From and within the US, the equities rally has ‘finally expanded’: Indosuez Wealth Management

Gains are no longer concentrated in growth stocks alone but have spread to the cyclical and value sectors.

Market momentum has shifted in the last two months and some markets that had lagged, such as China and the UK, have played a strong game of catch-up, says Laura Corrieras, equity portfolio manager at Indosuez Wealth Management.

This broader participation in the market rise can also be seen at the sector level, where gains are no longer concentrated in growth stocks alone but have spread to the cyclical and value sectors, adds Corrieras. “The market is finally starting to benefit from broader support.”

Europe’s earnings momentum

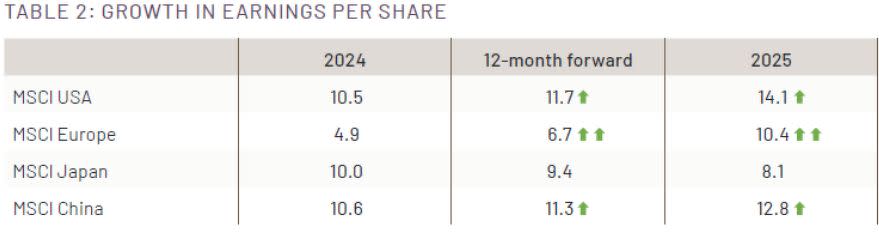

Europe’s first-quarter earnings season, now drawing to a close, was better than expected, says Corrieras. 58% of companies reported earnings per share (EPS) above consensus expectations. In addition, earnings estimates for 2024 to 2026 have been revised up, with EPS growth for the MSCI Europe Index estimated at +10.4% for 2025, compared to +4.9% for 2024.

The renewed earnings momentum confirms the more positive economic trend in Europe, where financial flows are starting to return, and an improvement in investor sentiment, Corrieras adds. “The European market is also supported by its still very attractive valuation, at 13.6x earnings for 2025, versus 19.4x for the US S&P 500 Index.”

The valuation gap is even more pronounced for value stocks, which are trading at a 50% discount to growth stocks. This accounts for the current appeal of certain segments of the European market, explains Corrieras.

Lastly, the UK looks “well-positioned” to benefit from the expanding scope of investments, says Corrieras. “UK equities are highly exposed to the value sectors — energy, commodities, financials — with shareholder return achieved through the highest dividend policy in the world. In addition, this market now offers a historic valuation discount to the MSCI World.”

US more than just the Magnificent Seven

After some profit-taking in April, the US markets rose and hit new highs in May. However, the rise is no longer concentrated only among the Magnificent Seven, which drove the market’s performance in 2023, says Corrieras.

Some of these stocks even delivered annual performances below the S&P 500, like Tesla and Apple. Conversely, the market rally expanded to cyclical sectors, such as energy and financials.

This expansion could also be found even within investment themes. After focusing heavily on the tech giants and specialised semiconductor manufacturers, investors have now turned to other components of the value chain, such as cloud service providers, data centres and electricity producers, according to Corrieras.

“The need for power has skyrocketed to keep artificial intelligence computing infrastructure running. We can therefore find growth drivers and investment opportunities in what is still a very robust economy, backed by a number of support plans,” she adds.

‘Symbolic’ tariffs between US-China

Mainland Chinese and Taiwanese equities have rebounded sharply since the beginning of March. The MSCI China Index’s year-to-date performance has even been above the MSCI US Index, says Corrieras.

China’s latest trade data beat expectations, restrictions have been eased on property purchases, and the dividend tax is likely to be eliminated, according to Corrieras. These factors all helped improve market sentiment and bring flows back to the region.

Although tensions between the US and China have recently been rekindled with higher tariffs on certain Chinese products, for the most part these measures seem “symbolic and political” in the run-up to the US presidential election in November, says Corrieras. “The impact on China looks limited for now.”

In addition, it was a very positive earnings season for Taiwanese and South Korean tech heavyweights, in particular along the entire high-tech supply chain. Equity momentum has sputtered recently in India, but growth in fundamentals remains intact and the general elections underway could act as a catalyst, says Corrieras.

Investment style

Despite high bond yields and less favourable seasonality, investors who seek protection against geopolitical risks and market volatility are turning to quality stocks, says Corrieras.

Although growth stocks are also under pressure due to high interest rates, they continue to perform well in the US, she adds, still driven by the wider AI theme.

At the same time, the market is seeing an expansion towards value stocks and to small- and mid-caps, mainly in Europe, according to Corrieras. “These value stocks are benefiting from stronger-than-expected economic momentum in Europe and from the recovery in China, which is very favourable for European cyclical players.”

In addition, investors are once again looking at small-caps as attractive opportunities, due to their significant discount and exposure to the relocation and reindustrialisation themes, she adds.

Table: Indosuez Wealth Management

See Also:

Click here to stay updated with the Latest Business & Investment News in Singapore

Beyond markets, geopolitical tensions fuel pessimism for the future

China's crackdown 'past its peak', Beijing now focused on 'pro-growth measures': Indosuez

Get in-depth insights from our expert contributors, and dive into financial and economic trends

Yahoo Finance

Yahoo Finance