Winnebago (WGO) to Buy Lithionics to Rev Up its E-Mobility Game

Recreational vehicle (RV) maker Winnebago Industries Inc. WGO recently inked an agreement to acquire Lithionics Battery ("Lithionics"), a lithium-ion battery manufacturer. The terms of the deal are kept under wraps.

The acquisition of Lithionics will empower Winnebago Industries with enhanced technological and engineering capabilities to offer consumers more innovative products with cutting-edge electrical solutions. The deal will result in strategic sourcing benefits and help secure Winnebago a critical area of its supply chain.

Winnebago’s CEO Michael Happe said, “The addition of Lithionics enhances Winnebago Industries’ ability to develop unique and diverse battery solutions across our portfolio, advancing our overall electrical ecosystem, driving organic growth and supply chain security, reinforcing our technological competitive advantage and allowing us to capitalize on consumer preferences for fully immersive, off-the-grid outdoor experiences.”

The company will develop a line of technologically advanced products that will change how people experience the outdoors by enabling them to take the convenience of electricity wherever they go. This will be accomplished by combining Lithionics' unique battery systems with Winnebago's strong brands and innovation expertise. The deal is expected to boost WGO’s near- and long-term margins.

Lithionics, a manufacturer of state-of-the-art battery solutions, was established in 2010 and offers house power for a range of outdoor items, including RVs, boats, specialty vehicles and other low-speed vehicles, as well as various industrial uses. Consumers will benefit from Lithionics' innovation in household power solutions as it advances key outdoor recreation product features like extending time off-the-grid, enhancing reliability, lowering noise and generating fewer emissions.

Shares of Winnebago have gained 1% over the past year against 3.1% increase of its industry.

Given the current economic uncertainty, RV shipments in 2023 are expected to be between 324,300 and 344,000 units, a reduction of around 32% year over year from the midpoint of the guided range. This is likely to weigh on company’s near-term sales. However, management believes that by fiscal 2025 things will turn around for good, with RV sales gaining momentum again. As such, it sticks to its long-term targets unveiled in November 2022. Winnebago aims for $5.5 billion in net revenues in fiscal 2025.

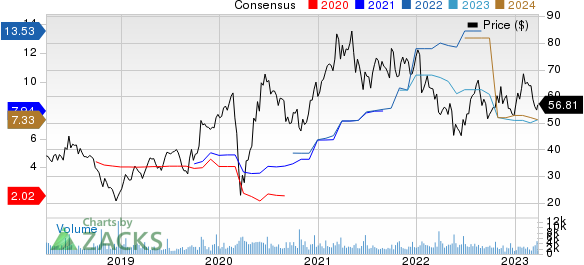

Winnebago Industries, Inc. Price and Consensus

Winnebago Industries, Inc. price-consensus-chart | Winnebago Industries, Inc. Quote

Zacks Rank & Key Picks

Winnebago currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks to consider in the Construction space include Modine Manufacturing MOD, Mazda Motor MZDAY and Wabash National WNC.

Modine Manufacturing currently sports a Zacks Rank #1 (Strong Buy). The company has a projected earnings growth rate of 43.09% for the current year. It has a trailing four-quarter earnings surprise of roughly 56.1% on average. MOD has gained approximately 131.2% in a year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Mazda Motor currently has a Zacks Rank #2 (Buy). The company has a projected earnings growth rate of 4% for the current year. It has a trailing four-quarter earnings surprise of roughly 97% on average. MZDAY has gained approximately 20.5% in a year.

Wabash National currently sports a Zacks Rank #1. The company has a projected earnings growth rate of 28.9% for the current year. It has a trailing four-quarter earnings surprise of roughly 46.1% on average. WNC has gained approximately 55.6% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Wabash National Corporation (WNC) : Free Stock Analysis Report

Winnebago Industries, Inc. (WGO) : Free Stock Analysis Report

Modine Manufacturing Company (MOD) : Free Stock Analysis Report

Mazda Motor Corporation (MZDAY) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance