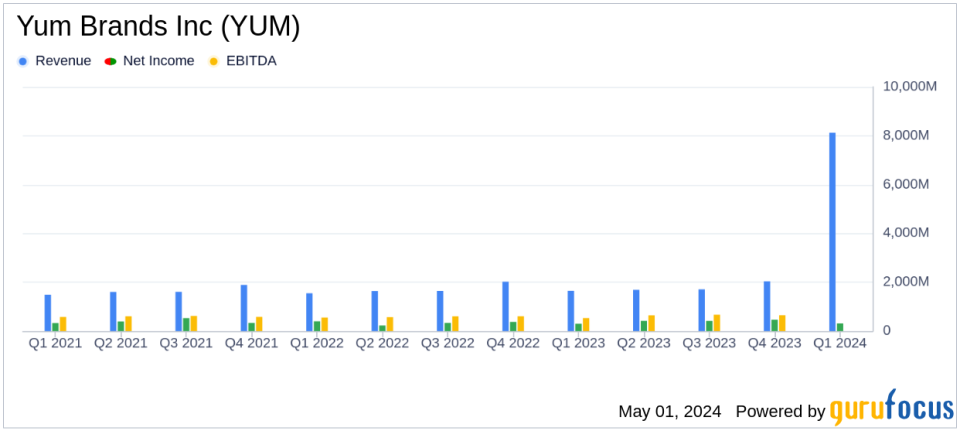

Revenue: Digital sales approached $8 billion, marking a significant shift towards digital platforms.

Global Unit Growth: Increased by 6%, with 808 new units opened, indicating expansion.

Same-Store Sales: Worldwide same-store sales saw a decline of 3%, despite overall unit growth.

Core Operating Profit: Grew by 6%, demonstrating resilience in operational efficiency.

Market Expansion: Notable unit growth in KFC and Taco Bell divisions, contributing to a total of over 59,000 restaurants globally.

On May 1, 2024, Yum Brands Inc (NYSE:YUM) disclosed its first-quarter earnings through its 8-K filing, revealing a mixed financial landscape. The company reported a first-quarter GAAP EPS of $1.10 and an EPS excluding special items of $1.15, closely aligning with the analyst estimate of $1.20 per share. Despite facing operational headwinds, the company managed a core operating profit growth of 6%, showcasing the resilience of its business model against a backdrop of global economic pressures.

Yum Brands, a global leader in the food service industry, operates under four major brands: KFC, Pizza Hut, Taco Bell, and The Habit Burger Grill. With a significant footprint, the company reported systemwide sales of $64 billion in 2023, positioning it as the second-largest restaurant company worldwide. Yum Brands thrives on a heavily franchised model, enhancing its scalability and operational efficiency.

Quarterly Financial Performance

The first quarter saw Yum Brands achieving a 2% growth in worldwide system sales, excluding foreign currency impacts, with a notable 6% increase in unit growth. However, same-store sales experienced a 3% decline. The digital sales mix was a standout performer, surpassing the 50% mark for the first time, indicating a robust adaptation to digital consumer behaviors.

Despite these gains, some segments faced challenges. The Pizza Hut Division, for instance, saw a 4% decline in system sales and a 10% drop in core operating profit, reflecting the competitive and operational difficulties in the pizza sector. Conversely, the KFC and Taco Bell Divisions showed more positive dynamics, with KFC's operating profit increasing by 6% and Taco Bell achieving a modest 2% growth in core operating profit.

Strategic Moves and Market Challenges

CEO David Gibbs highlighted the strategic expansions and digital integration as key drivers for future growth. Over 800 new units were opened during the quarter, underscoring the company's aggressive growth strategy. Gibbs noted, "Despite a difficult operating environment, we delivered 6% Core Operating Profit growth demonstrating the resilience of our business model."

"As expected, same-store sales were pressured this quarter, but we are encouraged by strong 2-year same-store sales growth and positive momentum exiting the quarter," said David Gibbs.

The emphasis on digital sales, which approached $8 billion, aligns with shifting consumer preferences and positions Yum Brands favorably against competitors.

Financial Health and Future Outlook

The company's balance sheet and cash flow statements reflect a stable financial position, capable of supporting continued expansion and shareholder returns. However, the reported 1% decline in GAAP operating profit indicates some underlying vulnerabilities that could affect future profitability if unaddressed.

Looking ahead, Yum Brands plans to continue its expansion, particularly in high-growth markets, and further enhance its digital capabilities. The acquisition of 218 KFC franchise restaurants in the U.K. and Ireland in late April 2024 exemplifies its strategic initiatives to bolster market presence.

For investors, Yum Brands presents a mixed bag of robust strategic positioning and some operational challenges. The company's ability to maintain growth in core operating profits and expand its digital and global footprint may offer potential upside, balanced against the backdrop of competitive and economic pressures that could influence future performance.

For more detailed financial analysis and future updates on Yum Brands Inc (NYSE:YUM), visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Yum Brands Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance