Yuan to Retrace on Currency Basket Re-Balancing

DailyFX.com -

Fundamental Forecast for the Yuan: Bearish

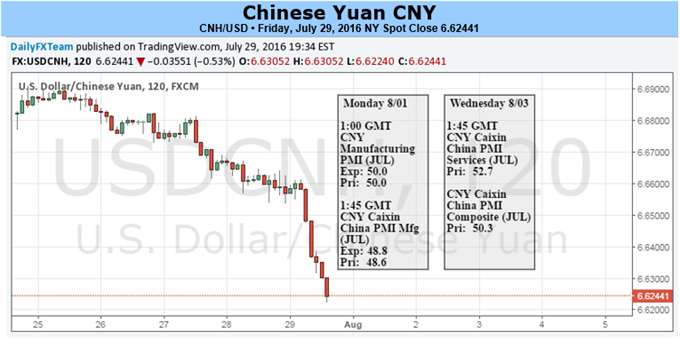

The onshore Yuan (USD/CNY) strengthened against the US Dollar for all five trading days this week, rising by+0.76% during that span of time. The offshore Yuan extended rallies for four consecutive days and broke the level of 6.6400 on Friday followingthe release of a disappointing GDP print in the U.S. This week, the PBOC continued to guide the Yuan rate stronger: the Yuan’s daily reference rate was increased by 158 pips or +0.24% on a weekly basis. Looking forward, event risk will be the key driver for Dollar/Yuan pairs. From China’s side, the official Manufacturing PMI print as well as the Caixin PMI reads for July will be released next week. In terms of outside of China, the Bank of England rate decision and US Non-farm Payrolls for July will likely either move Dollar/Yuan pairs directly; or weight the Yuan Index and, in-turn, impact Dollar/Yuan rates. Also, the PBOC has allowed the Yuan to consolidate against the US Dollar over the past week, but as we discussed the Central Bank’s FX target, it is less likely that they will guide the currency higher. Thus, we will more likely see Yuan rates retracing next week.

The Yuan Index is expected to come back into the spotlight amid potential moves in GBP/CNY and GBP/CNH rates, likely to be driven by the Bank of England (BOE) rate decision on Thursday. The probability of a 0.25% rate cut by BOE on August 4th is 100% according to GBP overnight index swaps (OIS). The rate cut may be largely priced-in already with such incredibly-high odds; but the size of BOE’s asset purchase program could bring some additional volatility due to uncertainty around this number. A more-dovish monetary policy is likely to send the Pound lower against other currencies, including the Yuan. Remember, the PBOC’s exchange rate target is to maintain the Yuan’s stability againstthe currency basket. Although the PBOC has not released the weekly CFETS Yuan Index for July 29th - they normally release Friday prints on the following Monday – the Yuan’s strength against the US Dollar this week is expected to send the Yuan Index higher. The USD/CNY pair takes up 26.40% in the CFETS Yuan Index, the largest weighting among the thirteen Yuan pairs represented. A weaker GBP would drive the Yuan Index even higher, which may raise the PBOC’s concerns. When the Pound plunged on the back of the UK’s Brexit referendum, the Yuan put in significant losses against the U.S. Dollar, not only because of the safe-haven demand in the Greenback but also because of the PBOC’s intention to keep the Yuan stable against the currency basket. Thus, Bank of England moves next week could impact the Yuan index again and, in-turn, move Dollar/Yuan rates.

Also, both the onshore and offshore Dollar/Yuan rates are currently in levels about 300 pips away fromthe key resistance levels of 6.70, at which the PBOC’s intervention was seen. This leaves room for the Yuan to weaken against the Dollar if it needs to even-out changes in the Yuan basket. Another major driver to Dollar/Yuan pairs is the Non-farm Payrolls (NFP) print for July that is scheduled to be released on Friday. Traders will want to be careful to hold any Yuan positions ahead of the NFP release as the reads in the past have caused large volatility in both USD/CNH and USD/CNY. Such moves especially driven by a significant miss can go against a trader’s position. For instance, the big miss in the May NFP print sent the offshore Yuan higher by +0.9%.

In terms of China’s domestic event risk, manufacturing PMI reads from both the Chinese government and the Caixin News will be the top headlines, though they may bring limited volatility to Yuan rates.The data released in the past week has shown continued weakness in China’s manufacturing sectorand the government official news agency has addresseddifficulties in China’s economy. Thus, these PMI prints are less likely to show big surprises.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance