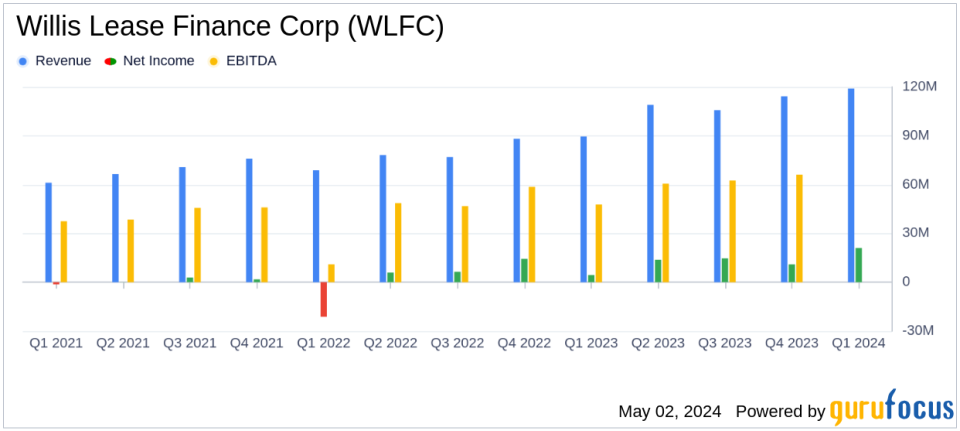

Willis Lease Finance Corp Reports Record Q1 2024 Earnings, Surging Pre-tax Income and Revenue Growth

Total Revenue: Reached $119.1M in Q1 2024, marking a 33% increase from $89.5M in Q1 2023.

Pre-tax Income: Soared to $29.9M in Q1 2024, a significant rise from $6.8M in Q1 2023.

Maintenance Reserve Revenue: Jumped 86.7% to $43.9M in Q1 2024 from $23.5M in Q1 2023.

Net Income: Increased dramatically to $20.9M in Q1 2024, up from $4.4M in Q1 2023.

Earnings Per Share: Diluted EPS climbed to $3.00 in Q1 2024 from $0.55 in Q1 2023.

Lease Portfolio Value: Grew to $2,270.4M as of March 31, 2024, from $2,223.4M as of December 31, 2023.

Book Value per Share: Increased to $69.35 at the end of Q1 2024, up from $67.73 at the end of 2023.

On May 2, 2024, Willis Lease Finance Corp (NASDAQ:WLFC), a prominent player in the commercial aircraft and engine leasing industry, announced a remarkable set of financial results for the first quarter of 2024. The company disclosed these figures in its recent 8-K filing, highlighting record-breaking revenue and pre-tax income figures. For the quarter ending March 31, 2024, WLFC reported total revenues of $119.1 million and a pre-tax income of $29.9 million, marking significant year-over-year growth.

Willis Lease Finance Corp, along with its subsidiaries, is engaged primarily in the leasing and servicing of commercial aircraft and aircraft engines. The company operates through two main segments: Leasing and Related Operations, and Spare Parts Sales. The majority of its revenue stems from its leasing activities, which include the acquisition and leasing of commercial aircraft engines and other equipment.

Performance Highlights and Strategic Insights

The first quarter of 2024 was particularly strong for WLFC, with core lease rent and maintenance reserve revenues reaching an all-time high of $96.8 million, a 26% increase from the previous year. This growth was primarily driven by robust, recurring lease and maintenance revenues, bolstered by a resurgent aviation market and airlines increasingly leveraging WLFC's leasing, parts, and maintenance capabilities.

According to Austin C. Willis, CEO of WLFC, the company's strategic development of its 145 maintenance and exchange capabilities over recent years has positioned it as a preferred partner for airlines looking to mitigate maintenance risks. This strategic positioning is particularly advantageous in the current supply chain constrained environment, enhancing WLFC's market presence and operational resilience.

Financial Analysis and Future Outlook

WLFC's financial performance in Q1 2024 reflects a solid operational execution and strategic asset management. The lease rent revenue remained stable at $52.9 million. However, a standout performance was observed in the maintenance reserve revenue, which soared by 86.7% to $43.9 million, reflecting high asset utilization by customers. Additionally, the company experienced a significant gain on sale of leased equipment amounting to $9.2 million, compared to a loss in the previous year.

The balance sheet as of March 31, 2024, shows a robust lease portfolio valued at $2,270.4 million, with total assets amounting to $2,674.4 million. The company's strategic acquisitions and careful management of assets have contributed to a healthy financial position, with a book value per diluted weighted average common share increasing to $69.35.

Despite challenges such as global economic uncertainties and potential industry-specific risks, WLFC's management remains optimistic about leveraging market opportunities and sustaining growth. The company's focus on expanding its leasing and maintenance capabilities, coupled with prudent financial management, positions it well for future success.

Overall, Willis Lease Finance Corp's Q1 2024 results not only demonstrate a successful quarter but also reflect the company's ongoing commitment to growth and operational excellence in the dynamic aviation leasing industry.

Explore the complete 8-K earnings release (here) from Willis Lease Finance Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance