How Working Parents Can Value Invest With Limited Time

“Huh, investing? I don’t even have time for my kids and you’re asking me to spend time on reading long annual reports?”

Well, reading annual reports are not the only way to find out if a stock is worth buying. For a company like Sheng Shiong, you can visit their physical supermarkets and see how they are doing on a daily basis.

“Even if I got the time, the market is so bad right now… I don’t think there are any stocks to buy.”

Actually, value stocks are more often than not hidden gems that investors miss out on – that’s why they are cheap.

If you’re a parent with your own family and kids to take care of but still want to invest for your family’s future, you’re not alone.

Many parents who are also part-time investors on weekends or whenever they can fork time out – like Pauline Teo from 8I Education – face the “time” problem.

Previously, Pauline shared some tips for young and budding investors (click here to read) and in this article, we’ll take a look at some advice for working parents, just like herself.

Analyse Stocks in a Group Instead of Going Solo

“The beauty of value investing is that it is not strictly speaking time-sensitive,” Pauline explained to us. If a company is truly a hidden gem, you should invest enough time into researching its true value before investing your money.

Most working parents, however, find it very hard to fork out time from their busy work and family schedules. But investing some time into your family’s future is important.

While most parents wouldn’t have all the time in the world, their weekends can be utilised. Pauline is working full-time too, with two young children and she did not employ a domestic helper.

With limited time on her hands, she spends some of her weekends analysing stocks. The key, as Pauline said, is that she formed a stock analysis group with friends she got to know when she started learning value investing back in 2010.

On an average month, Pauline would meet up with these friends whom she attended the Millionaire Investor Programme (MIP) with, and discuss the stocks they’ve analysed. That way, she reveals, she is able to learn about six stocks every month, as opposed to one or two on her own.

So, the time factor aside, what about the market factor? There are cheap stocks everywhere but how to tell if they are truly cheap relative to their intrinsic value, especially when our current stock market is so quiet and uncertain?

Back to the Basics of What Makes a Good Company

Well said, Mr. Buffett. The concept of value investing is simple, too, and many people would be able to tell you that value investors look for stocks with a good business model, excellent management team, and undervalued by the stock market.

Pauline explains, “There are always stocks with good business models and management teams but more often than not, they may not be selling at undervalued prices.” And the truth is, value stocks are rarer during bull markets than any other time.

That is not to say value investors won’t be able to find any value stocks during a bull market. The main point is this: value stocks are always waiting for value investors to unearth them. The deciding factor lies with how hard and much you search.

Thus, value investors should not worry too much about how the market is performing – just go back to the basics of what makes a good company:

Good business model

Excellent management team

Undervalued price relative to intrinsic value

Always Prepared for a Crisis

Nevertheless, picking up value stocks that are beaten down in a bear market is easier than picking value stocks among good companies that have already climbed during a bull market – it is in times of crisis where profits are made.

Borrowing another quote from Buffett, “Be fearful when others are greedy and be greedy when others are fearful.” Keep a close lookout during a bear market and consider selling in a bull market to realise your profits.

Especially for working parents, living as if you are always prepared for a crisis is a good practice that will protect your family, and might even be profitable in the long run. Think about being able to buy more of a value stock that is beaten down in price but not in value.

Pauline’s ending words, “One of the richest men in the world, Warren Buffett, has become one of the richest men in the world practicing Value Investing over more than 60 years. Value Investing is a proven concept practised by many successful investors such as Charlie Munger, Peter Lynch, and Sir John Templeton. It has been eight years since the last major economic crisis and we do not know for sure but crises seem to be part of an economic cycle. So how do you profit from a crisis?”

If You are Interested in Learning More…

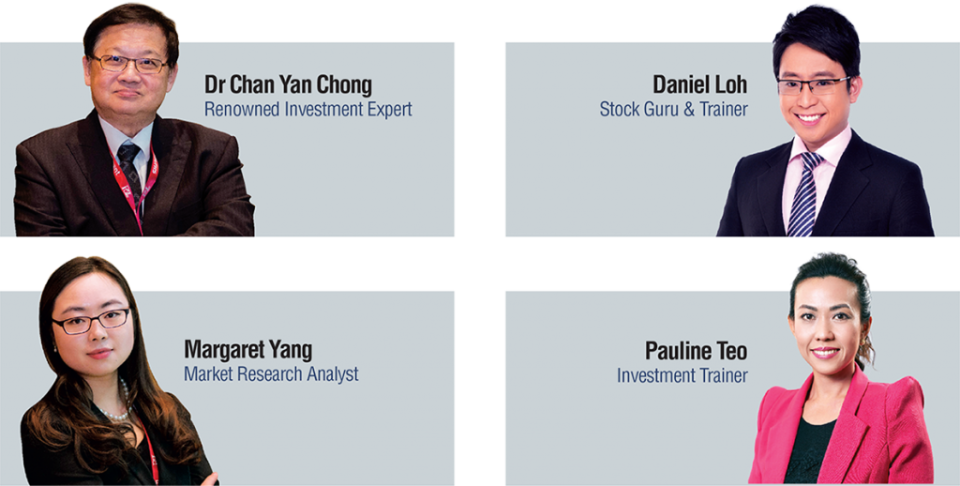

Director and lead trainer of 8I Education Pauline Teo will be speaking at our half-yearly Shares Investment Conference 2H2016 (*Mandarin event) to share more about value investing.

She will be covering topics:

Importance of Investing

What is Value Investing?

The 3R approach to Value Investing

Understand how to take advantage to profit from the crisis

Click on the button for more details of the event and to reserve tickets. Dr. Chan Yan Chong, renowned investment expert and Daniel Loh, local stock guru and investment trainer will also be speaking at the event.

Yahoo Finance

Yahoo Finance