Wyndham Hotels & Resorts Reports Q1 2024 Earnings: Adjusted EPS Meets Analyst Projections ...

Revenue: Reported at $305 million for Q1 2024, falling short of the estimated $309.55 million.

Net Income: Achieved $16 million, significantly below the estimated $60.88 million.

Earnings Per Share (EPS): Actual diluted EPS was $0.19, considerably lower than the expected $0.75.

Adjusted Free Cash Flow: Amounted to $102 million, showcasing robust liquidity and operational efficiency.

Global System Size Growth: Increased by 4% year-over-year, with international growth notably stronger at 8%.

Development Pipeline: Expanded by 8% year-over-year, reaching a record 243,000 rooms, indicating strong future growth potential.

Share Repurchase: Executed $57 million in buybacks and increased future authorization by $400 million, reflecting confidence in financial health and commitment to shareholder returns.

On April 24, 2024, Wyndham Hotels & Resorts Inc (NYSE:WH) disclosed its first-quarter earnings through its 8-K filing, revealing a mix of achievements and challenges. The company, a dominant player in the economy and midscale hotel segments, operates 872,000 rooms across more than 20 brands globally, with significant footprints in the United States and expanding presence in international markets.

Financial Performance Overview

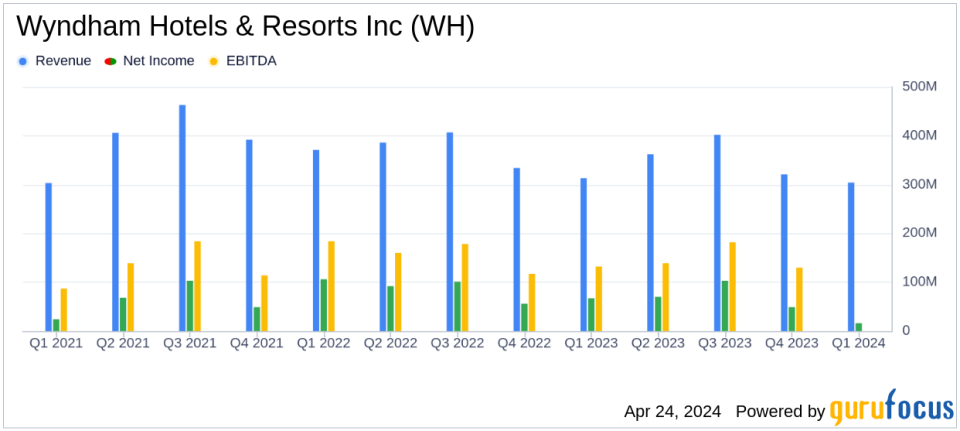

Wyndham reported a modest increase in global revenue per available room (RevPAR), up 1% in constant currency, although U.S. performance dipped by 5%. Internationally, the company saw a robust 14% growth. The total fee-related and other revenues slightly declined to $304 million from $308 million in the prior year's quarter, primarily due to a decrease in U.S. RevPAR and royalty and franchise fees.

The company's net income stood at $16 million, significantly lower than the $67 million reported in the first quarter of 2023. This decline was attributed to transaction-related expenses from an unsuccessful hostile takeover attempt by Choice Hotels, an impairment charge related to development advance notes, and higher interest expenses. Adjusted earnings per share (EPS) were $0.78, aligning closely with analyst estimates of $0.75 per share.

Strategic Developments and Operational Highlights

Wyndham continued to expand its footprint, opening over 13,000 rooms, a 27% increase year-over-year, and awarded 171 development contracts. The development pipeline grew by 8% to a record 243,000 rooms. Notably, the company entered the upscale extended stay segment through a strategic relationship with WaterWalk Extended Stay by Wyndham.

The company's balance sheet remains robust, with $76 million in net cash provided by operating activities and an adjusted free cash flow of $102 million. Wyndham's proactive management of its capital structure was evident as it executed $275 million of new forward-starting interest rate swaps to manage interest rate exposure effectively.

Shareholder Returns and Future Outlook

Wyndham returned $89 million to shareholders through share repurchases and dividends during the quarter. The board also approved a $400 million increase in the share repurchase authorization, underscoring confidence in the companys financial health and future prospects.

For the full year 2024, Wyndham updated its outlook, projecting a 3-4% growth in rooms and a 2-3% increase in global RevPAR. Adjusted EBITDA is expected to be between $690 million and $700 million, with adjusted net income projected at $341 million to $351 million. Adjusted diluted EPS is forecasted to range from $4.18 to $4.30, reflecting the impact of share repurchase activities.

Conclusion

Despite facing significant challenges, including a decline in U.S. RevPAR and transaction-related expenses, Wyndham Hotels & Resorts has demonstrated resilience through strategic expansions and robust shareholder returns. The company's focus on international growth and entry into new market segments positions it well for future success. Investors and stakeholders may look forward to stable growth and continued returns, supported by a strong balance sheet and effective capital management strategies.

Explore the complete 8-K earnings release (here) from Wyndham Hotels & Resorts Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance