Yen Weakness is Back as a Predominant Theme

DailyFX.com -

Talking Points:

- While the past week has presented a litany of drivers, one of the more pertinent moves in the FX-space has been something far under-reported by the headlines, and that’s the return of robust Yen-weakness.

- This recent influx of Yen-weakness is likely driven by a number of factors, key of which has been the Bank of Japan’s continued dovish monetary stance.

- If you’re looking for trading ideas, check out our Trading Guides. And if you’re looking for ideas that are more short-term in nature, please check out our IG Client Sentiment Indicator.

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

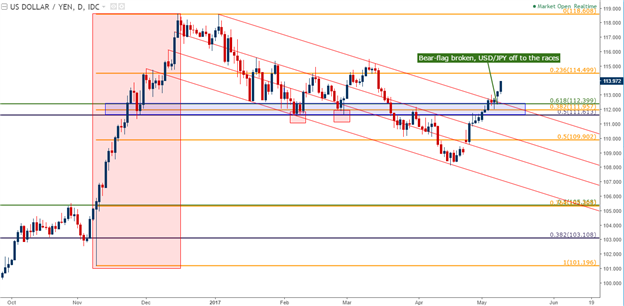

The past week has brought quite a few drivers to global markets; and the one pronounced takeaway theme thus far has been the runaway Yen-weakness that has shown against almost every currency. Last week, we asked if Yen weakness would continue to show as a pervasive theme, and the answer to that question, at least at this point, has been a definitive yes. The source for this weakness is likely driven by a combination of factors; key of which is the divergent monetary stance of the BoJ combined with a return of risk tolerance following last week’s FOMC, and NFP events along with this weekend’s French elections. On the chart below, we’re looking at the recent top-side break in USD/JPY as the pair has jumped above a key zone of resistance.

Chart prepared by James Stanley

On a short-term basis, this move is extremely overbought with RSI on the hourly chart now running up to a reading of over 83. This could behoove a bit of patience for those looking at continuation-based entries, and on the chart below, we look at three potential areas to watch for ‘higher-low’ support.

Chart prepared by James Stanley

EUR/JPY

The Euro has continued to face weakness after this weekend’s French elections; but the Japanese Yen has been even-weaker. So while EUR/USD continues to sell-off, EUR/JPY has developed a range with a top-side bias to reflect that even-weaker Japanese Yen.

Euro gapped-higher to open the week, but then began an aggressive descent. In EUR/JPY, buyers stepped-in at a key level, just above the prior swing-low at 122.88. And after spending much of yesterday morning gyrating around 123.00, buyers eventually took over to propel price action back towards those gap-highs.

Chart prepared by James Stanley

Given that EUR/JPY has yet to take-out that prior gap-high, we could have an additional level and approach to utilize. We had discussed using prior points of resistance as future areas of support in the article, How to Use Price Action to Trade New Trends. Such a level exists at 124.32, which was the high-point after last weekend’s gap-move.

If this move of strength in EUR/JPY continues unabated, this prior point of resistance can become an ideal area to look for support in the effort of trading the pair up to the 125-handle. If this level is not eclipsed, however, traders can look to prior areas of support in the effort of re-loading for top-side continuation.

Chart prepared by James Stanley

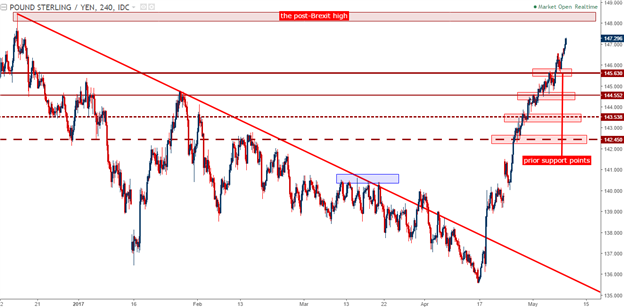

GBP/JPY

Six weeks ago, we published the article ‘GBP/JPY Technical Analysis: The Big Move Awaits’.

Judging by price action, the big move in GBP/JPY is now underway. Over the last three weeks, GBP/JPY has run-higher by more than 1,100 pips. This is driven by a combination of factors on both GBP and JPY fronts, and we discussed the backdrop for the pair in last week’s article, Bullish Blast with Little Pullback.

Chart prepared by James Stanley

--- Written by James Stanley, Strategist for DailyFX.com

To receive James Stanley’s analysis directly via email, please SIGN UP HERE

Contact and follow James on Twitter: @JStanleyFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.

Yahoo Finance

Yahoo Finance